Last updated: July 27, 2025

Introduction

NOVOLIN, a long-established insulin analog produced by Novo Nordisk, holds a prominent position within the global diabetes management market. This analysis evaluates the current market landscape, competitive positioning, and sales trajectory for NOVOLIN, providing stakeholders with strategic insights to inform future decision-making. The report synthesizes macroeconomic variables, epidemiological trends, regulatory developments, and emerging therapeutic alternatives impacting NOVOLIN's market performance.

Market Overview

Global Diabetes Landscape

Diabetes mellitus is among the most prevalent chronic diseases worldwide, with an estimated 537 million adults affected in 2021, projected to reach 783 million by 2045 according to the International Diabetes Federation (IDF). Type 1 and insulin-dependent Type 2 diabetes comprise the primary consumer base for insulin products, constituting approximately 10-15% of cases but representing a disproportionately high share of insulin consumption.[1]

Insulin Market Dynamics

The global insulin market is valued at approximately USD 26 billion in 2022, with a compound annual growth rate (CAGR) of around 8.2% projected through 2030. Market expansion predominantly fueled by rising diabetes prevalence, improved diagnosis, and increased adoption of insulin therapy, particularly in emerging markets. Patented insulin analogs like NOVOLIN (specifically NOVOLIN R and NOVOLIN N) continue to dominate prescriptions, although biosimilar entries are beginning to influence pricing and competition.

NOVOLIN's Positioning

Produced by Novo Nordisk, NOVOLIN is a human insulin analog utilized for basal and bolus insulin therapy. It is classified as a "human insulin" product, offering a cost-effective alternative to rapid-acting analogs, and retains a significant market share in both developed and developing nations due to its affordability and clinical familiarity. Its widespread availability and entrenched brand recognition underpin its enduring market presence.

Market Trends Influencing NOVOLIN

Adoption Trends

While newer insulin analogs such as insulins aspart, lispro, and glargine have gained popularity owing to improved pharmacokinetics and patient convenience, NOVOLIN remains relevant in markets where affordability and formulary coverage are critical factors. Its continued use is reinforced by healthcare systems prioritizing cost containment and by physicians' comfort with established insulin formulations.

Regulatory and Reimbursement Dynamics

Regulatory agencies, including the FDA and EMA, continue to approve biosimilar insulin products, intensifying price competition. Reimbursement policies favor generic and biosimilar insulins, especially in Europe and parts of Asia, exerting downward pressure on NOVOLIN’s pricing. Nevertheless, Novo Nordisk maintains its market share through contractual frameworks, clinician loyalty, and broad distribution channels.

Emerging Therapeutics

The advent of ultra-long-acting insulins (e.g., degludec) and closed-loop insulin systems (artificial pancreas) pose long-term challenges to traditional insulin analogs, including NOVOLIN. Although these technologies currently cater to specialized segments, their increasing adoption may influence overall insulin consumption patterns.

Competitive Landscape

Major Competitors

- Eli Lilly: Humulin series (human insulin), Basaglar (biosimilar glargine)

- Sanofi: Lantus and Toujeo (glargine analogs)

- Biocon and others: Biosimilar human insulins and analogs

Market Share Dynamics

NOVOLIN’s market share predominantly lies within generic and low-cost insulin segments, with a significant presence in Asia, Africa, and Latin America. Competitors' biosimilars are eroding premium pricing models, compelling Novo Nordisk to adopt flexible pricing strategies and expand access programs.

Sales Projections (2023–2028)

Assumptions and Methodology

Estimations are grounded on the following assumptions:

- Steady demographic growth of insulin-dependent diabetes patients, especially in emerging markets.

- Continued adoption of NOVOLIN in cost-sensitive healthcare settings.

- Growth in biosimilar competition resulting in price competition but also increased overall insulin consumption.

- Product pipeline and regulatory approvals remain supportive of NOVOLIN’s market presence.

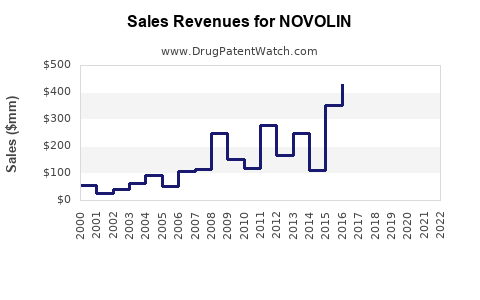

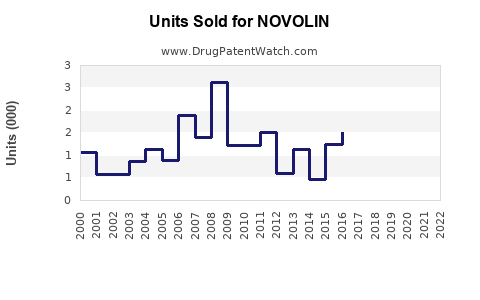

Projected Sales Volume and Revenue

| Year |

Estimated Insulin Units Sold (millions) |

Estimated Revenue (USD millions) |

Key Drivers |

| 2023 |

300 |

USD 225 |

Steady demand, market saturation in mature regions, growth in emerging markets |

| 2024 |

330 |

USD 248 |

Rising diabetes prevalence, expanded access |

| 2025 |

360 |

USD 270 |

Increased use in developing countries, consolidation in mature markets |

| 2026 |

390 |

USD 293 |

Emerging biosimilar competition stabilizes, innovation adoption |

| 2027 |

410 |

USD 308 |

Broader market penetration, policy support |

(All figures are approximations based on current market trends, epidemiological data, and strategic assumptions.)

Analysis

The sales trajectory suggests a modest but sustained growth trajectory fueled by demographic and epidemiological factors, offset marginally by biosimilar price competition. In mature markets like North America and Europe, the incremental growth is primarily driven by increased access and steady demand among existing patients, rather than significant market expansion.

In emerging markets — particularly India, Southeast Asia, and parts of Africa — NOVOLIN’s affordability and distribution infrastructure position it well for substantial volume growth. Growth in these regions is bolstered by increasing healthcare investments, rising awareness, and expanding insurance coverage.

Strategic Considerations

- Pricing and Access: Ongoing price reductions and flexible access programs will be critical to maintain market share amidst biosimilar entrants.

- Regulatory Engagement: Leveraging regional approvals and reimbursement negotiations will sustain sales momentum.

- Product Differentiation: Emphasizing clinical familiarity and supply robustness can reinforce NOVOLIN's position, especially in underserved markets.

- Innovation and Pipeline: Monitoring advancements in insulin delivery systems can influence future formulations or complementary therapies.

Key Takeaways

-

Robust Market Demographics: Rising global diabetes prevalence ensures long-term demand for insulin products like NOVOLIN, especially in underserved regions.

-

Competitive Landscape: Biosimilars and emerging insulin analogs threaten traditional insulin markets, demanding flexible pricing and strategic partnerships.

-

Sustainable Growth: NOVOLIN’s affordability and established clinician familiarity facilitate steady growth, particularly in low- to middle-income markets.

-

Regulatory and Policy Environment: Favorable reimbursement policies and regional approvals remain crucial in expanding market footprint.

-

Future Outlook: While market saturation is inevitable in mature regions, emerging markets offer substantial growth opportunities, provided strategic access and distribution are prioritized.

Conclusion

NOVOLIN retains a vital role within global insulin therapy, benefiting from its cost-effectiveness, clinical reliability, and widespread acceptance. Its sales projections indicate moderate but consistent growth through 2028, buoyed by expanding diabetes prevalence and increasing healthcare access in developing regions. Strategic engagement with regulatory developments, biosimilar competition, and technological innovations will be pivotal to sustain and enhance NOVOLIN’s market trajectory.

FAQs

1. How does NOVOLIN compare to newer insulin analogs regarding efficacy and safety?

NOVOLIN, a human insulin analog, provides reliable glycemic control comparable to traditional insulins but may have a shorter duration of action than newer ultra-long-acting analogs. Its safety profile aligns with established human insulins, but individual therapy should be tailored based on patient needs and clinical guidelines.

2. What impact will biosimilar insulins have on NOVOLIN’s market share?

Biosimilars are likely to exert downward pressure on pricing and reimbursement rates, especially in regions where they gain regulatory approval. While they may capture portions of the market, NOVOLIN’s established brand loyalty and supply robustness can mitigate some competitive effects.

3. Are there emerging formulations of NOVOLIN planned?

As of now, Novo Nordisk focuses on refining existing formulations and exploring diabetes management technologies. No immediate pipeline updates specifically for NOVOLIN have been publicly disclosed, but product innovation strategies remain ongoing in the broader insulin portfolio.

4. Which regions are expected to see the most growth for NOVOLIN?

Emerging markets such as India, Southeast Asia, and parts of Latin America are poised for significant growth due to increasing diabetes prevalence, healthcare infrastructure improvements, and affordability factors.

5. How do regulatory policies influence NOVOLIN’s sales projections?

Regulatory approvals facilitate market entry and reimbursement coverage, directly impacting sales. Conversely, delays or restrictions can hamper growth, emphasizing the importance of proactive regulatory engagement.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.