Last updated: July 29, 2025

Introduction

Losartan/HCT (hydrochlorothiazide) is a combination antihypertensive medication primarily used to manage high blood pressure (hypertension) and reduce cardiovascular risk. As a fixed-dose combination (FDC), it synergizes an angiotensin II receptor blocker (ARB), losartan, with a diuretic, hydrochlorothiazide, offering enhanced therapeutic efficacy and improved patient adherence. Given the global burden of hypertension, the drug’s market dynamics are significant for pharmaceutical stakeholders. This analysis evaluates current market trends, factors influencing sales, and forecasts future revenue trajectories.

Market Landscape Overview

Global Hypertension Prevalence and Therapeutic Needs

Hypertension affects approximately 1.28 billion adults worldwide, constituting a major risk factor for stroke, myocardial infarction, and kidney disease [1]. The rising prevalence, driven by aging populations, sedentary lifestyles, and obesity, sustains strong demand for antihypertensive therapies.

Pharmacological Role of Losartan/HCT

As an ARB-based combination, losartan/HCT offers advantages over monotherapy, including improved blood pressure control, reduced side effects, and enhanced compliance due to fixed dosing. The combination is particularly suitable for patients requiring multiple antihypertensive agents, aligning with guideline recommendations for combination therapy in resistant or uncontrolled hypertension.

Competitive Positioning

Losartan/HCT faces competition from other ARB/thiazide combinations like valsartan/HCT, olmesartan/HCT, and amlodipine/HCT. Its market share hinges on factors such as efficacy, safety profile, cost, and patent status. Losartan’s patent expiry in many regions has facilitated generic entry, impacting pricing and market penetration.

Market Dynamics and Drivers

Regulatory Approvals and Product Approvals

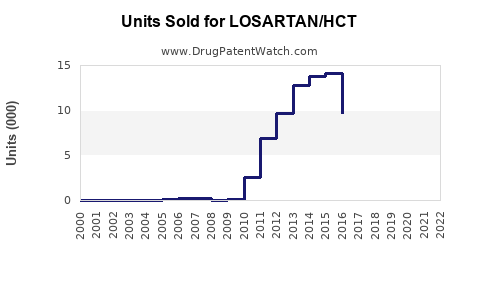

Generic versions of losartan/HCT have been available since patent expiration, bolstering accessibility and affordability. Major players include Mylan, Teva, and Apotex, producing generics that have expanded the market.

Pricing and Reimbursement Policies

The availability of generics drastically reduces drug prices, influencing prescribing habits and sales volumes. Reimbursement policies in key markets like the U.S., EU, and Asia significantly impact patient access and consumption patterns.

Physician and Patient Prescribing Patterns

Clinicians favor fixed-dose combinations for ease of use and adherence. Increased awareness of hypertension and its management, alongside guideline endorsements, has fostered higher prescribing rates.

Market Penetration and Patient Demographics

The drug’s penetration is higher among elderly populations and patients with comorbidities such as diabetes and chronic kidney disease, who require multi-drug regimens.

Sales Projections: Regional Insights

United States

- Current Market Status: The U.S. remains the largest market for antihypertensive drugs, with annual sales exceeding $10 billion for combination therapies.

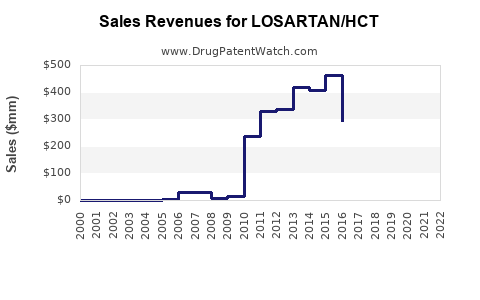

- Projection: With an aging population and guideline-driven prescribing, sales of losartan/HCT are expected to grow at a CAGR of approximately 4-6% over the next five years, reaching $600–$700 million by 2028 [2].

European Market

- Market Dynamics: Europe’s extensive adoption of generic medications and cost-containment measures promote higher usage of affordable antihypertensive combinations.

- Projection: Sales growth is anticipated at 3-5% CAGR, with revenues around €150–€200 million in 2028.

Asia-Pacific

- Market Drivers: Rapid urbanization, increasing hypertension prevalence, and rising healthcare investments drive demand.

- Projection: The region could see an 8-10% CAGR, with sales reaching $400–$600 million, propelled by expanding access and local manufacturing.

Emerging Markets

Countries in Latin America, Africa, and the Middle East exhibit increasing hypertension awareness and improving healthcare infrastructure, offering growth opportunities, albeit tempered by affordability concerns.

Factors Influencing Future Sales

- Patent Expirations: Ongoing generic competition could suppress prices, but volume sales are likely to offset pricing reductions.

- Innovations and Formulation Improvements: Development of pediatric formulations or sustained-release variants could expand indications and adherence.

- Regulatory Trends: Favorable approval pathways for generics and bioequivalents are poised to boost market penetration.

- Healthcare Policy Changes: Emphasis on cost-effective, guideline-compliant therapies will favor fixed-dose combination use.

- Patient Compliance Initiatives: Programs promoting medication adherence will support increased prescription volumes.

Risks and Challenges

- Generic Market Saturation: While affordability spurs volume growth, price erosion due to generics may limit revenue increases.

- Competitive Substitutes: Introduction of newer agents or alternatives with better safety profiles could impact market share.

- Regulatory Hurdles: Variations in approval standards may delay market expansion in certain regions.

- Reimbursement Constraints: Budget restrictions and formulary restrictions may limit access, affecting sales.

Conclusion

Losartan/HCT benefits from a sizable and expanding hypertension market, with growth driven by demographic trends, prescribing practices, and healthcare policy shifts favoring combination therapies. While patent expiries and generics introduce pricing pressures, increasing global hypertension prevalence and the drug’s proven efficacy support optimistic sales trajectories. Stakeholders should monitor regional market variables, regulatory landscapes, and competitive innovations to optimize growth strategies.

Key Takeaways

- The global market for losartan/HCT is projected to grow at a CAGR of approximately 4-8% over the next five years, reaching $1 billion or more in total sales.

- Generic integration into markets enhances affordability and volume but constrains pricing; balanced strategies include portfolio diversification and focus on brand differentiation.

- Asia-Pacific and emerging markets present high-growth opportunities due to demographic shifts and increasing healthcare access.

- Regulatory agility and adherence to clinical guidelines will be critical to maintaining and expanding market share.

- Continuous monitoring of competitive products and market dynamics is essential for strategic positioning.

FAQs

1. What factors are driving the demand for losartan/HCT globally?

Growing hypertension prevalence, aging populations, patient preference for fixed-dose combinations, and guideline endorsements foster increased demand. Cost-efficiency from generics and expanding healthcare infrastructure in emerging markets further propel consumption.

2. How does patent expiration impact sales projections for losartan/HCT?

Patent expiry facilitates generic competition, reducing prices and driving volume sales. This typically results in a short-term revenue dip but can expand the overall market size due to increased access.

3. Which regions are expected to see the highest growth in losartan/HCT sales?

Asia-Pacific and emerging markets are poised for the highest growth, owing to demographic trends, improved healthcare access, and affordability shifts.

4. How might future innovations influence the losartan/HCT market?

Development of novel formulations, combination strategies, or drugs with improved safety profiles could either enhance sales through new indications or challenge existing products if new standards emerge.

5. What are the main challenges facing losartan/HCT market expansion?

Generic price erosion, competitive alternatives, regulatory barriers, and reimbursement restrictions pose significant challenges to sustained growth.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] MarketResearch.com. (2022). Hypertension Medications Market Outlook.