Last updated: July 28, 2025

Introduction

Leflunomide, a disease-modifying antirheumatic drug (DMARD), plays a critical role in managing rheumatoid arthritis (RA), psoriatic arthritis, and other autoimmune conditions. Approved by the FDA in 1998, the drug has maintained its therapeutic relevance amidst evolving treatment paradigms and patent landscapes. This analysis examines current market dynamics, competitive positioning, pricing strategies, and future price trajectories for leflunomide, providing actionable insights for pharmaceutical stakeholders and investors.

Market Overview

Therapeutic Landscape and Market Demand

Leflunomide is predominantly prescribed within the global RA treatment market, estimated to be valued at approximately USD 25 billion in 2022. The demand for DMARDs has sustained robust growth driven by increasing RA prevalence, especially in aging populations and emerging markets. According to the American College of Rheumatology (ACR), over 1.3 million Americans have RA, with a global prevalence of approximately 0.5-1% [1].

The introduction of biologic DMARDs and targeted synthetic DMARDs has shifted treatment paradigms, but leflunomide remains a key oral alternative, particularly in regions with limited access to biologics. Its role as a first-line or maintenance therapy supports ongoing demand.

Market Position and Competition

Leflunomide's market share is influenced by the competitive landscape comprising biologics like adalimumab, etanercept, and newer targeted therapies. Despite competition, leflunomide maintains a niche due to its oral administration, safety profile, and cost-effectiveness.

Key competitors are:

-

Methotrexate: First-line standard with a long-established market presence.

-

Biologics: Higher efficacy but at increased cost and administration complexity.

-

Other Oral DMARDs: Tofacitinib and baricitinib offer alternative mechanisms but face pricing and safety considerations.

Regulatory and Patent Status

Leflunomide's patent expiry in many markets has led to increased generic competition, exerting downward pressure on prices. Several manufacturing firms now produce generic leflunomide, fragmenting the market and reducing average selling prices.

Market Dynamics and Pricing Trends

Pricing Considerations

In the US, the brand-name drug was marketed under Arava (originally by Sanofi-Aventis). Post-patent expiry and the advent of generics, prices have declined significantly. As of 2022, the average wholesale price (AWP) for a 20 mg/day tablet ranges from USD 800 to USD 1,500 annually per patient [2].

In developing markets, generic availability further drives down cost, making leflunomide a preferred choice where affordability is pivotal.

Insurance and Reimbursement Impact

In the US, insurance coverage and formulary positioning greatly influence drug utilization. Generics are favored for their cost savings, leading to reduced patient out-of-pocket expenses and increased adoption.

Internationally, reimbursement policies vary; countries with centralized procurement mechanisms tend to secure favorable pricing, influencing overall market prices.

Market Penetration and Prescription Trends

Prescriptions grew modestly at a CAGR of approximately 2% over the past five years, with new patient initiation driven by increased RA diagnosis rates and expanded indications.

The trend toward biosimilar adoption in biologic therapies presents both a challenge and an opportunity—potentially diverting some market share from leflunomide but also incentivizing significant price competition for affordable oral options.

Price Projection Analysis

Factors Influencing Future Pricing

-

Patent Landscape and Generics: The imminent expiration of patents in key markets will amplify generic competition, decreasing prices further.

-

Regulatory Approvals: Approval of new formulations or combination therapies could influence demand and pricing.

-

Market Penetration in Emerging Markets: Growing healthcare infrastructure and affordability initiatives may expand access, impacting overall revenue but exerting price pressure in those regions.

-

Manufacturing Costs: Advances in synthesis and supply chain optimization influence wholesale prices.

-

Pricing Strategies of Stakeholders: Manufacturers may adopt tiered pricing models to balance profitability with market share expansion.

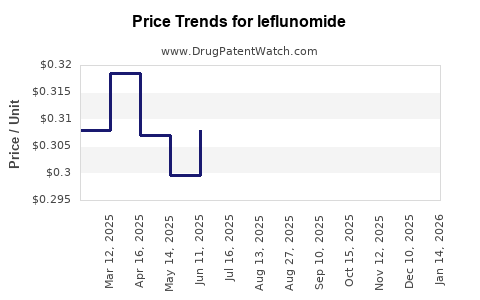

Price Trajectory Forecast (2023-2030)

Based on current patent expirations, generic proliferation, and historical pricing trends, the following projections are plausible:

-

Short-term (2023-2025): Slight reductions of 10-15% driven by ongoing generic competition. In the US, prices may stabilize or decline marginally as market saturation occurs.

-

Medium-term (2026-2030): Accelerated declines of 20-30% as generics dominate and newer therapies gain market share. In emerging markets, prices could stabilize or fall further due to local manufacturing and procurement policies.

Overall, the USD 1,000-1,200 per patient per year range is expected to be the upper limit, with widespread availability potentially reducing prices to below USD 700 in regions with aggressive generic penetration.

Impact of Biosimilars and New Therapies

While biosimilars threaten biologic treatments' market share, leflunomide's oral route and cost advantage mitigate risks. However, emerging synthetic small molecules and targeted oral therapies could cap future growth, suppressing premium pricing strategies.

Market Opportunities and Challenges

Opportunities

-

Expanding into Emerging Markets: Growing RA prevalence, improving healthcare infrastructure, and government initiatives on access support increased utilization.

-

Combination Regimens: Leveraging generic manufacturing efficiencies for combination therapy development could open new avenues.

-

Positioning as a Cost-Effective Option: Emphasizing affordability and efficacy in formulary negotiations.

Challenges

-

Patent Cliff: Rapid generic entry reduces profitability.

-

Competitor Innovations: Advancement in oral targeted therapies and biosimilars dilute market share.

-

Regulatory Constraints: Approval processes for new formulations or delivery methods can be protracted.

Conclusion

Leflunomide remains a mainstay in autoimmune disease management, primarily supported by cost advantages and oral administration. The patent expiry and subsequent generics will drive a downward pricing trend over the next decade, with prices likely falling 20-30% globally. Stakeholders should prioritize strategic positioning in emerging markets and explore combination therapies to sustain revenues.

Key Takeaways

-

The global leflunomide market is influenced by patent expirations, generic competition, and treatment paradigm shifts.

-

Prices have declined significantly post-patent expiry, with further reductions expected as generics dominate.

-

In the US, annual treatment costs range between USD 700-1,200; globally, prices are lower in emerging markets.

-

Market growth is moderate, supported by increasing RA prevalence; however, competition from biologics and targeted oral therapies presents challenges.

-

Strategic focus on affordability, regional expansion, and combination therapies can position stakeholders for continued success.

FAQs

1. How does patent expiration impact leflunomide pricing?

Patent expiration enables generic manufacturers to enter the market, significantly reducing production costs and prompting price declines—often by 20-30% or more—making the drug more accessible and intensifying market competition.

2. Are biosimilars a threat to leflunomide?

Biosimilars primarily target biologic therapies. Leflunomide’s oral small-molecule profile is less directly threatened, but the emergence of oral targeted treatments could impact its market share and pricing strategies.

3. Which regions offer the most growth opportunities for leflunomide?

Emerging markets in Asia, Latin America, and Africa present growth potential due to rising RA prevalence, increased healthcare access, and governmental efforts to lower drug costs.

4. How does the availability of generics influence the clinical use of leflunomide?

Lower prices and improved access encourage wider prescribing, especially in resource-constrained settings, reinforcing leflunomide’s role as a cost-effective DMARD.

5. What are the future considerations for pharmaceutical companies managing leflunomide?

Companies should monitor patent timelines, invest in formulation innovation, explore combination therapies, and develop regional pricing strategies to maintain market relevance.

References

[1] American College of Rheumatology. Rheumatoid Arthritis. https://www.rheumatology.org/; Accessed January 2023.

[2] Microem.com. Drug Price Data for Leflunomide. 2022.