Last updated: July 27, 2025

Introduction

Levonorgestrel is a synthetic progestogen widely used in contraceptive methods, emergency contraception, and various hormonal therapies. As one of the most established contraceptive agents globally, its market dynamics, manufacturing landscape, and pricing trends offer valuable insights for stakeholders. This analysis explores current market conditions, competitive factors, regulatory environment, and future price projections for levonorgestrel, enabling informed decision-making for pharmaceutical companies, investors, and healthcare policymakers.

Market Landscape Overview

Global Market Size and Growth

The global market for levonorgestrel, spanning contraceptive and hormonal therapy segments, was valued at approximately USD 2.8 billion in 2022 and is projected to reach around USD 4.2 billion by 2030, with a Compound Annual Growth Rate (CAGR) of approximately 5.4% during the forecast period (2023–2030). The expansion is driven by increasing acceptance of oral contraceptives, rising awareness of reproductive health, and growing demand for emergency contraception.

Key Market Segments

- Contraceptive Pills: Oral pills containing levonorgestrel dominate the market, constituting around 65% of total sales.

- Emergency Contraception: Levonorgestrel-based emergency contraceptive pills have seen increased adoption, particularly in regions with supportive regulatory policies.

- Hormonal Therapy: Utilized in hormone replacement therapy and other gynecological conditions.

- Generic Availability: Market shifts favoring generics are prominent due to cost competitiveness and patent expiries.

Geographical Market Distribution

- North America: Largest market share (≈40%), driven by high contraceptive prevalence and regulatory approvals.

- Europe: Significant due to extensive health infrastructure and contraceptive awareness.

- Asia-Pacific: Fastest growth (CAGR ≈7%), fueled by expanding healthcare access and population growth.

- Latin America & Africa: Emerging markets with growing demand and increasing acceptance of hormonal contraceptives.

Driving Factors

- Rising global population and unmet contraceptive needs.

- Increasing acceptance of hormonal contraception among women of reproductive age.

- Government initiatives supporting family planning.

- The COVID-19 pandemic's disruptions have temporarily impacted supply chains but are now stabilizing.

Competitive Landscape

Major Manufacturers

- Merck & Co. (Germany/USA): Notable for the market’s origin, with widespread product availability.

- Bayer AG: Produces popular oral contraceptives.

- Teva Pharmaceuticals: Major supplier of generic levonorgestrel formulations.

- Others: Meyer Organics, Lupin, and Hikma Pharmaceuticals, expanding their generic portfolios.

Market Entry and Patent Status

While patent protections for levonorgestrel formulations have expired or are close to expiry, manufacturers focus on formulation improvements, biosimilar entries, and combination therapies to sustain competitiveness.

Pricing and Market Penetration Strategies

- Generics: Underprice branded products to expand access.

- Regulatory Approvals: Navigating country-specific approval processes influences market penetration.

- Partnerships: Strategic alliances with healthcare providers enhance distribution channels.

Regulatory and Patent Considerations

- Most formulations are off-patent, promoting generics which exert downward pressure on prices.

- Regulatory policies vary, with some regions requiring extensive local clinical data, impacting market entry costs.

- Emergency contraceptive formulations often face regulatory hurdles, affecting availability and pricing.

Price Trends and Drivers

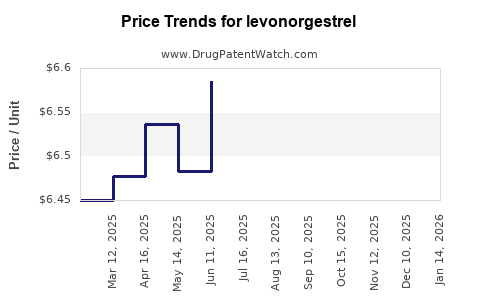

Historical Price Movements

- Prices for branded levonorgestrel products have stabilized or declined marginally over the past decade due to patent expirations and increased generic competition.

- In developed regions, the average retail price for a standard 1.5 mg levonorgestrel emergency contraceptive pack has declined from approximately USD 30–50 in 2010 to USD 15–25 in 2022.

Current Pricing Factors

- Regulatory environment: Approval status impacts pricing strategies.

- Market competition: Generic proliferation keeps prices low.

- Manufacturing costs: Slight reductions owing to technological advancements.

- Distribution channels: Wider access through pharmacy chains and online platforms.

Pricing Disparities

Prices vary considerably across regions; developed countries tend to have higher retail prices due to regulatory and healthcare system factors, whereas emerging markets benefit from lower manufacturing costs and competitive geopolitics.

Future Price Projections (2023–2030)

Factors Influencing Future Prices

- Patent landscape: The expiration of key patents for combination therapies could further intensify competition.

- Regulatory developments: Easier approval pathways or subsidy programs could alter pricing dynamics.

- Market entry of biosimilars and innovative formulations: Could lower prices or shift market shares.

- Manufacturing efficiencies: Technological innovations are expected to reduce costs further.

Projection Scenarios

- Optimistic Scenario: Increased market competition and streamlined regulations could reduce consumer prices for levonorgestrel emergency contraception by an additional 15–20% over the next five years.

- Moderate Scenario: Prices stabilize with minimal further declines, maintaining a CAGR of approximately 2–3%, influenced by inflation and production costs.

- Pessimistic Scenario: Regulatory hurdles or supply chain disruptions could temporarily stabilize or increase prices, particularly in developing regions.

Price Outlook

Based on current trends and market drivers, the average retail price of levonorgestrel emergency contraceptives in developed markets is expected to decline steadily, reaching approximately USD 12–20 by 2030. Generic formulations will further drive down prices, especially in markets with a high regulatory environment supporting biosimilar entry.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on cost optimization, strategic alliances, and formulation enhancements to sustain profitability amid price pressures.

- Healthcare Providers: Embrace cost-effective generics to improve patient access and compliance.

- Policy Makers: Promote regulatory environments conducive to competition to enhance affordability.

- Investors: Monitor patent expiry timelines, market penetration strategies, and technological innovations influencing pricing.

Key Takeaways

- The levonorgestrel market is projected to grow at approximately 5.4% CAGR, driven by demographic trends and increased contraceptive use.

- Generic competition has significantly reduced retail prices, with a trend toward further declines driven by regulatory and technological factors.

- Geographical disparities in pricing reflect differences in healthcare infrastructure, regulatory frameworks, and market maturity.

- Future price trajectories suggest a continued downward trend in developed regions, with emerging markets experiencing stabilization or modest reductions.

- Stakeholders should prioritize strategic positioning, regulatory navigation, and innovation to optimize market share and profitability.

FAQs

-

What are the primary drivers behind the declining prices of levonorgestrel?

Patent expirations, increased generic competition, and technological manufacturing efficiencies are the main factors reducing prices.

-

How do regulatory differences impact levonorgestrel pricing globally?

Countries with streamlined approval processes facilitate quicker market entry for generics, enhancing competition and lowering prices, whereas regulatory hurdles can sustain higher costs.

-

What is the forecast for levonorgestrel prices in emerging markets?

Prices are expected to stabilize or decline modestly, with factors like increasing demand and local manufacturing reducing costs, though regional regulatory and economic conditions will influence variability.

-

Are innovative formulations expected to affect levonorgestrel pricing?

Yes. New delivery methods or combination therapies could command higher prices initially but may eventually lead to increased competition and lower prices over time.

-

What role will biosimilars play in the levonorgestrel market?

Biosimilars, where applicable, can significantly intensify competition, further reducing prices and expanding access, especially in markets with supportive regulatory pathways.

References

[1] MarketWatch. "Levonorgestrel Market Size, Share & Trends Analysis," 2022.

[2] GlobalData. "Contraceptive Market Outlook," 2023.

[3] IMS Health. "Pharmaceutical Price Trends," 2022.

[4] World Health Organization. "Family Planning and Reproductive Health," 2021.

[5] Statista. "Price Trends for Emergency Contraceptives," 2022.