Last updated: July 29, 2025

Introduction

HUMULIN, a long-standing insulin therapy developed by Eli Lilly and Company, is part of the highly competitive diabetes management market. As a biosimilar or branded recombinant insulin, HUMULIN addresses the global diabetes epidemic, which continues to expand at a rapid pace. This analysis evaluates current market dynamics, competitive positioning, regulatory landscape, and future sales forecasts to inform strategic decisions for pharmaceutical stakeholders.

Market Overview

Global Diabetes Market

The global diabetes therapeutics market was valued at approximately USD 54 billion in 2022 and is projected to reach USD 99 billion by 2030, growing at a compounded annual growth rate (CAGR) of around 8%[1]. The rising prevalence of diabetes mellitus—particularly type 1 and type 2—fuels demand for insulin therapies, including HUMULIN. Factors influencing growth include increasing urbanization, sedentary lifestyles, obesity rates, and improved diagnosis techniques.

HUMULIN’s Position in the Insulin Segment

HUMULIN, specifically formulated as human insulin, competes primarily with other long-acting insulins such as Novo Nordisk’s Tresiba and Sanofi’s Lantus. While newer ultra-long-acting insulins have gained market share, HUMULIN retains a significant foothold due to its longstanding safety profile, affordability, and wide availability, especially in emerging markets.

Regulatory Landscape and Intellectual Property

Despite patent expirations, Lilly has maintained market presence through formulation improvements, biosimilar entries, and strategic collaborations. Regulatory agencies, notably the FDA and EMA, facilitate approvals for biosimilars, boosting competition but also expanding treatment options.

Market Dynamics and Competitive Landscape

Key Drivers

- Rising Global Prevalence of Diabetes: The International Diabetes Federation estimates approximately 537 million adults globally with diabetes in 2021, expected to reach 783 million by 2045[2].

- Increasing Access in Emerging Markets: Countries like India, China, and Brazil see expanding healthcare infrastructure, increasing insulin accessibility.

- Price Sensitivity and Affordability: HUMULIN's relatively lower cost compared to newer insulins bolsters its market share, especially in low- to middle-income regions.

- Advances in Delivery Devices: Introduction of prefilled pens and continuous insulin infusion systems enhance patient adherence and demand.

Challenges

- Market Entry of Biosimilars: Companies such as Biocon, Momenta, and other biosimilar producers are increasing competition.

- Therapeutic Innovation: The emergence of ultra-long-acting insulins and non-insulin therapies (e.g., GLP-1 receptor agonists) shifts some market share away from traditional formulations.

- Pricing Pressures: Insurers and healthcare systems push for cost-effective treatments, influencing sales.

Sales Projections for HUMULIN

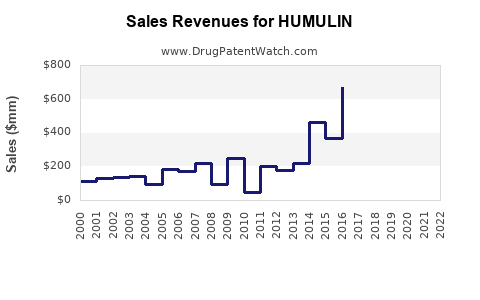

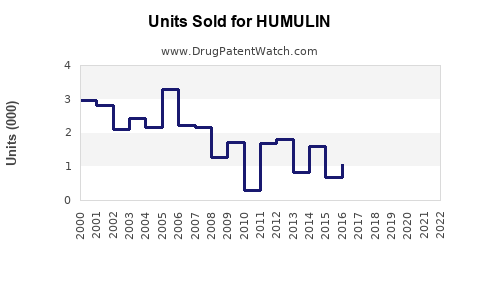

Historical Sales Performance

HUMULIN’s annual revenue peaked during the early 2010s but plateaued somewhat with the rise of innovative insulins and biosimilar competitors. In 2022, Lilly reported HUMULIN revenues of approximately USD 2.5 billion, reflecting its steady but mature market position[3].

Forecast Assumptions

- Market Penetration: Gradual decline in HUMULIN’s market share due to biosimilar competition and market shifts.

- Pricing Dynamics: Slight downward pressure on unit pricing globally; however, volume growth may offset price declines.

- Geographic Growth: Rapid expansion in emerging markets will maintain or slightly increase sales volume.

- Product Lifecycle: Likely to transition towards niche or formulary-restricted segments as newer insulins dominate.

Projected Sales Range (2023-2030)

| Year |

Estimated Revenue |

Key Factors |

| 2023 |

USD 2.4 billion |

Market maturity, biosimilar competition |

| 2024 |

USD 2.3 billion |

Slight decline amid generic entries |

| 2025 |

USD 2.2 billion |

Increasing biosimilar competition |

| 2026 |

USD 2.1 billion |

Market saturation, price pressures |

| 2027-2030 |

USD 2.0 billion |

Market stabilization, potential niche use |

Cumulative sales over the forecast period are projected around USD 14-15 billion, factoring in regional growth and market share adjustments.

Potential Future Growth Opportunities

- Strategic Partnerships: Collaborations with emerging markets’ healthcare systems could sustain volume.

- Formulation Enhancements: Development of new delivery systems or biosimilar formulations may revitalize sales.

- Therapeutic Positioning: Repositioning HUMULIN for niche indications or combination therapies.

Strategic Implications

- Focus on Market Expansion: Prioritize entry into underserved regions where insulin access is limited.

- Cost Optimization: Maintain affordability to compete effectively against biosimilars and innovative insulins.

- Innovation Investment: Invest in formulation improvements, device technology, and biosimilar development.

- Regulatory Strategy: Strengthen global registration efforts to sustain market presence.

Key Takeaways

- HUMULIN remains a vital component of Eli Lilly's diabetes portfolio but faces intensifying biosimilar competition.

- The global insulin market exhibits steady growth driven by rising diabetes prevalence, especially in emerging markets.

- While traditional formulations like HUMULIN will see volume declines, strategic positioning can prolong sales lifespan.

- Affordability, access, and innovation are critical to maintaining a competitive edge and achieving sales targets.

- Long-term success depends on integration of biosimilar development, market penetration in developing regions, and lifestyle-related therapeutic innovations.

Conclusion

HUMULIN’s market outlook reflects a classic case of a mature pharmaceutical product balancing mature sales with emerging challenges from biosimilar rivals and evolving treatment paradigms. Pharmaceutical companies must leverage strategic partnerships, innovate delivery systems, and expand geographic reach to preserve its revenue streams amid market shifts.

FAQs

1. How is the market share for HUMULIN expected to evolve over the next decade?

HUMULIN’s market share is projected to decline gradually due to biosimilar competition, but its affordability and established safety profile will sustain its relevance, particularly in cost-sensitive markets. Strategic innovations and regional expansion could mitigate decline rates.

2. What are the main competitive advantages of HUMULIN?

Its longstanding safety record, affordability, broad access in emerging markets, and compatibility with various delivery devices position HUMULIN favorably against newer, more expensive insulins.

3. How will biosimilars impact HUMULIN’s future sales?

Biosimilars will introduce pricing pressures and erode market share, but HUMULIN’s brand recognition and distribution network provide some resilience. Continued innovation and cost management will be critical.

4. What growth opportunities exist for HUMULIN?

Expanding into underserved markets, optimizing biosimilar formulations, and integrating advanced delivery devices present opportunities for sustaining demand.

5. How might new therapeutic developments affect HUMULIN’s market?

Emerging therapies like ultra-long-acting insulins and non-insulin agents could divert some patients, decreasing HUMULIN’s volume. However, combination therapies or niche applications might create residual demand.

References

[1] Grand View Research. “Diabetes Market Size & Share Analysis, 2022-2030.”

[2] International Diabetes Federation. “IDF Diabetes Atlas, 9th edition,” 2021.

[3] Eli Lilly Annual Report, 2022.