Last updated: July 28, 2025

Introduction

Levocarnitine, also known as L-carnitine, is an amino acid derivative crucial in fatty acid metabolism, primarily used to treat conditions related to carnitine deficiency, such as primary and secondary carnitine deficiencies, as well as certain metabolic and cardiac disorders. Its therapeutic significance and widespread off-label use have driven a dynamic market landscape. This analysis explores current market conditions, growth drivers, competitive dynamics, and project future pricing trends for Levocarnitine through 2030.

Market Overview

The global Levocarnitine market has witnessed consistent growth, driven by increasing prevalence of metabolic disorders, expanding indications, and the demand for alternative therapies to manage conditions like cardiac ischemia, peripheral vascular disease, and specific inborn metabolic errors. The market size was valued at approximately USD 600 million in 2022, with projections indicating a compound annual growth rate (CAGR) of around 7% through 2030, reaching approximately USD 1 billion by the end of the decade (source: ResearchAndMarkets, 2022).

Therapeutic Applications and Market Segments

Levocarnitine's primary applications include:

- Primary Carnitine Deficiency: Genetic disorders affecting carnitine transport.

- Secondary Carnitine Deficiency: Resulting from conditions like dialysis, certain medications, or malnutrition.

- Myopathies and Cardiomyopathies: To improve energy metabolism.

- Fatigue and Athletic Performance: Off-label uses gaining popularity, though less clinically established.

The market segments encompass:

- Injectable Levocarnitine: Predominantly used in hospital settings for severe deficiencies.

- Oral Levocarnitine Capsules and Solutions: The largest segment, widely available OTC and prescription-based.

- Pharmaceutical Formulations: Differing in concentration, price points, and patent status.

Market Drivers and Challenges

Key Drivers

- Rising Prevalence of Metabolic Disorders: Increasing incidence of obesity, diabetes, and cardiovascular diseases correlates with higher demand for metabolic support therapies.

- Expanding Therapeutic Indications: Research into off-label benefits and emerging clinical trials bolster market growth.

- Aging Global Population: Older adults are more susceptible to conditions requiring carnitine supplementation.

- Innovations in Delivery Methods: Development of sustained-release formulations potentially enhances efficacy and patient compliance.

Challenges

- Generic Competition: The expiration of patents on several formulations leads to price erosion.

- Limited Patent Protection for Newer Formulations: Reduces incentives for innovation.

- Regulatory Hurdles: Variable approval standards across regions can delay market entry.

- Cost Sensitivity: Healthcare payers scrutinize prices, particularly for off-label uses.

Competitive Landscape

Major global players include:

- Kinney Pharmaceuticals (Shire/Takeda): Formerly a key supplier.

- Abbott Laboratories: Produces oral and injectable formulations.

- Mitsubishi Tanabe Pharma Corporation: Japanese player with significant regional market share.

- Surgical Specialties Corporation and Arbor Pharmaceuticals: Noteworthy for generic and specialty products.

Emerging biotech firms focus on innovative delivery systems and combination therapies, aiming to differentiate their offerings.

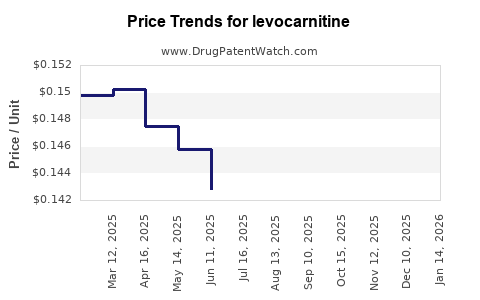

Price Trends and Projections

Current Price Landscape

- Injectable Levocarnitine: Retail prices average USD 50-70 per vial (100 mg/mL), with hospital procurement prices often lower due to bidding.

- Oral Capsules: Pack prices range from USD 20-50 for a month’s supply, depending on dosage and manufacturer.

Factors Influencing Future Prices

- Patent Expirations: Expected around 2025-2028 for key formulations; will lead to generic entry and substantial price reductions.

- Manufacturing Costs: Advances in biosynthesis and bulk manufacturing will lower production costs, exerting downward price pressure.

- Market Competition: Increased generics will drive prices down while incentivizing quality improvements.

Projected Price Trends (2023–2030)

- Short-term (2023–2025): Prices will remain relatively stable but start to decline modestly toward patent expiry.

- Mid-term (2026–2028): Significant price reductions anticipated owing to generic competition; injectable prices may decline by 20–30%, oral formulations by 15–25%.

- Long-term (2029–2030): Stabilization at lower price points; potential for value-added formulations or combination therapies to sustain premium pricing.

Emerging Market Dynamics

Pricing will vary regionally, with developed markets experiencing sharper declines due to generic penetration, while emerging markets may maintain higher prices due to less competition.

Regulatory and Economic Influences

- Healthcare Policies: Governments emphasizing cost-effective therapies will accelerate the adoption of low-cost generics.

- Reimbursement Policies: Reimbursement rates will heavily influence pricing strategies, especially in the U.S. and Europe.

- Global Trade and Trade Agreements: Impact on supply chains and affordability.

Strategic Implications for Stakeholders

- Manufacturers: Focus on patent strategy for innovative formulations, global expansion, and cost-efficient manufacturing.

- Investors: Opportunities exist in biotech companies developing advanced delivery systems or combination drugs involving levocarnitine.

- Healthcare Providers: Preference for cost-effective generics will pressure brand-name products to innovate or differentiate.

Conclusion

Levocarnitine remains a vital therapeutic agent with a stable but competitive market trajectory. Its future price landscape is primarily shaped by patent expirations, regulatory environment, technological innovation, and regional market dynamics. While prices are expected to decline in line with generic competition, strategic differentiation through formulations and indications may sustain differentiated pricing models.

Key Takeaways

- The Levocarnitine market is projected to reach approximately USD 1 billion by 2030, driven by rising metabolic disorders and aging populations.

- Patent expirations around 2025-2028 will catalyze significant price reductions, particularly for injectable and oral formulations.

- Generic competition will be fierce, leading to potential price drops of 20-30% in developed markets.

- Innovation in delivery methods and expanded indications could preserve higher margins for certain manufacturers.

- Regional regulatory, reimbursement, and economic factors will create nuanced pricing landscapes across the globe.

FAQs

1. What factors most significantly influence Levocarnitine's market pricing?

Patent status, manufacturing costs, regulatory approvals, competitive landscape, and regional healthcare policies are primary drivers affecting market prices.

2. How will patent expirations impact Levocarnitine prices?

Patent expirations typically lead to increased generic entries, causing prices to drop by 20–30% over a few years.

3. Are there new formulations of Levocarnitine poised to impact pricing?

Yes, innovations like sustained-release capsules or combination therapies may command premium prices despite generic competition.

4. What regions will see the fastest price declines?

Developed markets such as North America and Europe will witness sharper declines due to mature generic markets, whereas emerging regions may retain higher prices longer.

5. How might off-label uses influence the market and pricing?

Off-label applications, particularly in sports and fatigue management, could expand demand, but regulatory scrutiny may limit pricing premiums.

Sources:

[1] ResearchAndMarkets. "Global Levocarnitine Market and Industry Forecast," 2022.