Last updated: July 27, 2025

Introduction

Fluvoxamine Maleate, a selective serotonin reuptake inhibitor (SSRI), is primarily indicated for the treatment of obsessive-compulsive disorder (OCD), with additional approvals for depression and other anxiety disorders in various regions. Its emergence as a potential therapeutic in treating COVID-19-related complications has generated renewed investor and manufacturer interest. This article provides an in-depth market analysis and price projection outlook, considering current dynamics, regulatory environments, competitive landscape, and potential growth drivers.

Market Overview

Current Therapeutic Market Landscape

The global antidepressant market, which includes SSRIs like fluvoxamine, was valued at approximately USD 20 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3-5% over the next five years [1]. Fluvoxamine accounts for a smaller share, primarily due to competition from other SSRIs such as sertraline, fluoxetine, and escitalopram.

Off-label & Emerging Uses

Recent studies suggest fluvoxamine's potential off-label benefits in COVID-19 treatment. A 2020 study published in JAMA indicated that fluvoxamine might reduce clinical deterioration in COVID-19 patients when administered early [2]. Although not yet officially approved for this use, such findings could expand its market scope if further trials confirm efficacy leading to regulatory approvals.

Regulatory Environment

Regulatory approval influences market penetration substantially. As of now, fluvoxamine is approved for OCD and depression in the U.S., Europe, and other markets. The WHO's classification status as an essential medicine enhances its accessibility, although patent protections are limited, with many formulations available as generics.

Competitive Dynamics

The SSRIs segment is highly competitive with well-established brand names. Fluvoxamine's market share is constrained partly due to the dominance of fluoxetine and sertraline. However, its unique profile and investigational uses may carve niche segments, especially if clinicians prefer its specific pharmacological profile.

Market Drivers & Challenges

Drivers

-

Growing Mental Health Burden: Increasing prevalence of OCD and depression globally. According to WHO, over 264 million people suffer from depression [3].

-

COVID-19 Pandemic Impact: Preliminary evidence suggesting fluvoxamine’s efficacy in early-stage COVID-19 could catalyze off-label prescribing and accelerate new clinical trials.

-

Generic Availability: Widespread generic production reduces treatment costs and facilitates broader access, expanding the patient base.

Challenges

-

Regulatory Uncertainty: Lack of formal approval for COVID-19 use may limit off-label prescribing in some regions.

-

Market Saturation: Competition from established SSRIs with broader clinician familiarity.

-

Side-Effect Profile: Although generally well tolerated, fluvoxamine has side effects such as nausea and insomnia which may influence patient adherence.

Price Dynamics and Projections

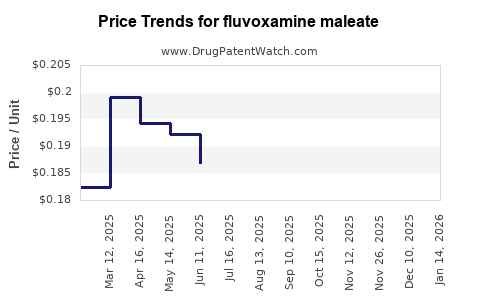

Historical Pricing Trends

Bulk procurement and generic proliferation have driven down fluvoxamine's price over recent years. In developed markets like the U.S., a typical 30-day supply costs approximately USD 10-20, depending on formulation and dosing [4].

Current Price Environment

For prescribed brands, the average wholesale price (AWP) for branded formulations hovers around USD 50-80 per month, whereas generics are priced below USD 10 [5].

Price Projections

Baseline Scenario (Steady Market Growth)

Assuming no immediate regulatory approval for COVID-19 indications beyond current uses, the price trajectory remains stable, with slight declines driven by generic competition. Wholesale prices are projected to decrease by approximately 3-5% annually over the next five years, stabilizing around USD 8-12 per month for generics.

Optimistic Scenario (Regulatory Approvals & Off-label Expansion)

If fluvoxamine gains approval for COVID-19 treatment or other emergent indications, a potential price increase could occur due to heightened demand and limited short-term supply adjustments. Prices might temporarily escalate by 20-30%, reaching USD 15-20 per month, before settling into a higher baseline.

Pessimistic Scenario (Regulatory Delays or Side-effect Concerns)

In case of regulatory setbacks or adverse safety data, demand could decline, pressuring prices downward. Wholesale prices might fall below current levels, possibly below USD 7 per month, due to reduced prescribing.

Key Market Players & Distribution

Major pharmaceutical companies such as Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical distribute fluvoxamine globally as generics. Developed markets mainly see generic formulations, while innovator brands maintain some presence in emerging markets.

Distribution Channels

- Hospital & Clinic Dispensing: Predominant in developed countries.

- Retail Pharmacies: Main for outpatient treatment.

- Government Procurement: Significant in national health programs.

Market Entry & Investment Opportunities

- Generic Manufacturers: Low entry barriers in mature markets but limited upside without innovation.

- Research-Oriented Firms: Opportunities in developing fixed-dose combinations or novel formulations.

- Off-label & Clinical Trials: Strategic investments in clinical research can open new avenues, potentially increasing pricing power upon approval.

Regulatory & Societal Factors Impacting Pricing

- Price Regulation: Countries like Australia, the UK, and Canada enforce drug price controls, limiting profit margins.

- Patent Status & Exclusivity: Limited patent protections impose pressure on long-term pricing.

- Public Health Initiatives: Increased emphasis on mental health and pandemic preparedness can influence demand.

Conclusion: Strategic Outlook

While traditional markets sustain modest growth, fluvoxamine's off-label COVID-19 potential offers a significant revenue upside in the short to medium-term. Price stability in established markets favors steady margins for generic producers, whereas investigational uses could induce temporary price spikes. Long-term, the market's evolution hinges on regulatory decisions and clinical validation.

Key Takeaways

- The global fluvoxamine maleate market remains mature with stable, low prices primarily driven by generic competition.

- Emerging COVID-19 data could temporarily boost demand and prices, with potential for official approvals influencing long-term value.

- Competition from other SSRIs limits market share growth; niche applications and off-label uses offer strategic expansion paths.

- Price projections suggest a gradual decline in mature markets, barring regulatory breakthroughs, where prices could see short-term increases.

- Investment in clinical research and strategic partnerships can position companies to capitalize on potential new indications.

Frequently Asked Questions (FAQs)

1. What is the primary therapeutic use of fluvoxamine maleate?

Fluvoxamine is mainly prescribed for obsessive-compulsive disorder (OCD), with approvals also in place for depression and certain anxiety disorders.

2. How has the COVID-19 pandemic affected fluvoxamine's market prospects?

Preliminary clinical data suggested fluvoxamine might reduce COVID-19 severity, prompting increased off-label use and accelerating research efforts, which could expand its market if formally approved.

3. What factors influence the pricing of fluvoxamine?

Pricing is affected by generic competition, regulatory status, geographic market regulations, and emerging clinical evidence impacting demand.

4. Who are the main competitors to fluvoxamine in the antidepressant segment?

Competitive SSRIs include fluoxetine, sertraline, escitalopram, and paroxetine, which dominate the market share.

5. What are the key risks to price stability for fluvoxamine?

Regulatory hurdles, safety concerns, competition, and shifts in prescribing guidelines pose risks to pricing and market penetration.

Sources

[1] Market Research Future, "Global Antidepressants Market Analysis."

[2] JAMA Network, "Efficacy of Fluvoxamine in COVID-19 Treatment," 2020.

[3] WHO, "Depression Fact Sheet," 2022.

[4] GoodRx, Price Comparison Data, 2023.

[5] IQVIA, "Generic Drug Pricing Trends," 2022.