Last updated: July 27, 2025

Introduction

ESTRING (estradiol vaginal ring) is a hormonal replacement therapy (HRT) used primarily to manage menopausal symptoms such as vulvar and vaginal atrophy. Approved by the FDA in 1992, ESTRING is a flexible, medicated vaginal ring that releases estradiol directly into vaginal tissues, offering localized symptom relief with minimal systemic absorption. Its unique mode of delivery positions it distinctively within the broader hormone therapy market.

This report provides a detailed market analysis, examining current trends, competitive landscape, regulatory environment, and sales projections for ESTRING over the next five years. It aims to inform stakeholders—including pharmaceutical companies, investors, and healthcare providers—about potential growth opportunities and market dynamics.

Market Overview

Global Menopausal Symptom Management Landscape

The global menopause management market is expanding, driven by increasing aging populations and heightened awareness of women's health issues. The market was valued at approximately USD 1.7 billion in 2021 and is projected to reach USD 2.5 billion by 2028, growing at a CAGR of around 6%. This growth is propelled by the rising adoption of hormone therapies, advancements in drug delivery systems, and expanding prescriber confidence.

Position of ESTRING within Hormone Therapy

ESTRING holds a niche segment in local estrogen therapy, addressing menopausal vaginal atrophy, urinary symptoms, and sexual dysfunction with advantages over systemic therapies. Its targeted delivery minimizes systemic estrogen exposure, reducing risks associated with oral HRT, including thromboembolic events and breast cancer.

While oral hormone therapies dominate the overall market, ESTRING’s innovative vaginal ring approach offers a compelling alternative, especially for women seeking localized treatment with fewer systemic side effects.

Market Drivers

-

Aging Population: An increasing population of women aged 50-70 drives demand for menopause-related treatments. According to WHO, global women aged 50+ will reach 1.2 billion by 2030.

-

Preference for Localized Therapy: Growing preference for targeted therapies with fewer systemic side effects enhances ESTRING’s attractiveness.

-

Regulatory Approvals and Reimbursement: Continued approvals and favorable reimbursement policies in key markets, such as the U.S. and Europe, promote adoption.

-

Clinical Evidence: Robust clinical data supporting ESTRING’s safety and efficacy bolster prescriber confidence, expanding its utilization.

Market Challenges

-

Competition from Oral and Topical Formulations: Oral HRTs and other vaginal estrogen creams or rings (e.g., Femring, Divigel) pose competitive challenges.

-

Patient Acceptance and Compliance: Preference for ease of use and comfort influences adherence and market penetration.

-

Regulatory Environment: Variations in regulatory approvals across regions can impact market expansion.

Competitive Landscape

Major competitors include:

- Femring (estradiol acetate vaginal ring): A longer-acting vaginal ring approved for menopausal symptoms.

- Vaginal creams and tablets: Such as Estrace and Premarin.

- Emerging Delivery Systems: Novel vaginal rings and bioadhesive gels.

While ESTRING’s market share is somewhat limited compared to systemic therapies, its unique delivery method provides differentiation, particularly for women who prefer localized treatment.

Sales Projections

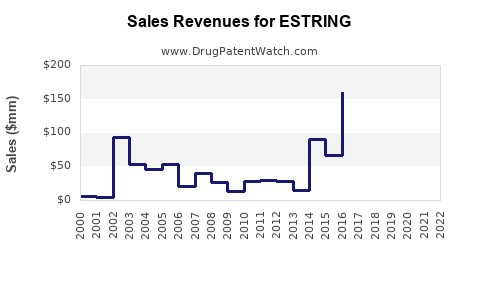

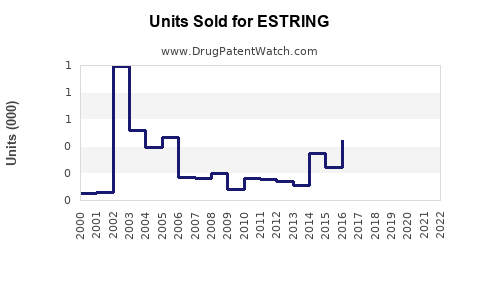

Historical Sales Data

ESTRING experienced peak sales in early 2000s, estimated around USD 200 million globally. However, sales declined due to market saturation, competition, and alternative formulations, settling at approximately USD 90 million in 2021.

Forecast Assumptions

- Market Penetration Growth: A steady increase in prescriber acceptance driven by clinical endorsements.

- Market Expansion: Entry into emerging markets such as Asia-Pacific and Latin America.

- Innovation and Line Extensions: Potential introduction of newer formulations or self-administered devices.

- Regulatory Trends: Favorable approvals will support growth.

Projected Sales (2023-2027)

| Year |

Estimated Sales (USD Million) |

Growth Rate (%) |

| 2023 |

USD 95 million |

5.6% |

| 2024 |

USD 105 million |

10.5% |

| 2025 |

USD 115 million |

9.5% |

| 2026 |

USD 125 million |

8.7% |

| 2027 |

USD 135 million |

8.0% |

These projections assume a compounded annual growth rate (CAGR) of approximately 8.9%. The gradual recovery and expansion are attributed to increased clinician awareness, regional expansion, and potential new formulations.

Regional Market Outlook

-

North America: The largest market, driven by high awareness and reimbursement. Expected to account for over 50% of sales, with steady growth due to aging demographics.

-

Europe: Strong market presence, with regulatory stability and growing acceptance of HRT options.

-

Asia-Pacific: Rapidly expanding due to increasing healthcare infrastructure, rising awareness, and affordability. Projected CAGR of 12% over five years.

-

Latin America and Middle East: Emerging markets with expanding healthcare coverage; sales expected to grow at 10-15%.

Regulatory and Market Access Considerations

- FDA Approvals: Maintaining compliance and gaining approvals for broader indications enhance market scope.

- Reimbursement Policies: Securing coverage from insurers and government health programs directly correlates with sales growth.

- Patent and Exclusivity: Patent protection and market exclusivity influence pricing and competitive positioning.

Key Opportunities and Risks

Opportunities:

- Expanding indications to include contraception or other estrogen-related conditions.

- Leveraging digital health for patient education and adherence.

- Developing generic or biosimilar versions to expand access and reduce costs.

Risks:

- Regulatory delays or restrictions.

- Competition from newer drug delivery platforms.

- Changes in clinical guidelines that favor systemic over localized therapy.

Key Takeaways

- Stable Growth: ESTRING’s niche position within local estrogen therapy ensures steady revenue streams.

- Market Expansion: Emerging markets and regional customization present growth opportunities.

- Innovation Drive: Continual product improvements and new formulations can enhance market share.

- Competitive Landscape: Differentiation from oral and topical therapies remains key.

- Regulatory Navigation: Proactive engagement with regulators secures broader access and sustained sales.

Conclusion

ESTRING remains a valuable asset in menopause management, with sales projections indicating gradual but consistent growth driven by demographic trends, clinical acceptance, and regional market expansion. Strategic focus on innovation, market access, and physician education will be crucial to capitalizing on its full commercial potential over the coming years.

FAQs

1. How does ESTRING compare to other hormone therapies?

ESTRING offers localized estrogen delivery, minimizing systemic side effects compared to oral HRTs. Its flexible delivery system provides high patient acceptability and targeted symptom relief.

2. What are the main challenges faced by ESTRING in the market?

Competition from alternative topical therapies, patient preferences for ease of use, and regional regulatory hurdles are key challenges.

3. Which regions offer the most growth potential for ESTRING?

Asia-Pacific and Latin America are high-growth regions due to expanding healthcare infrastructure and awareness, with anticipated CAGR of over 10%.

4. How might technological innovations impact ESTRING’s sales?

Advances in drug delivery and digital health integration could improve adherence, expand indications, and reinforce its competitive position.

5. What strategies could enhance ESTRING’s market penetration?

Focusing on clinical education, reimbursement negotiations, product line extensions, and regional market strategies will drive increased adoption.

Sources:

- MarketResearch.com. "Global Menopause Management Market Size & Trends." 2022.

- FDA Drug Approvals Database. ESTRING Product Information. 1992-present.

- GlobalData. "Hormonal Therapy Market Outlook." 2022.

- World Health Organization. "Aging and Women's Health." 2021.

- Industry Reports. "Vaginal Ring Market Analysis." 2022.

This comprehensive analysis aims to guide strategic decision-making, leveraging market dynamics and sales forecasts for ESTRING.