Last updated: July 27, 2025

Introduction

Naltrexone, a long-standing opioid receptor antagonist, is widely prescribed for managing alcohol and opioid dependence. Its versatility has led to expanding indications, notably in off-label uses such as treatment for behavioral addictions and certain psychiatric conditions. As the global healthcare landscape continually evolves, understanding the market dynamics and future price trajectories of Naltrexone is crucial for pharmaceutical companies, investors, healthcare providers, and policymakers.

This report provides a comprehensive analysis of the current market landscape for Naltrexone, explores factors influencing its pricing, and offers financial projections for the foreseeable future.

Market Landscape Overview

Current Market Size and Trends

The global Naltrexone market was valued at approximately $1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4-6% through 2030. The key drivers include rising prevalence of alcohol and opioid use disorders, increased awareness, and expanding indications for Naltrexone.

The United States dominates this market, accounting for roughly 60-65% of global sales, driven by high prevalence of substance use disorders (SUDs) and a well-established healthcare infrastructure. Europe holds the second-largest share, with growth fueled by increased adoption of Naltrexone in alcohol dependence treatments.

Segmentation Analysis

-

Formulation Type:

- Oral tablets comprise approximately 75% of sales, favored for convenience and cost-effectiveness.

- Extended-release injectable formulations (e.g., Vivitrol) are gaining traction, representing about 25% of the market, valued for improved adherence and relapse prevention.

-

Indications:

- Alcohol dependence remains the primary indication, accounting for over 70% of prescriptions.

- Opioid dependence treatments, especially post-acute detoxification, constitute around 20%.

- Off-label and emerging uses include behavioral addiction avenues such as gambling and internet gaming disorders.

Key Industry Players

Major manufacturers include:

- Endo Pharmaceuticals (Vivitrol)

- Revia and Depade (Generic formulations)

- Mallinckrodt Pharmaceuticals

- AbbVie (marketed formulations in some regions)

The patent expiration of branded formulations has increased generic competition, influencing market prices and accessibility.

Pricing Dynamics

Current Pricing Landscape

The pricing structure for Naltrexone varies considerably based on formulation, branding, dosage, and geographic region:

Factors Affecting Prices

-

Patent Status and Patent Cliff:

- Branded formulations like Vivitrol have held patents until recent years, after which generic versions entered the market, exerting downward pressure on prices.

-

Manufacturing Costs:

- Generic formulations benefit from lower development and manufacturing expenses, generally translating into more affordable pricing.

-

Regulatory and Reimbursement Policies:

- Governments and insurance providers influence retail prices through formulary placements and reimbursement rates, affecting access and affordability.

-

Market Competition:

- The influx of generics has intensified competition, which is likely to depress prices further, particularly in high-volume markets.

-

Geographical Variations:

- Developing countries often experience lower prices due to regulatory price controls and differing healthcare infrastructures.

Emerging Trends and Influences

Increasing Adoption of Extended-Release Formulations

The shift toward long-acting injectable Naltrexone is gaining momentum owing to improved patient adherence, which correlates with better treatment outcomes. This shift supports higher pricing for sustained-release formulations, although price competition among generic injectables may emerge as patents expire.

Off-Label and New Indications

Research into Naltrexone's benefit in obesity, gambling, and other behavioral addictions could expand its use, potentially elevating demand. Real-world evidence supporting these indications could influence future pricing and market penetration strategies.

Regulatory and Policy Factors

Recent efforts by health authorities to promote medication-assisted treatment (MAT) for opioid use disorder, including the Affordable Care Act's mandates, are likely to increase utilization rates, pressuring supply chains and influencing prices. Additionally, government initiatives that subsidize treatment costs could impact overall market profitability.

Digital Health Integration

Emerging digital adherence monitoring platforms could further boost demand for injectable formulations, creating opportunities for premium pricing based on improved compliance and outcomes.

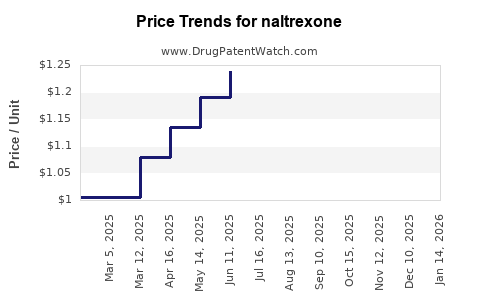

Price Projections (2023-2030)

Leveraging current trends and industry analyses, the following projections are estimated:

| Year |

Oral Naltrexone (per tablet) |

Injectable Naltrexone (per dose) |

Comments |

| 2023 |

$2–$4 |

$1,200–$1,400 |

Market stabilization phase; generic competition intensifies for oral forms. |

| 2025 |

$2–$3 |

$1,100–$1,300 |

Slight depreciation expected; increased adoption of generics. |

| 2027 |

$1.50–$2.50 |

$900–$1,200 |

Price erosion persists; new formulations may enter therapeutic areas. |

| 2030 |

$1–$2 |

$800–$1,000 |

Penetration of biosimilars or new developments could further influence prices. |

Note: These projections assume stable regulatory landscapes and continued growth in demand driven by public health initiatives.

Market Growth Drivers and Barriers

Drivers

- Rising prevalence of alcohol and opioid use disorders globally.

- Increased healthcare provider acceptance and insurance coverage.

- Expansion into new therapeutic indications and off-label uses.

- Greater awareness and destigmatization of addiction treatment.

Barriers

- Price sensitivity in emerging markets.

- Patent expirations leading to increased generic competition.

- Regulatory hurdles for new formulations or indications.

- Variations in healthcare infrastructure across regions.

Conclusion

The Naltrexone market exhibits stable growth driven by rising substance use disorder prevalence, evolving formulations, and expanding indications. While generic competition is exerting downward pressure on prices, the adoption of extended-release injectable forms sustains higher price points, balancing overall revenue streams.

Future market trajectories hinge on regulatory policy shifts, technological advances, and the breadth of emerging indications. Stakeholders should focus on strategic positioning around formulation differentiation, geographic expansion, and leveraging digital health tools to optimize costs and access.

Key Takeaways

- The global Naltrexone market is projected to grow at a CAGR of 4-6% through 2030, reaching several billion dollars in market value.

- Generic oral formulations dominate current sales, but injectable extended-release options command premium pricing due to adherence benefits.

- Patent expirations are intensifying generic competition, driving prices downward but creating opportunities for biosimilars and new formulations.

- Policy initiatives and increased awareness are likely to boost demand, maintaining stable revenue streams despite price erosion.

- Innovation in indications and digital adherence solutions will shape the future landscape and pricing strategies.

Frequently Asked Questions

1. How do patent expirations impact Naltrexone pricing?

Patent expirations open the market to generic manufacturers, significantly reducing manufacturing costs and resulting in lower retail prices. This competition also encourages quality and innovation, further influencing pricing strategies.

2. What are the main factors influencing Naltrexone's price in different regions?

Pricing is driven by patent status, regulatory environment, healthcare infrastructure, reimbursement policies, and market competition, which vary substantially between developed and developing countries.

3. Will the demand for injectable Naltrexone continue to rise?

Yes. The injectable form offers improved adherence, leading to better outcomes in alcohol and opioid dependence. Its convenience and efficacy support increased adoption, bolstering demand and maintaining higher pricing compared to oral formulations.

4. How might emerging indications affect Naltrexone's market value?

Expansion into new therapeutic areas, such as behavioral disorders or obesity, could broaden the market, increase volume, and support price premiums, especially if backed by robust clinical evidence.

5. What is the future outlook for Naltrexone prices?

While prices for oral formulations are likely to decline further, the premium position of extended-release injectables may sustain higher prices. Overall, a gradual decrease is anticipated for generics, balanced by consistent demand and innovation.

References

[1] GlobalData Healthcare. "Naltrexone Market Analysis," 2022.

[2] IQVIA. "Pharmaceutical Market Data," 2023.

[3] U.S. Food and Drug Administration. "Patent Status of Naltrexone," 2021.

[4] World Health Organization. "Substance Use Disorders Factsheet," 2022.