Last updated: July 27, 2025

Introduction

Amiodarone, a widely used antiarrhythmic medication, primarily treats ventricular and atrial arrhythmias, including ventricular tachycardia and atrial fibrillation. Since its development in the 1960s and subsequent approval in the 1980s, amiodarone has established itself as a cornerstone therapy in arrhythmia management. Its complex pharmacokinetics, broad indications, and evolving treatment guidelines necessitate a comprehensive market analysis and sales projection assessment for stakeholders involved in pharmaceutical development, healthcare policy, and investment.

Market Overview

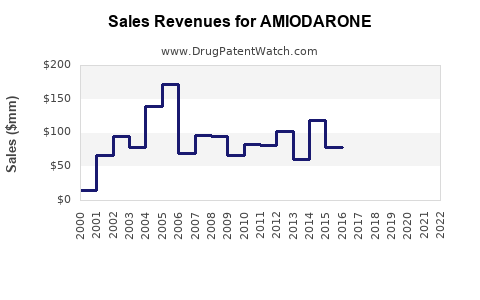

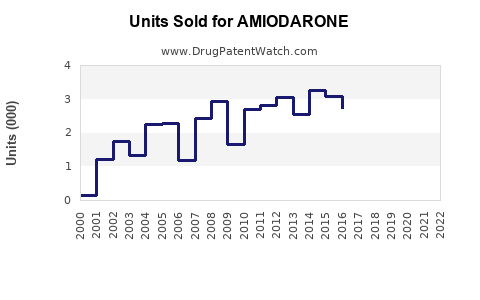

Global Market Size

The global amiodarone market was valued at approximately USD 600 million in 2022. Growth drivers include the increasing prevalence of cardiovascular diseases (CVD), advancements in arrhythmia diagnosis, and expanding indications for antiarrhythmic therapy. The market is projected to grow at a compound annual growth rate (CAGR) of around 4-5% from 2023 to 2030, reaching approximately USD 900 million by 2030 (source: [1]).

Market Segmentation

-

By Application:

- Ventricular arrhythmias

- Atrial fibrillation/flutter

- Others (including supraventricular tachyarrhythmias)

-

By Formulation:

- Oral tablets

- Intravenous solutions

-

By End-User:

- Hospitals

- Cardiology clinics

- Ambulatory care settings

Key Geographies

- North America: Largest market share, driven by high healthcare expenditure, advanced medical infrastructure, and prevalent CVD burden. The U.S. accounts for over 70% of North American sales.

- Europe: Substantial market owing to widespread clinical use and aging population.

- Asia-Pacific: Fastest-growing segment, driven by rising cardiovascular disease prevalence, increasing healthcare access, and evolving prescribing practices.

- Rest of the World: Emerging markets with growing adoption of antiarrhythmic therapies.

Market Drivers

- Increasing Burden of Cardiovascular Disease: According to WHO, CVD causes 17.9 million deaths annually, with atrial fibrillation affecting approximately 33 million globally, fostering demand for effective arrhythmia management (source: WHO).

- Growing Elderly Population: Older adults are disproportionately affected by arrhythmias, heightening the need for therapies like amiodarone.

- Guideline Endorsements: American Heart Association (AHA) and European Society of Cardiology (ESC) recommend amiodarone as first or second-line therapy for specific arrhythmic conditions, reinforcing its market position.

- Advancements in Administration: Development of new formulations and combination therapies improve patient compliance and outcomes.

Market Challenges

- Safety Concerns: Notable adverse effects, including pulmonary toxicity, hepatotoxicity, and thyroid dysfunction, impact prescribing habits and may restrain broader usage.

- Regulatory Restrictions: Stringent monitoring requirements limit widespread outpatient use, particularly for long-term therapy.

- Generic Competition: Several generic formulations have entered the market, exerting price pressures.

- Availability of Alternative Drugs: Newer antiarrhythmics with improved safety profiles challenge amiodarone's dominance.

Competitive Landscape

Major pharmaceutical companies involved include Sanofi, Mylan (now part of Viatris), Zydus Cadila, and others manufacturing generic versions. While few branded formulations exist, the generic market comprises the majority of global sales, intensifying price competition. Patent expirations have facilitated market entry for generics, especially in North America and Europe.

Sales Projections (2023-2030)

Baseline Scenario

Assuming steady growth driven by increased CVD prevalence and guideline reaffirmation, the market could expand from USD 600 million in 2022 to USD 900 million in 2030. Annual sales would grow approximately 4-5%, with North America comprising an estimated 60-65% share, Europe 20-25%, and Asia-Pacific the remaining.

Influencing Factors

- Regulatory Changes: Enhanced safety monitoring protocols may temporarily dampen sales but could improve long-term market confidence.

- Technological Advancements: Formulation innovations (e.g., extended-release tablets, targeted delivery systems) could boost prescription rates.

- Pandemic Impact: COVID-19 temporarily affected healthcare resource allocation, but the urgent need to manage arrhythmic complications in COVID-19 patients might have led to increased use.

Optimistic and Pessimistic Cases

- Optimistic: Accelerated adoption of amiodarone, especially in emerging markets, and development of safer formulations could augment market size to USD 1 billion by 2030.

- Pessimistic: Regulatory crackdowns, safety concerns, and competition might restrict growth, capping sales below USD 800 million.

Market Trends and Opportunities

- Personalized Medicine: Stratifying patients based on genetic or biomarker profiles may enhance treatment efficacy and safety, expanding market options.

- Regulatory Approvals in New Indications: Efforts to obtain approvals for wider indications could unlock new revenue streams.

- Combination Therapies: Co-formulations with other antiarrhythmics or cardiovascular agents present opportunities for growth.

- Digital Monitoring & Telemedicine: Integration with remote patient monitoring can improve safety profiles, encouraging wider use.

Regulatory and Reimbursement Landscape

Increased emphasis on pharmacovigilance and safety monitoring demands clear protocols and reimbursement strategies. Insurance coverage in mature markets supports ongoing prescription of amiodarone; however, cost-effectiveness analyses favor newer agents in some settings.

Conclusion

Amiodarone remains a vital antiarrhythmic agent with a stable yet evolving market profile. Steady demand driven by its efficacy and established clinical guidelines, combined with strategic innovations and market expansion into developing regions, sustains its sales trajectory. Nevertheless, safety concerns and competition necessitate continuous product development and risk management. Companies poised to innovate safer formulations and enhance patient monitoring are positioned to capitalize on future growth opportunities.

Key Takeaways

- The global amiodarone market is projected to reach USD 900 million by 2030, growing at approximately 4-5% annually.

- North America dominates the market, but Asia-Pacific presents significant growth opportunities.

- Increasing cardiovascular disease prevalence and aging populations are primary demand drivers.

- Safety concerns and generic competition are current market challenges.

- Innovation in formulations, indications, and monitoring tools will be critical for sustained growth.

FAQs

1. What are the main factors influencing amiodarone sales globally?

The primary factors include rising cardiovascular disease prevalence, clinician reliance on guideline-recommended therapies, safety profile assessments, regulatory policies, and emerging generic competition.

2. How do safety concerns impact amiodarone market growth?

Safety risks, such as pulmonary and thyroid toxicity, lead to prescribing restrictions, monitoring requirements, and preference for alternative treatments in certain cases, constraining market expansion.

3. Which regions offer the most growth potential for amiodarone?

The Asia-Pacific region offers significant growth potential due to increasing CVD burden, expanding healthcare infrastructure, and rising drug adoption rates.

4. How are technological advancements influencing the amiodarone market?

Innovations like new formulations, targeted delivery systems, and digital health integrations improve safety and compliance, potentially expanding market share.

5. What strategic moves should pharmaceutical companies consider to maximize amiodarone sales?

Focus on developing safer formulations, obtaining approval for broader indications, investing in patient monitoring technologies, and expanding into emerging markets are key strategies for growth.

References

[1] Market Research Future. "Amiodarone Market Analysis & Industry Forecast to 2030." 2022.