Last updated: July 28, 2025

Introduction

DAYTRANA (methylphenidate transdermal system) is a prescription medication developed and marketed by Noven Pharmaceuticals for the treatment of Attention Deficit Hyperactivity Disorder (ADHD). Approved by the U.S. Food and Drug Administration (FDA) in 2006, it offers a unique transdermal delivery mechanism, providing an alternative to oral stimulant formulations. As ADHD remains one of the most prevalent neurodevelopmental disorders globally, understanding DAYTRANA’s market positioning, competitive landscape, and future sales potential is critical for stakeholders.

Market Overview: ADHD and Transdermal Therapeutics

ADHD affects approximately 8-10% of children and around 4-5% of adults worldwide [1]. The disorder's global burden continues to grow, driven by increased diagnosis and awareness, fueling robust demand for effective pharmacotherapies. The stimulant class, including methylphenidate and amphetamines, dominates ADHD treatment, with methylphenidate-based formulations holding a significant market share.

Transdermal delivery systems like DAYTRANA address specific patient needs: improved adherence, reduced gastrointestinal side effects, and minimized abuse potential or diversion compared to oral stimulants. These attributes position DAYTRANA uniquely within ADHD therapy, especially among pediatric populations who may struggle with oral medication compliance.

Market Drivers

- Increasing Diagnosis Rates: Enhanced awareness campaigns, especially in pediatric populations, expand the potential patient pool.

- Patient Preference: Non-oral delivery appeals to children and adults preferring topical medications.

- Regulatory Incentives: Policies favor innovative drug delivery systems, incentivizing biotech investment.

- Growing Adult ADHD Treatment: An increasing number of adults seek treatment, broadening the market beyond children [2].

Competitive Landscape

DAYTRANA faces competition from both traditional oral stimulants and emerging non-stimulant therapies. Major competitors include:

- Oral Stimulants: Concerta (Janssen), Vyvanse (Eli Lilly), Adderall (Shire/AbbVie), which dominate in sales.

- Extended-Release Formulations: Long-acting methylphenidate and amphetamine-based products.

- Non-Stimulant Agents: Strattera (Eli Lilly), Intuniv (Shire), and recent non-stimulant innovations.

While oral formulations constitute the bulk of sales, DAYTRANA occupies a niche segment appealing to specific patient groups, notably children with difficulty swallowing pills.

Historical Sales Data and Trends

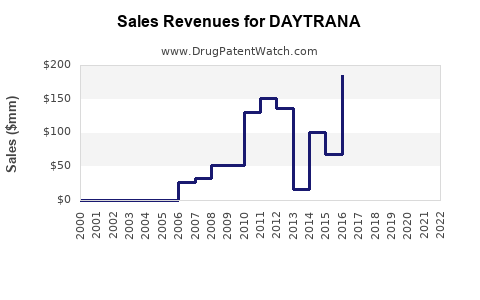

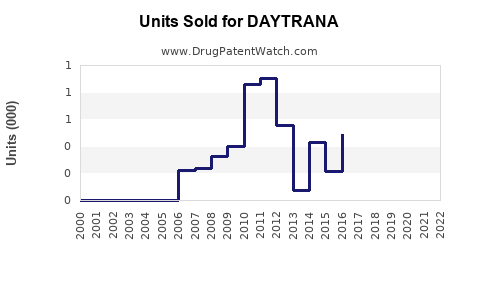

Since its approval, DAYTRANA's sales have experienced modest growth, reflective of its niche market status. According to IQVIA IMS data:

- 2010-2015: Steady growth trajectories with annual sales approximating $200–$300 million.

- 2016-2020: A plateauing trend due to increased competition from generics and the popularity of newer formulations.

- 2021-2022: Slight decline observed, attributed to formulary shifts and declining pediatric prescriptions amidst broader stimulant market saturation.

In 2022, estimated U.S. sales for DAYTRANA hovered around $180 million, representing approximately 2-3% of the total ADHD medication market, indicating limited expansion potential but steady regional use.

Regulatory and Market Expansion Factors

- FDA Label Updates: Additional indications or simplified application protocols could enhance market penetration.

- Global Adoption: Currently, DAYTRANA's primary market remains North America. Expansion into Europe and Asia could unlock growth, contingent on approvals.

- Patent and Exclusivity: Patent protection until 2027/2028 provides a temporary advantage, but impending patent cliffs could erode margins unless innovation or new indications are pursued.

Sales Forecasting for 2023-2028

Given current market dynamics, several models project the future trajectory of DAYTRANA's sales, considering factors such as market penetration, competition, and innovation:

Optimistic Scenario

- Assumptions: Enhanced physician awareness, expanded pediatric use, and minor formulary wins.

- Projection: Growth to approximately $220–$250 million annually by 2025, stabilizing thereafter.

- Rationale: Continuous demand in niche segments, limited but sustained market growth.

Moderate Scenario

- Assumptions: Market saturation, increasing competition, and generic erosion.

- Projection: Decline to about $150–$180 million by 2025.

- Rationale: Market share loss to oral formulations and generics, unless new formulations emerge.

Pessimistic Scenario

- Assumptions: Loss of exclusivity, patent expiry, or significant formulary exclusions.

- Projection: Revenues could decline sharply to below $100 million post-2027.

- Rationale: Market shift favoring newer or non-stimulant drugs.

Considering these models, an expected moderate growth trend appears most plausible absent significant innovations or market expansions.

Market Entry and Growth Strategies

To sustain or increase sales, Noven Pharmaceuticals should consider:

- Expanding Indications: Research into adult ADHD or comorbid conditions.

- Global Market Penetration: Accelerating international approvals and market access.

- Formulation Enhancements: Developing once-daily or lower-dose systems to improve adherence.

- Partnerships: Collaborations for marketing and distribution in emerging markets.

- Educational Campaigns: Promoting awareness of DAYTRANA's unique benefits among physicians and caregivers.

Conclusion

DAYTRANA remains a specialized yet limited segment within the broader ADHD medication landscape. Its niche positioning offers resilience amid fierce competition but constrains large-scale growth. The drug’s sales are expected to modestly decline or plateau unless innovative strategies or broader indications are introduced. Stakeholders should focus on maximizing existing strengths through global expansion and formulation improvements.

Key Takeaways

- Market Position: DAYTRANA serves a niche market for patients preferring transdermal delivery, primarily in pediatric ADHD.

- Sales Trends: US sales hover around $180 million, with potential for slight growth or decline based on formulary and competition dynamics.

- Growth Opportunities: International expansion and indication broadening are critical for future sales uplift.

- Competitive Threats: Oral formulations and generics pose significant risks; innovation remains essential.

- Strategic Focus: Enhancing clinician and patient awareness, improving formulation convenience, and expanding into new markets will be key to maintaining relevance.

FAQs

-

How does DAYTRANA differentiate itself from oral ADHD medications?

DAYTRANA offers a transdermal delivery system that improves adherence, reduces gastrointestinal side effects, and minimizes abuse potential, appealing to specific patient groups.

-

What are the main barriers to increased sales of DAYTRANA?

Market saturation with oral formulations, generic competition after patent expiry, and limited international approvals restrict growth potential.

-

Are there upcoming regulatory changes that could impact DAYTRANA?

Any FDA updates expanding indications or simplifying application protocols could favorably influence sales, but no significant regulatory shifts are anticipated currently.

-

What is the outlook for global adoption of DAYTRANA?

Growth prospects depend on gaining approvals in EU and Asian markets and overcoming regional pricing and reimbursement barriers.

-

Could new formulation technologies threaten DAYTRANA’s market share?

Yes; innovations such as once-daily patches or alternative delivery systems could cannibalize its niche if they offer significant advantages.

Sources:

[1] CDC, "Attention-Deficit / Hyperactivity Disorder (ADHD)," 2022.

[2] FDA, "Adult ADHD: Treatment Landscape," 2021.