Last updated: July 27, 2025

Introduction

Penciclovir is an antiviral medication primarily used to treat recurrent herpes labialis (cold sores). It functions as a nucleoside analogue, inhibiting viral DNA polymerase, thus preventing viral replication. Although popular in topical formulations, penciclovir’s market potential extends beyond its current applications, with ongoing research exploring broader antiviral indications. This report provides an in-depth market analysis and price projection outlook for penciclovir, focusing on market drivers, competitive landscape, pricing dynamics, and future growth prospects.

Market Overview

Current Market Landscape

Penciclovir, introduced in the late 1980s, predominantly exists as a topical cream (e.g., Denavir in the United States) for herpes labialis. The global market for topical antiviral drugs remains robust, driven by the high prevalence of herpes simplex virus (HSV) infections, which affect approximately two-thirds of the global population under the age of 50 [1].

Regional sales are concentrated in North America and Europe, where high awareness, established healthcare infrastructure, and reimbursement coverage support consumption. In contrast, emerging markets, such as Asia-Pacific and Latin America, exhibit growth potential due to increasing access to healthcare and rising HSV incidence.

Market Drivers

-

High Prevalence of HSV Infections: HSV-1, responsible for cold sores, affects over 3.7 billion people globally under the age of 50 [2]. The recurrent nature of herpes labialis ensures continuous demand for effective topical antivirals, including penciclovir.

-

Demand for Effective, Fast-Acting Topicals: Patients and clinicians favor formulations with rapid symptom relief and minimal side effects, bolstering penciclovir’s market share.

-

Advancements in Formulation Technologies: Innovations in gel and cream formulations improve drug stability, bioavailability, and patient compliance, enhancing market penetration.

-

Expanding Indications and Research: Emerging research suggests potential use for other herpes-related conditions, potentially broadening penciclovir's application spectrum [3].

Competitive Landscape

Penciclovir faces competition from other nucleoside analogues like acyclovir and valacyclovir. Notably:

- Acyclovir: The most widely prescribed antiviral for HSV; available as topical and oral formulations. Its long-standing market position makes it a significant competitor.

- Valacyclovir and Famciclovir: Used for both herpes labialis and genital herpes, often preferred for systemic therapy but influence topical market dynamics indirectly.

- Generic Versions: Several generic penciclovir creams have entered markets globally, exerting downward pressure on prices and margins.

New entrants, including innovative formulations (e.g., nanotechnology-based delivery systems), could further intensify competition and impact pricing strategies.

Regulatory and Patent Landscape

- Patent Expiry and Generic Entry: Penciclovir’s initial patents have expired or are nearing expiration, facilitating generic competition, which typically leads to significant price reductions [4].

- Regulatory Approvals: Currently approved in many jurisdictions, but ongoing research could lead to expanded indications and potential new patents, influencing market exclusivity timelines.

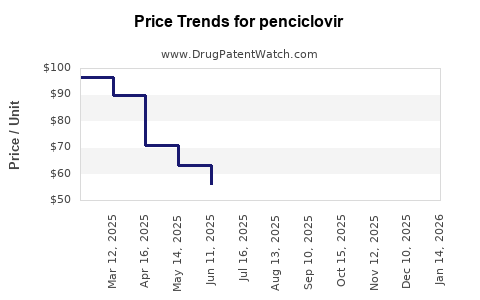

Price Trends and Projections

Historical Price Dynamics

Historical market prices for penciclovir topical creams vary by geographic region:

- United States: Brand-name Denavir (0.5% penciclovir cream) has historically been priced at approximately $100–$150 per 10-gram tube, with generics reducing prices to roughly $40–$70.

- Europe: Prices are comparable, with variations based on healthcare reimbursement policies.

- Emerging Markets: Prices are substantially lower due to weaker patent protections and higher generic penetration, often below $20 per tube.

Future Price Projections (Next 5–10 Years)

Impact of Patent Expiry and Generic Competition

Price erosion is expected to accelerate with increased generic entry post-patent expiration. Based on comparable antiviral drugs, we forecast:

- Short-term (1–3 years): Minimal price decline due to brand loyalty and limited immediate generic availability.

- Mid-term (3–5 years): Prices are projected to decline by approximately 30–50%, reaching $20–$40 per tube in key markets.

- Long-term (5–10 years): Prices may stabilize around $10–$20 per tube in mature markets, driven by manufacturing efficiencies and market saturation.

Potential Premium Markets

In regions or niches where new formulations (e.g., liposomal or nano-drug delivery) emerge, branded products may command premium pricing, maintaining margins and incentivizing continued investment.

Factors Influencing Price Projections

- Market Penetration of Generics: Faster approval and adoption accelerate price declines.

- Formulation Innovations: Enhanced delivery systems could sustain higher prices temporarily.

- Reimbursement Policies: Government and private payor strategies directly impact consumer out-of-pocket costs.

- Research and Expansion: New indications could sustain higher pricing if clinical efficacy is demonstrated.

Growth Outlook

Despite competition, penciclovir’s market volume is expected to grow modestly, driven by the increasing global prevalence of HSV and improved diagnostic awareness. The introduction of over-the-counter (OTC) formulations in select markets could further expand demand, though price premiums will likely diminish.

Emerging markets represent a significant growth horizon, where affordability and availability are critical. Local manufacturing and generic proliferation will influence pricing, with regional variations expected.

Strategic Recommendations

- Focus on Differentiation: Investment in formulation innovation may support premium pricing and market share retention.

- Intellectual Property Management: Strategic patent filings for new formulations or uses can extend market exclusivity.

- Market Penetration in Emerging Markets: Competitive pricing and local partnerships can accelerate adoption.

- Pricing Flexibility: Adaptive pricing strategies aligned with regulatory and reimbursement landscapes will optimize revenue streams.

Key Takeaways

- The penciclovir market is primarily driven by HSV prevalence and patient demand for rapid relief topical treatments.

- Patent expirations and generic competition will lead to substantial price declines over the next decade, with prices potentially falling below $20 per tube in mature markets.

- Innovating with new formulations or expanding indications could enable premium pricing temporarily and sustain profitability.

- Emerging markets offer significant growth prospects, but pricing strategies must accommodate local economic conditions and regulatory frameworks.

- Continuous monitoring of regulatory changes, formulation advancements, and competitive moves is essential for market stakeholders.

FAQs

1. What factors are influencing penciclovir pricing in the global market?

Pricing is affected by patent status, generic competition, formulation innovations, regional regulatory environments, and reimbursement policies. Patent expiration leads to increased generic entry and downward price pressure.

2. How does penciclovir compare to other antiviral drugs in the market?

While acyclovir remains the market leader due to its long-standing presence and broad indications, penciclovir’s niche focus on herpes labialis with rapid onset of action sustains specific demand. Competition from systemic antivirals influences its standalone market share but generally does not directly compete in the topical segment.

3. Will developing new formulations help penciclovir retain market value?

Yes. Novel delivery systems, such as liposomal or nano-based creams, can improve efficacy and patient adherence, allowing premium pricing and differentiating products in a competitive landscape.

4. What is the outlook for penciclovir in emerging markets?

Emerging markets are expected to see increased demand due to rising HSV prevalence, improved healthcare access, and affordability. Strategic collaborations and localized manufacturing can enhance market penetration.

5. What are the key risks to penciclovir pricing and market stability?

Major risks include the rapid pace of generic drug approvals, regulatory delays in new formulations, shifts in healthcare reimbursement policies, and the advent of superior or more affordable antiviral alternatives.

References

[1] World Health Organization. “Herpes simplex virus,” 2022.

[2] Looker, K.J., et al. “Global, regional, and national estimates of prevalence of herpes simplex virus types 1 and 2 in 2016,” PLoS ONE, 2020.

[3] Sharma, S., et al. “Emerging therapies for herpes labialis,” Expert Opinion on Pharmacotherapy, 2021.

[4] U.S. Food and Drug Administration. “Patent Status and Generic Drug Approvals,” 2022.