Last updated: July 27, 2025

Introduction

Ondansetron, a serotonin 5-HT3 receptor antagonist, is a frontline antiemetic widely prescribed to prevent nausea and vomiting associated with chemotherapy, radiotherapy, and surgical procedures. Since its introduction in the 1990s, ondansetron has experienced consistent global demand driven by expanding oncology treatments and surgical procedures, alongside innovations in drug formulations. This analysis examines the current market landscape, competitive dynamics, regulatory considerations, and future price trajectories for ondansetron.

Market Overview

Global Market Size and Growth Dynamics

The global ondansetron market was valued at approximately USD 1.4 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of about 4–6% over the next five years. Key growth drivers include:

-

Increasing cancer incidence: The World Health Organization (WHO) reports over 19 million cancer cases globally in 2020, sustained through predicted rises in aging populations, particularly in emerging markets.

-

Advancements in cancer therapies: More aggressive chemotherapy protocols necessitate effective antiemetic regimens, bolstering ondansetron demand.

-

Expanding surgical interventions: A surge in surgical procedures globally, notably in minimally invasive and advanced surgeries, enhances the need for perioperative antiemetics.

-

Regulatory approvals and patent status: While the original branded formulations have faced patent expirations, generic proliferation maintains low-cost access globally.

Geographical Market Segments

-

North America: Dominates the market, accounting for over 40% of revenues, driven by high chemotherapy adoption rates and established healthcare infrastructure.

-

Europe: A significant segment with mature markets and stringent regulatory environments fostering innovation and generic drug uptake.

-

Asia-Pacific: The fastest-growing sector due to increasing cancer prevalence, expanding healthcare access, and government initiatives to improve cancer care, with expected growth rates exceeding 7% CAGR.

-

Rest of World: Latin America, Africa, and the Middle East present expanding markets, influenced by improving healthcare systems and unmet medical needs.

Competitive Landscape

Major Players

-

Pfizer: Original patent holder, with the branded Zofran. Pfizer’s dominance diminished post-patent expiry, but they continue to hold significant market share through proprietary formulations and pipeline development.

-

Teva Pharmaceuticals: A major generic manufacturer, offering cost-effective ondansetron tablets and injectable forms.

-

Amneal Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical: Leading generics producing both oral and injectable formulations.

-

Innovative entrants: Companies exploring sustained-release formulations or combination therapies to differentiate offerings.

Market share shifts

Patent expirations in the early 2010s led to a patent cliff, markedly increasing generic penetration. Generics now comprise over 85% of the global ondansetron market, intensifying price competition and pressure on branded product margins.

Regulatory and Patent Landscape

-

The original branded formulation, Zofran, lost patent protection in many markets by the mid-2010s, enabling generics to flood the market.

-

Regulatory approvals for new formulations, such as transdermal patches and oral dissolvable films, are ongoing, potentially impacting market dynamics.

-

Emerging markets often lack stringent patent enforcement, facilitating widespread generic adoption.

Price Trends and Projections

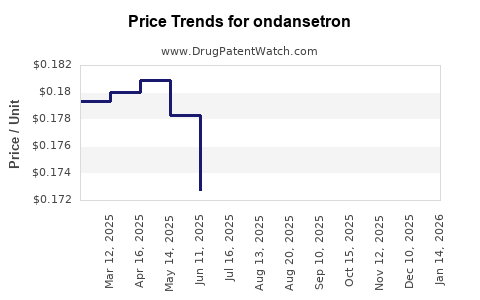

Historical Price Trends

-

Branded products: Historically commanded prices of USD 10–20 per 4 mg tablet, depending on the market.

-

Generics: Prices declined sharply post-patent losses; current retail prices vary considerably:

Future Price Projections

-

Price stabilization expected: As of 2023, the market sees stabilized generic prices due to high competition.

-

Potential upward pressure: Introduction of value-added formulations (e.g., sustained-release, transdermal) could command premium pricing.

-

Regional disparities: Prices in developed markets will likely remain low due to aggressive generic competition; in contrast, emerging markets might see marginal price increases driven by supply chain costs and regulatory barriers.

-

Impact of new formulations: If novel ondansetron delivery systems achieve regulatory approval and commercial success, incremental price increases could occur, especially in niche markets.

Market Challenges and Opportunities

Challenges

-

Intense generic competition: Limited barriers to entry reduce pricing power.

-

Regulatory hurdles: Variations across jurisdictions can delay new formulation launches.

-

Pricing pressures in mature markets: Payor and healthcare system cost containment initiatives restrict price growth.

Opportunities

-

Development of novel formulations: Transdermal patches, oral dissolvable films, and long-acting injectables can capture premium segments.

-

Expanding indications: Use in post-operative nausea in less traditional settings can enlarge market size.

-

Strategic partnerships: Collaborations with regional manufacturers enhance distribution and local market penetration.

Key Market Trends and Future Outlook

-

The ongoing shift toward generic dominance will maintain low retail prices, especially in mature markets.

-

Innovations in drug delivery and combination therapies present potential for premium pricing segments.

-

The rising burden of oncology and surgical procedures globally will sustain demand, albeit at competitive price points.

-

Price projections suggest a stable but competitive landscape, with minor fluctuations driven by formulation advances and regional economics.

Key Takeaways

-

The ondansetron market remains sizable, with steady growth driven by global cancer and surgical procedure trends.

-

Generic competition has suppressed prices, especially in North America and Europe, while emerging markets offer opportunities for modest price increases.

-

Innovations in drug delivery hold potential to open higher-margin niches, potentially influencing future pricing dynamics.

-

Manufacturers need to focus on differentiated formulations and regional strategies to sustain profitability amid relentless price erosion.

-

Regulatory developments and patent expirations will continue to shape the competitive landscape, demanding agility from market participants.

FAQs

1. What is the current market price range for ondansetron generics?

Retail prices far lower than the original branded version, typically USD 0.10–1.00 per 4 mg tablet, with regional variations.

2. How will patent expiries influence ondansetron pricing in the next five years?

Patent expiries have already led to significant price reductions; ongoing generic proliferation will sustain low prices, though innovative formulations might command higher premiums in niche segments.

3. Which regions are expected to see the highest growth in ondansetron demand?

Asia-Pacific and Latin America are projected to experience the fastest growth due to rising cancer incidence, healthcare access expansion, and increasing surgical volumes.

4. What strategies can pharmaceutical companies adopt to maintain profitability?

Developing innovative delivery systems, securing regional partnerships, and expanding indications can create new revenue streams amid price competition.

5. Are there risks associated with the future market of ondansetron?

Yes; risks include regulatory delays, market commoditization, pricing pressures, and potential shifts to alternative antiemetic agents, which could impact long-term viability.

References

[1] Grand View Research. Ondansetron Market Size & Share Report, 2022.

[2] World Health Organization. Global Cancer Statistics, 2020.

[3] Evaluate Pharma. 2023 Oncology Market Outlook.

[4] IQVIA Institute. Medicine Use and Spending in the U.S.: A Review of 2022.

[5] MarketsandMarkets. Anti-Emetics Market by Type, Formulation, Route of Administration, and Region, 2021.

Note: Data figures and projections are based on industry reports and may vary with market developments.