Last updated: July 27, 2025

Introduction

Ibuprofen, a non-steroidal anti-inflammatory drug (NSAID), is widely used for its analgesic, antipyretic, and anti-inflammatory properties. As one of the most extensively used over-the-counter (OTC) medications globally, its market dynamics are influenced by factors including demographic shifts, healthcare trends, regulatory policies, and competitive innovations. This report provides a comprehensive market analysis and sales projections for ibuprofen over the next five years.

Market Overview

The global ibuprofen market has demonstrated consistent growth driven by increasing awareness of self-medication for minor pains and fevers, expanding aging populations, and rising prevalence of chronic inflammatory conditions. The OTC category constitutes a significant segment, favored for its accessibility and consumer familiarity. The key regions influencing market trajectories include North America, Europe, Asia-Pacific, Latin America, and the Middle East/Africa.

Current Market Landscape

Market Size and Revenue

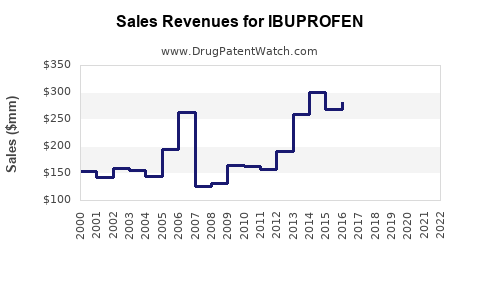

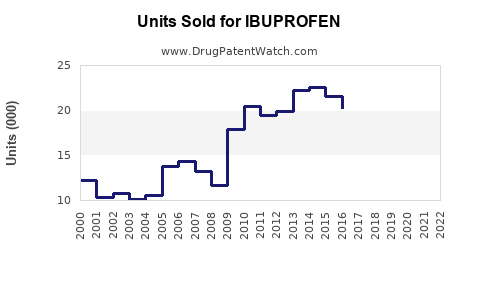

According to recent industry reports, the global ibuprofen market was valued at approximately USD 3.2 billion in 2022, with expectations to reach around USD 4.2 billion by 2028, registering a compound annual growth rate (CAGR) of about 5.6% (2023–2028). North America accounts for roughly 35% of the market, driven by high OTC utilization and healthcare infrastructure, while Asia-Pacific exhibits the fastest growth owing to population expansion and increased health awareness.

Key Players

Major manufacturers include Johnson & Johnson (Motrin), Boehringer Ingelheim, Pfizer, and local players in emerging markets. Patent expirations and the rise of generic formulations have increased market accessibility and affordability, further boosting sales.

Regulatory Environment

In Western markets, ibuprofen remains OTC-approved, with regulatory bodies like the FDA maintaining stringent guidelines for safety and labeling. Emerging markets are witnessing evolving regulatory frameworks, creating both opportunities for market entry and challenges related to compliance.

Drivers of Market Growth

- Healthcare Awareness: Rising awareness of self-care and OTC medications enhances consumer demand (e.g., minor pain relief, fever reduction).

- Aging Populations: Older populations are more prone to inflammatory conditions, increasing the need for accessible NSAIDs.

- Chronic Disease Prevalence: Epidemics of arthritis, musculoskeletal disorders, and related conditions boost demand.

- Product Innovation: Development of combination drugs, sustained-release formulations, and flavor variants appeals to broader demographics.

Challenges and Constraints

- Safety Concerns: Risks associated with NSAIDs, including gastrointestinal, cardiovascular, and renal adverse effects, invite regulatory scrutiny.

- Competitive Market: Emergence of alternative analgesics and natural remedies influences consumer choices.

- Regulatory Limitations: Restrictions on high-dose formulations and labeling may impact sales growth in specific regions.

Sales Projections (2023–2028)

| Year |

Market Size (USD Billion) |

Growth Rate (%) |

| 2023 |

3.4 |

6.3 |

| 2024 |

3.6 |

5.9 |

| 2025 |

3.8 |

5.6 |

| 2026 |

4.0 |

5.3 |

| 2027 |

4.2 |

5.0 |

| 2028 |

4.4 |

4.8 |

Note: These projections account for organic market growth, product introductions, geographic expansion, and potential regulatory impacts.

Regional Outlook

- North America: Continues to lead due to high OTC penetration. Market growth moderate but steady at around 3–4% annually.

- Europe: Stable growth with significant OTC sales and evolving prescription policies.

- Asia-Pacific: Highest CAGR (~8%) due to large populations, increasing healthcare expenditure, and local manufacturing.

- Latin America & Middle East: Emerging markets with expanding access to healthcare and increasing adoption of OTC analgesics.

Market Opportunities and Strategic Recommendations

- Product Diversification: Innovate formulations to cater to specific demographic needs, such as pediatric, geriatric, or chronically ill populations.

- Market Entry in Emerging Economies: Leverage low-cost manufacturing and local partnerships to penetrate markets with burgeoning middle classes.

- Regulatory Navigation: Maintain compliance by engaging with health authorities proactively, especially for novel combinations or new delivery systems.

- Brand Differentiation: Emphasize safety, efficacy, and convenience to compete effectively against natural and alternative remedies.

Conclusion

Ibuprofen remains a cornerstone analgesic with robust global demand. Market growth is expected to remain steady, driven predominantly by demographic trends, healthcare awareness, and product innovation. Companies that adapt to regulatory shifts, expand in high-growth regions, and prioritize safety will be positioned for sustained sales expansion.

Key Takeaways

- The global ibuprofen market is projected to reach USD 4.4 billion by 2028, with a CAGR of 4.8–5.6%.

- North America dominates, but Asia-Pacific offers the highest growth opportunities.

- Demographic shifts, chronic disease prevalence, and OTC accessibility fuel demand.

- Regulatory and safety concerns necessitate proactive compliance and consumer education strategies.

- Strategic diversification and regional expansion are critical for capturing market share.

FAQs

-

What factors are driving the growth of the ibuprofen market?

Increasing self-medication practices, aging populations, prevalence of inflammatory and pain-related conditions, and ongoing product innovations are primary drivers.

-

How do regulatory policies impact ibuprofen sales?

Stringent safety regulations and restrictions on high-dose formulations can limit availability in certain markets, while supportive policies facilitate broader OTC access.

-

What are the main competitive challenges for ibuprofen manufacturers?

Safety concerns, competition from alternative analgesics, natural remedies, and regulatory hurdles pose ongoing challenges.

-

Which regions present the highest growth potential for ibuprofen?

Asia-Pacific offers the fastest growth, attributed to demographic expansion, rising healthcare spending, and developing pharmaceutical infrastructure.

-

What innovations are shaping the future of ibuprofen products?

Novel delivery systems (e.g., sustained-release), combination therapies, flavoring, and targeted formulations for specific populations are expected to enhance market appeal.

References

[1] Market Research Future. “Ibuprofen Market Research Report.” 2022.

[2] Transparency Market Research. “Global NSAID Market Outlook: 2023–2028.” 2023.

[3] U.S. Food and Drug Administration (FDA). “Regulatory Guidelines for OTC NSAIDs.” 2022.

[4] IQVIA. “Global Pharmaceutical Sales Data.” 2022.