Last updated: July 27, 2025

Introduction

Humira (adalimumab), developed by AbbVie Inc., is a monoclonal antibody designed to inhibit tumor necrosis factor alpha (TNF-alpha), a key driver of inflammation in various autoimmune diseases. Launched in 2003, Humira has established itself as one of the best-selling pharmaceuticals globally, with a dominanthold particularly in rheumatoid arthritis, psoriasis, Crohn’s disease, and ankylosing spondylitis. This analysis provides an in-depth overview of Humira's current market landscape and future sales trajectory, considering competitive dynamics, patent expirations, emerging biosimilars, and regional market variations.

Market Landscape Overview

Global Therapeutic Area and Indications

Humira's primary indications encompass autoimmune and inflammatory conditions:

- Rheumatoid Arthritis (RA): The largest revenue contributor, especially in developed markets.

- Psoriasis and Psoriatic Arthritis: Robust patient base due to high prevalence.

- Crohn’s Disease and Ulcerative Colitis: Significant adoption in inflammatory bowel diseases.

- Ankylosing Spondylitis and Juvenile Idiopathic Arthritis: Expanding use in these populations.

The global market for TNF-alpha inhibitors, including Humira, reached approximately $30 billion in 2022, with Humira accounting for nearly 70% of that market. Growth drivers include increasing prevalence of autoimmune disorders, early diagnosis, and expanding treatment guidelines.

Regional Market Dynamics

- North America: Leading market, driven by healthcare infrastructure, high disease prevalence, and robust payer coverage. Humira's patent exclusivity contributed strongly to revenues until recent expiries.

- Europe: Significant market, with mature reimbursement systems fostering steady sales.

- Emerging Markets (Asia, Latin America): Growing adoption driven by rising autoimmune disease awareness, but constrained by affordability and regulatory hurdles.

Competition and Biosimilars

Humira's patent landscape has historically limited biosimilar competition since its launch. However, patent expirations in key markets have dramatically reshaped the competitive environment:

- United States: The patent exclusivity ended in 2023, opening the door for biosimilar entrants such as Amgen's Amjevita, Samsung's Imraldi, and others.

- Europe: Biosimilar competition began in 2018, leading to price reductions averaging 20-30% in some jurisdictions.

- Impact on Market Share: As biosimilars enter, Humira's market share is expected to decline sharply, but revenue decline will be gradual initially due to negotiated discounts and patient switching dynamics.

Sales Projections: Pre- and Post-Patent Expiry

Historical Sales Performance

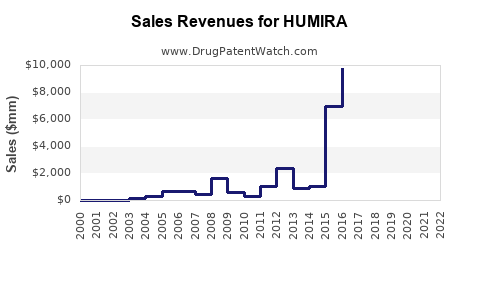

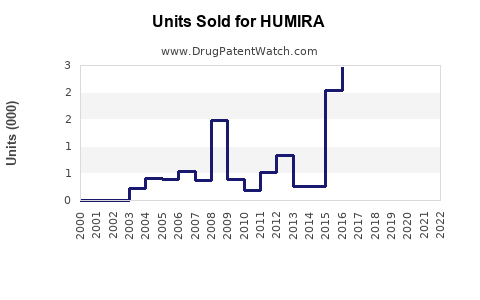

Humira's sales peaked at $21.2 billion in 2021, sustaining its position as the top-selling drug globally. Over the last decade, sales growth averaged approximately 23% annually, predominantly driven by expansion into new indications and geographic regions.

Forecasting Trends (2023-2030)

- 2023-2025: After patent expiry, sales are projected to decline by approximately 20-25% annually in the U.S. as biosimilar market share expands. However, other markets will exhibit more gradual declines, influenced by market penetration, pricing strategies, and prior stockpiling.

- 2026-2030: Long-term revenue will stabilize at a new baseline influenced by hospital and specialty pharmacy contracts, continued global expansion, and lifecycle management strategies such as biosimilar rebates and formulary placements.

Key Assumptions in Projections

- Continued adoption of biosimilars in mature markets.

- Persistence of Humira’s brand loyalty and clinical efficacy.

- Expansion into emerging markets facilitated by lower-cost biosimilars.

- Regulatory and reimbursement policies favoring biosimilar uptake.

An estimated compound annual decline rate (CAGR) of 20-25% from 2022 to 2025 is anticipated, with revenues gradually stabilizing around $8-10 billion in 2027 before a potential plateau due to replacement by biosimilars and biosimilar-patented biologics.

Strategies to Mitigate Revenue Erosion

AbbVie is actively implementing lifecycle management strategies including:

- Developing Next-Generation Biologics: ABV-085 (a biosimilar competitor) and enhanced formulations.

- Expanding Indications: Research into new autoimmune and inflammatory conditions.

- Partnerships and Market Access: Collaborations with payers for better formulary positioning.

- Market Penetration in Emerging Economies: Cost-effective formulations and strategic pricing.

Future Market Opportunities

While traditional blockbusters face revenue compression, the long-term opportunity lies in:

- Personalized medicine approaches, enhancing patient outcomes.

- Combination therapies with other biologics or small molecules.

- Innovative delivery systems, improving patient adherence.

Emerging therapeutics targeting pathways beyond TNF-alpha (e.g., IL-17, IL-23 inhibitors) pose competitive threats but also opportunities for differentiation and diversification.

Conclusion

Humira's sales future hinges on navigating patent expirations, biosimilar competition, regional market dynamics, and lifecycle expansion initiatives. While an inevitable decline is projected post-2023 in mature markets, strategic positioning and pipeline development will be critical for sustaining global revenues. The company's capacity to innovate and adapt to shifting regulatory landscapes will determine its long-term market relevance.

Key Takeaways

- Humira remains a cornerstone in autoimmune therapeutics with peak sales in 2021 at over $21 billion.

- Post-2023, biosimilar competition in key markets will reduce revenues by approximately 20-25% annually initially.

- Emerging markets and lifecycle management strategies will be vital for maintaining profitability.

- Long-term growth will depend on diversifying indications, developing next-generation biologics, and strategic partnerships.

- AbbVie's focus on innovation and market access will be essential amid decreasing exclusivity in mature markets.

FAQs

1. When will Humira's sales decline stabilize?

Sales are expected to decline significantly through 2025 due to biosimilar competition, with stabilization around 2027 as generics capture substantial market share and the remaining revenues normalize at lower levels.

2. How will biosimilar market entry affect pricing?

Increased biosimilar competition typically results in a 20-30% reduction in list prices, with further discounts driven by payer negotiations and formulary preferences.

3. Are there new indications or formulations that could sustain Humira sales?

Yes. AbbVie is investing in expanding indications, including investigational uses in dermatology, neurology, and other autoimmune disorders. New formulations aimed at improving administration and adherence are also under development.

4. How does regional variability influence sales projections?

Developed markets like the U.S. and Europe will see more pronounced declines post-patent expiry, whereas emerging markets will experience slower adoption of biosimilars, offering growth opportunities despite affordability constraints.

5. What is the long-term outlook for Humira’s market share?

While market share in traditional markets will diminish due to biosimilars, Humira's brand strength and ongoing lifecycle efforts could sustain a meaningful, albeit reduced, segment in global autoimmune treatment landscapes.

Sources:

[1] EvaluatePharma, 2022. "Top 100 Best-Selling Drugs."

[2] IQVIA, 2022. "Global Trends in Biologic Sales."

[3] AbbVie Inc., Annual Reports, 2022.

[4] FDA and EMA Regulatory Filings, 2022.

[5] MarketWatch, 2022. "Biologics and Biosimilars Market Analysis."