Last updated: July 27, 2025

Introduction

Sucralfate, a gastroprotective agent primarily indicated for the treatment and prevention of duodenal ulcers, remains a significant entity within the global gastrointestinal (GI) therapeutics market. Its unique mechanism of forming a protective barrier over ulcer sites positions it as a vital option, particularly for patients intolerant to other therapies such as proton pump inhibitors (PPIs) and H2 receptor antagonists. This comprehensive market analysis evaluates current dynamics influencing sucralfate’s commercial landscape and offers informed price forecasts, integrating recent trends, regulatory factors, and market drivers.

Market Overview

Global Market Size and Trends

The global gastroprotective drugs market surpasses USD 10 billion in valuation, experiencing steady growth driven by increasing prevalence of GI disorders and aging populations [1]. Sucralfate’s segment, although mature, continues to offer stability, especially in markets with limited access to newer therapies or where traditional treatments dominate.

In 2022, the demand for sucralfate was approximately USD 600 million, with North America and Europe representing significant market shares due to high GERD and ulcer prevalence. Emerging markets, notably Asia-Pacific, show considerable growth potential, driven by increasing healthcare infrastructure investments and rising awareness.

Key Market Drivers

- Prevalence of GI Disorders: The surge in peptic ulcer disease, especially in aging populations, sustains demand.

- Therapeutic Alternatives Limitations: Sucralfate remains a preferred choice for patients contraindicated for PPIs or experiencing adverse reactions.

- Healthcare Access in Developing Regions: Expansion of healthcare infrastructure enhances drug availability.

- Regulatory Considerations: Maintenance of approvals for existing formulations sustains the market base.

Competitive Landscape

Sucralfate’s patent expired decades ago, leading to a landscape dominated by generic manufacturers. Major players include:

- Pfizer (original patent holder)

- Sandoz (Novartis)

- Sun Pharma

- Teva Pharmaceuticals

- Mylan (Viatris)

Generic manufacturing keeps prices competitive but also influences market stability and profitability.

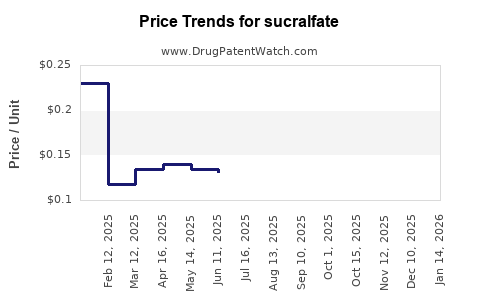

Pricing Dynamics

Current Pricing Structures

In developed markets such as the United States, the average retail price for a 1g oral suspension of sucralfate ranges from USD 3 to USD 5 per 100-gram bottle, reflecting typical generic pricing strategies. In Europe, prices align similarly, with variations based on healthcare policies and drug reimbursement systems.

In developing countries, prices are markedly lower, often below USD 1 per dose, facilitated by local generics and lower regulatory costs.

Factors Affecting Price Levels

- Manufacturing Costs: Economies of scale and local production influence retail prices.

- Regulatory Environment: Simplified approval processes for generics reduce entry barriers and impact pricing.

- Market Competition: High generic penetration maintains competitive pricing.

- Reimbursement Policies: Insurance coverage and government subsidies modulate patient out-of-pocket expenses.

- Supply Chain Dynamics: Disruptions and regulatory compliance costs affect pricing stability.

Market Challenges and Opportunities

Challenges

- Market Saturation: High generic availability limits profit margins.

- Lack of Innovation: Absence of new formulations or delivery mechanisms minimizes differentiation.

- Competition from Newer Agents: PPIs and other ulcer-healing drugs offer alternative pathways, although sucralfate retains niche indications.

Opportunities

- Expand Indications: Exploring adjunct uses such as biofilm management in infections or potential roles in COVID-19-related GI complications.

- Formulation Innovations: Development of sustained-release or targeted delivery systems could command premium pricing.

- Emerging Markets: Penetration in regions with rising GI disease burden offers growth prospects.

- Regulatory Reimbursement Improvements: Favorable policies could facilitate market expansion.

Price Projection Analysis

Over the next five years, several factors will shape sucralfate’s pricing trajectory:

- Market Maturity and Competition: Continued generic proliferation is expected to sustain low per-unit costs, particularly in mature markets.

- Regulatory Changes: Accelerated approval pathways, especially in emerging markets, could temporarily lower entry barriers, further pressuring prices.

- Healthcare Spending Growth: Increasing affordability and reimbursement in developing markets may lead to slight price fluctuations, but overall downward pressure will persist.

Forecast Summary

| Region |

2023-2027 Price Projection |

Influencing Factors |

| North America |

USD 3.50 - USD 4.50 per 100g |

Market saturation; focus on cost containment; stable demand |

| Europe |

USD 3.00 - USD 4.00 per 100g |

Regulatory environment; competition; healthcare policy shifts |

| Asia-Pacific |

USD 1.50 - USD 3.00 per 100g |

Rapid market growth; low manufacturing costs; expanding access |

| Latin America |

USD 2.00 - USD 3.50 per 100g |

Improving healthcare infrastructure; generic competition |

Overall, prices will remain relatively stable in developed regions, with minor declines driven by increased competition. Emerging markets may see slight price reductions due to local manufacturing efficiencies.

Regulatory and Market Outlook

Regulatory pathways for generic sucralfate formulations are well established, resulting in predictable access and pricing regimes. The potential for new formulations or combination therapies remains limited, given the drug’s decades-long market presence and straightforward chemical profile.

In light of increasing focus on patient-centric therapies, companies may explore delivering sucralfate via novel routes, potentially supporting premium pricing. However, such innovations are currently constrained by regulatory and patent considerations.

Key Market Trends and Implications

- Consolidated Market: The dominance of generic manufacturers stabilizes prices but compresses profit margins.

- Pricing Pressure: Cost-containment initiatives and healthcare austerity measures are likely to maintain downward pricing trends.

- Geographical Expansion: Targeted marketing in emerging markets can offset stagnation in mature economies.

- Patent & Regulatory Landscape: As patents have long expired, generic proliferation will sustain competitive pricing.

Key Takeaways

- Sucralfate remains a stable, low-cost therapeutic option globally, though it faces intense competition from generics.

- Prices are expected to remain stable or decline slightly over the next five years, primarily influenced by patent expirations and market competition.

- Growth opportunities exist in emerging markets and through formulation innovations, although the latter faces regulatory and economic hurdles.

- Market saturation in developed regions limits price increases but guarantees consistent demand.

- Manufacturers should focus on expanding into underserved regions, optimizing manufacturing efficiencies, and exploring niche indications to sustain profitability.

FAQs

1. What are the primary factors influencing sucralfate’s pricing trends?

Market competition, manufacturing costs, regulatory frameworks, and healthcare reimbursement policies predominantly influence pricing fluctuations.

2. How does the patent landscape impact sucralfate’s market?

Since the original patent expired decades ago, a plethora of generics dominate, leading to fiercely competitive pricing and limited premium opportunities.

3. Are there upcoming formulations that could alter sucralfate’s market price?

Currently, no significant innovative formulations are in late-stage development. The focus remains on generics and existing formulations.

4. Which regions present the highest growth potential for sucralfate?

Emerging markets in Asia-Pacific and Latin America offer considerable growth prospects due to expanding healthcare infrastructure and rising GI disorder prevalence.

5. How might regulatory changes affect sucralfate’s future market and pricing?

Streamlined approval procedures for generics could intensify price competition, while restrictive regulations might limit market access, both impacting pricing.

References

[1] Research and Markets. “Gastroprotective Drugs Market Size, Share & Trends Analysis Report,” 2022.