Share This Page

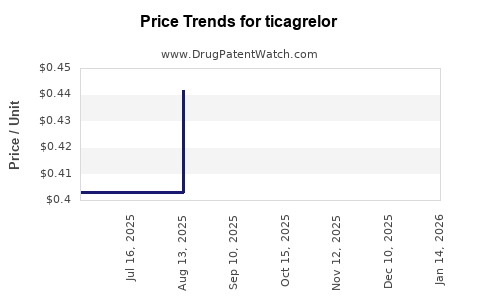

Drug Price Trends for ticagrelor

✉ Email this page to a colleague

Average Pharmacy Cost for ticagrelor

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TICAGRELOR 60 MG TABLET | 76282-0584-60 | 4.13213 | EACH | 2026-01-28 |

| TICAGRELOR 60 MG TABLET | 43598-0629-60 | 4.13213 | EACH | 2026-01-21 |

| TICAGRELOR 90 MG TABLET | 76282-0550-60 | 0.42163 | EACH | 2026-01-21 |

| TICAGRELOR 60 MG TABLET | 67877-0522-60 | 4.13213 | EACH | 2026-01-21 |

| TICAGRELOR 60 MG TABLET | 00378-2214-91 | 4.13213 | EACH | 2026-01-21 |

| TICAGRELOR 60 MG TABLET | 62332-0500-60 | 4.13213 | EACH | 2026-01-21 |

| TICAGRELOR 60 MG TABLET | 00480-2688-06 | 4.13213 | EACH | 2026-01-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TICAGRELOR: A Strategic Overview

Introduction

Ticagrelor, a potent oral antiplatelet agent marketed under the brand name Brilinta (or Brilique outside the US), has gained significant traction in the cardiovascular therapeutics segment. Approved by the U.S. FDA in 2011, it is prescribed primarily for the prevention of thrombotic cardiovascular events in patients with acute coronary syndrome (ACS) and recent myocardial infarction (MI). As the global cardiovascular disease (CVD) burden continues to rise, the market dynamics for ticagrelor are subject to evolution driven by regulatory policies, competitive landscape, clinical guidelines, and pricing strategies. This analysis explores current market conditions and provides price projection insights over the next five years.

Market Landscape

Global Market Size and Growth Trends

The global antiplatelet drugs market, valued at approximately USD 15 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 6% through 2028[1]. Ticagrelor, representing a significant component within this segment, benefits from increased adoption driven by clinical evidence favoring its efficacy over clopidogrel in certain patient populations.

In 2022, the European market accounted for roughly 40% of the total ticagrelor sales, followed by North America with approximately 35%. Asia-Pacific and other emerging markets are witnessing rapid expansion owing to rising CVD prevalence and improved healthcare infrastructure[2].

Competitive Dynamics

Ticagrelor faces competition primarily from:

- Clopidogrel (Plavix/Sanofi/AbbVie)

- Prasugrel (Effient/Daiichi Sankyo)

- Other agents and biosimilars entering the market

While clopidogrel remains the most cost-effective, its variable response due to genetic polymorphisms limits its clinical utility. Prasugrel offers comparable efficacy but with a different safety profile. Recent advances include the development of generic versions of clopidogrel and prasugrel, exerting pressure on ticagrelor’s pricing.

Regulatory and Clinical Guideline Impact

The 2017 European Society of Cardiology (ESC) guidelines recommend ticagrelor as a preferred P2Y12 inhibitor in acute coronary syndrome management, further bolstering market uptake[3]. However, reimbursement policies and patent expirations influence pricing and accessibility.

Current Pricing Environment

Pricing in Major Markets

- United States: The list price for a 60-count package of Brilinta (90 mg tablets) ranges from USD 350 to USD 410, translating to approximately USD 5.80 per tablet[4].

- European Union: Pricing strategies vary among countries, with prices ranging from EUR 60 to EUR 80 for a 30-day supply of 90 mg tablets.

- Emerging Markets: Significant discounts and generic options lower prices, often below USD 2 per tablet.

Insurance and Reimbursement Impact

In countries like the US and Europe, insurance coverage and reimbursement policies greatly influence patient out-of-pocket costs and, subsequently, market penetration. Cost-effectiveness analyses favor ticagrelor in high-risk populations, promoting broader utilization.

Future Price Projections (2023–2028)

Key Drivers for Price Trends

- Patent Expiry and Generic Entry: The US patent for ticagrelor is set to expire around 2024–2025[5], likely leading to generic competition, which could reduce prices by 50–80%, depending on market conditions.

- Market Penetration in Emerging Economies: Increased access through tiered pricing strategies will sustain steady growth and potentially stabilize prices.

- Reimbursement Policies: Governments and insurers adopting value-based pricing models may negotiate lower prices, especially in cost-sensitive markets.

Projected Price Trajectory

| Year | US Price Range (USD per tablet) | European Price Range (EUR per tablet) | Emerging Markets (USD per tablet) |

|---|---|---|---|

| 2023 | USD 5.80 – USD 6.30 | EUR 2.00 – EUR 2.50 | USD 1.50 – USD 2.50 |

| 2024 | USD 3.50 – USD 4.00 (post-patent expiries) | EUR 1.20 – EUR 1.50 | USD 1.00 – USD 2.00 |

| 2025–2028 | Stabilization at USD 2.50 – USD 4.00 in US; EUR 1.00 – EUR 2.00 in Europe | Continued decrease expected | Possible decline due to increased generics |

Note: Price reductions are speculative, influenced by generic market entry, insurance negotiations, and manufacturer strategies.

Strategic Considerations for Stakeholders

Pharmaceutical Companies

- Pricing Strategies: Pre-patent expiration, maintaining premium pricing in premium markets is essential. Post-expiration, focus shifts towards competitive pricing and biosimilars.

- Market Expansion: Leveraging clinical guidelines favoring ticagrelor in emerging markets offers growth avenues.

Healthcare Providers & Payers

- Value-Based Pricing: Supporting reimbursement negotiations based on clinical benefits over cost.

- Patient Access: Ensuring affordability through tiered pricing schemes, especially in low-income countries.

Regulators

- Pricing Oversight: Monitoring drug prices to balance innovation incentives and affordability.

- Patent Policies: Streamlining approvals for generics to expedite price reductions post-patent expiry.

Key Takeaways

- The global ticagrelor market is poised for growth driven by increasing cardiovascular disease incidence and evolving clinical guidelines favoring its use.

- Patent expiration and generic competition are critical factors likely to decrease prices substantially after 2024, especially in the US.

- Pricing strategies will evolve to accommodate market-specific economic conditions, insurance reimbursements, and policy changes.

- Stakeholders must adopt flexible approaches balancing profitability, accessibility, and regulatory compliance.

- The growing adoption in emerging markets offers significant growth potential, but price points will be sensitive to economic and infrastructural factors.

FAQs

Q1: How will patent expiry affect ticagrelor prices globally?

A1: Patent expiry typically leads to generic entry, resulting in substantial price reductions—up to 80%—especially in markets with robust generic manufacturing capabilities such as the US and Europe.

Q2: Are there any biosimilar versions of ticagrelor in development?

A2: Currently, no biosimilars exist for ticagrelor; however, the entry of generic small-molecule competitors post-patent expiration is expected to influence market pricing.

Q3: How do clinical guidelines influence the pricing and market share of ticagrelor?

A3: Favorable guidelines, such as those from ESC and AHA, promote increased prescribing, which sustains higher price points pre-patent expiry. Post-expiry, market share may shift toward lower-cost generics unless brand strategies shift focus.

Q4: What are the main factors influencing the pricing strategies in emerging markets?

A4: Factors include economic conditions, healthcare infrastructure, government policies, patent status, and manufacturing capabilities. Tiered pricing and local partnerships are common strategies.

Q5: How might evolving clinical evidence impact future price projections?

A5: Confirmatory trials demonstrating superior efficacy or safety can sustain premium pricing; conversely, evidence of limited benefits may pressure price reductions to remain competitive.

References

[1] Markets and Markets. "Antiplatelet Drugs Market," 2022.

[2] IQVIA. "Global Cardiovascular Disease Market Report," 2022.

[3] ESC Guidelines for the management of acute coronary syndromes, 2017.

[4] GoodRx. "Brilinta (Ticagrelor) Prices," 2023.

[5] U.S. Patent and Trademark Office. "Patent Details for Ticagrelor," 2022.

More… ↓