Last updated: July 28, 2025

Introduction

Progesterone, a naturally occurring steroid hormone vital for the regulation of female reproductive functions, has longstanding clinical applications in hormone replacement therapy, fertility treatments, and the prevention of preterm birth. With rising demand driven by demographic trends and expanding therapeutic indications, the global progesterone market is poised for notable growth. This analysis evaluates current market dynamics, key drivers, competitive landscape, regulatory pathways, and provides revenue projections and pricing trends expected over the next five years.

Market Overview and Size

The global progesterone market was valued at approximately USD 1.2 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of 6.2% through 2028, reaching roughly USD 1.9 billion. The growth is primarily fueled by increased awareness about reproductive health, expanding indications for hormone therapy, and rising adoption of assisted reproductive technologies (ART). North America dominates the market, accounting for over 40% of revenue, followed by Europe and Asia-Pacific, where emerging markets exhibit significant growth potential.

Key Drivers

Increasing Incidence of Reproductive Disorders

Infertility and pregnancy-related complications are rising globally. As infertility affects approximately 8-12% of couples worldwide [1], demand for fertility treatments incorporating progesterone supplementation remains robust. Additionally, preterm birth prevention and hormone replacement therapies in menopausal women further bolster demand.

Advancements in Fertility Technologies

The expansion of in-vitro fertilization (IVF) procedures, which routinely employ progesterone to support luteal phases, contributes substantially to market growth. The global IVF market over USD 13 billion and growing at approximately 10% annually [2], directly impacts progesterone demand.

Regulatory Approvals and Reproductive Health Policies

The approval of new formulations, such as extended-release injections and bioidentical preparations, aligns with patient preferences and regulatory trends favoring safety and efficacy. The recognition of progesterone's role in preventing preterm labor by entities like the U.S. Food and Drug Administration (FDA) has further validated its clinical utility and market sustainability.

Emerging Markets

Rapidly expanding healthcare infrastructure and increasing awareness in Asia-Pacific and Latin America present significant growth opportunities, fostering market diversification and increased accessibility.

Competitive Landscape

Key Players

The progesterone market is characterized by a mix of generic manufacturers, biosimilar developers, and branded pharmaceutical companies:

- Bayer AG: Offers promising proprietary formulations like Crinone (vaginal gel) and Endometrin (vaginal insert).

- Ferring Pharmaceuticals: Provides endometrial preparation products and injectable progesterone.

- AbbVie: Known for compounded and licensed formulations, including injectable and oral options.

- Watson Pharmaceuticals (Actavis): Generic formulations and biosimilars at competitive prices.

- Other contributors include Mylan, Sandoz, and local generic companies.

Product Trends

Market offerings include oral capsules, vaginal gels or inserts, intramuscular injections, and natural bioidentical formulations. The trend favors non-invasive, patient-friendly routes, notably vaginal and oral, over injections, to improve compliance.

Patent and Regulatory Challenges

Brand-name formulations often have patent protections, regionally varying in duration, allowing generic players to dominate post-expiry. Biosimilars and bioequivalent formulations face regulatory hurdles but offer cost advantages, increasing market penetration.

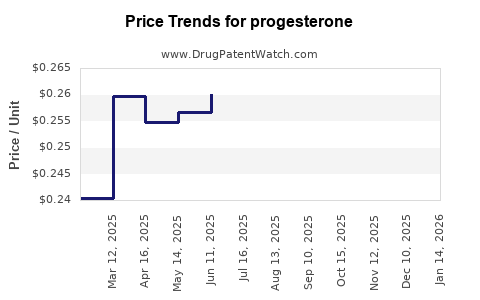

Pricing Trends and Projections

Current Price Landscape

Prices for progesterone vary based on formulation, strength, and region:

- Generic vaginal gels/inserts: USD 15–30 per pack (30 doses).

- Injectable formulations: USD 50–100 per vial, depending on dosage and brand.

- Oral capsules: USD 10–20 per month supply.

The high-cost injectable formulations are often used in specific clinical settings, such as fertility clinics, whereas oral and vaginal forms are more common for routine use.

Price Trajectory (2023–2028)

With increasing competition, especially from biosimilars and generics, prices for branded products are expected to decline by approximately 10–15% annually, driven by market saturation and cost pressures. Conversely, innovative formulations with improved delivery mechanisms or bioidentical preparations are projected to command premium pricing, maintaining a segment of high-margin products.

Specifically:

- Oral formulations: Expected to decrease from USD 15 to approximately USD 10–12 per pack.

- Vaginal gels/inserts: Anticipated to fall from USD 20 to USD 12–15 per pack, assuming increased generic availability.

- Injectable formulations: Prices likely to decrease from USD 80 to USD 50–60 per vial.

Innovations introducing sustained-release systems or combination therapies could sustain higher price points in niche markets.

Regulatory and Market Entry Considerations

Regulatory pathways across regions affect pricing and market access:

- United States: FDA approval for various formulations, with generics gaining patents expiry in the next 2–3 years.

- Europe: Stringent EMA standards for biosimilars, but flexible for generics.

- Emerging Markets: Often less regulated, where price competition is fierce, and market entry barriers are lower.

Market entrants leveraging biosimilar technologies or novel delivery routes will need to navigate complex regulatory environments but can achieve significant cost advantages and capture unmet needs.

Future Outlook and Opportunities

The increasing adoption of personalized medicine, combined with the regulatory endorsement of progesterone in preventing preterm birth, indicates sustained demand. The market will likely see:

- Growth in bioidentical and natural progesterone formulations, appealing to patients seeking "natural" options.

- Innovations in delivery systems, such as transdermal patches or subcutaneous implants, providing sustained hormone levels with convenience.

- Partnerships and licensing agreements for biosimilars to expand accessible formulations at reduced costs.

These trends will influence pricing, with innovative, differentiated products commanding higher margins, while commoditized forms decline in price due to competition.

Key Takeaways

- The global progesterone market is expected to reach USD 1.9 billion by 2028, with a CAGR of 6.2%.

- The primary growth drivers include increasing infertility rates, advancements in ART, and the expanding use of hormone therapies.

- The competitive landscape is dominated by large pharma brands, with a rising impact from biosimilars and generics.

- Prices are projected to decline steadily for standard formulations, while innovative delivery systems and bioidentical preparations maintain premium pricing levels.

- Regulatory environments and regional market dynamics significantly influence pricing strategies and market entry.

Conclusion

The progesterone market remains a vital segment within reproductive medicine, with promising growth fueled by demographic trends, technological advancements, and evolving clinical guidelines. While price competition intensifies, innovation and targeted therapies present opportunities for premium offerings. Stakeholders must navigate regulatory landscapes adeptly and focus on differentiation to optimize market share and profitability.

FAQs

1. What are the primary formulations of progesterone available in the market?

Progesterone is commercially available in oral capsules, vaginal gels and inserts, intramuscular injections, and bioidentical compounded forms, each tailored to specific clinical needs and patient preferences.

2. How does the expiry of patents influence progesterone pricing?

Patent expiries enable generic and biosimilar manufacturers to enter the market, leading to significant price reductions, particularly for widely used formulations like vaginal gels and injections.

3. Which regions present the most lucrative opportunities for progesterone manufacturers?

North America leads in revenue, but Asia-Pacific and Latin America offer expanding markets driven by rising reproductive health awareness and improving healthcare infrastructure.

4. What are the emerging innovations that could impact progesterone pricing and market share?

Innovations include sustained-release delivery systems, bioidentical formulations, and transdermal patches, which could command premium prices and open new therapeutic niches.

5. How do regulatory policies affect the competitiveness of new progesterone products?

Regulatory pathways determine the speed of approval and market access; regions with streamlined processes favor rapid introduction of biosimilars and generics, impacting pricing strategies and competition.

References

[1] World Health Organization. (2021). Infertility definitions and statistics.

[2] MarketWatch. (2022). Global IVF market report.

[3] FDA Approvals Database. (2022). Reproductive health approvals.