Last updated: July 27, 2025

Introduction

Escitalopram oxalate, a selective serotonin reuptake inhibitor (SSRI), is widely prescribed for major depressive disorder, generalized anxiety disorder, and other mental health conditions. As an established pharmaceutical, it occupies a significant portion of the psychiatric medication market globally. This analysis provides a comprehensive review of the current market landscape, valuation trends, emerging dynamics, and future pricing projections for escitalopram oxalate.

Current Market Landscape

Global Market Size and Regional Distribution

The global antidepressant market, driven largely by SSRIs like escitalopram, was valued at approximately USD 15.4 billion in 2022, with SSRIs accounting for over 70% of revenues within the segment, according to Fortune Business Insights. Escitalopram, marketed primarily under brand names like Lexapro, constitutes a substantial share, particularly in North America, which dominates with over 55% market penetration.

Europe follows as a significant market, driven by increasing mental health awareness and government initiatives. The Asia-Pacific region shows exponential growth potential due to rising prescription rates and growing healthcare infrastructure, although current market share remains modest compared to Western markets.

Market Dynamics and Drivers

- Growing Prevalence of Mental Health Disorders: An increase in diagnosed depression and anxiety disorders, exacerbated by the COVID-19 pandemic, has bolstered demand for SSRIs, especially escitalopram.

- Patent Expirations and Generic Entry: With the expiration of Lexapro’s patent in many jurisdictions (notably the U.S. in 2012), generic versions flooded the market, reducing prices and expanding access.

- Rising Awareness and Treatment Acceptance: Advances in psychiatric diagnosis and destigmatization efforts continue to expand treatment populations.

- Regulatory Approvals for New Indications and Formulations: Additional approvals for extended-release formulations and biosimilars may influence market dynamics.

Key Market Players

Major pharmaceutical companies involved in escitalopram manufacturing include:

- Forest Laboratories (now part of Allergan/AbbVie): Original patent holder and marketer of Lexapro.

- Generics Manufacturers: Such as Teva, Mylan, Sun Pharmaceuticals, and Hikma, which have entered the market post-patent expiry, offering lower-priced alternatives.

- Emerging Biotech Firms: Developing biosimilars and novel SSRIs aiming to capture share through innovation.

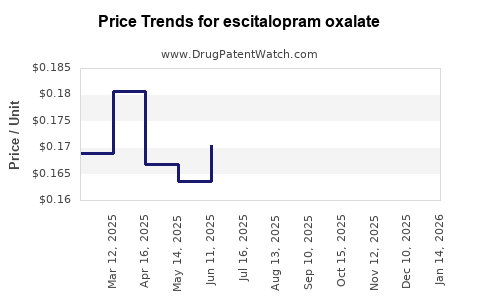

Pricing Trends and Historical Data

Brand Name vs. Generic Pricing

After patent expiry, the price of escitalopram declined sharply. In the U.S., the average wholesale price (AWP) for brand-name Lexapro was around USD 560 per month in 2011, but generic versions now retail at approximately USD 15–50 per month, depending on supply chain and insurance coverage.

Cost Factors Influencing Prices

- Manufacturing Costs: Improvements in synthesis processes and increased competition have driven prices downward.

- Regulatory and Quality Assurance: Stringent quality standards, especially for biosimilars and generics, influence production costs.

- Market Penetration and Insurance Reimbursement: High insurance coverage in developed economies sustains demand and stabilizes prices.

Current Prices (2023)

| Formulation |

Approximate Cost (USD/month) |

Notes |

| Brand (Lexapro) |

USD 300–560 |

Limited to specific regions, usually through prescription |

| Generic |

USD 15–50 |

Widely accessible, variable based on pharmacy and region |

Emerging Trends and Market Projections (2023-2030)

Impact of Biosimilars and New Formulations

Biosimilar development, although more prominent for biologics, is gradually influencing the psychiatric space, with some biotech firms exploring advanced formulations that could impact pricing and market competition significantly.

Potential for Price Stabilization or Increase

While generic competition has traditionally suppressed prices, factors like supply chain disruptions, regulatory changes, and patent litigations could create localized price escalations. Also, the development of extended-release forms or combination therapies may command premium pricing.

Forecasted Market Value and Price Trajectory

By 2030, the global market for escitalopram is projected to be valued at around USD 7–9 billion, with compounded annual growth rates (CAGR) of approximately 3–5% driven by increased adoption in emerging markets and broader indications.

Pricing could stabilize at an average of USD 10–20 per month for generic formulations, with potential higher premiums for advanced or branded versions in niche markets.

Influence of Policy and Patent Laws

Regulatory initiatives, such as expedited biosimilar approval pathways and patent litigations, are expected to influence pricing indirectly. Countries with robust intellectual property protections will likely sustain higher prices longer, while markets with swift generic approvals will see continued price erosion.

Market Challenges and Opportunities

Challenges

- Pricing Pressure: Intense competition from generics continues to depress prices.

- Regulatory Hurdles: Delays in approval pathways for new formulations may restrict market entry.

- Supply Chain Risks: Global disruptions can temporarily inflate prices.

Opportunities

- Innovation in Delivery: Novel formulations such as transdermal patches or sustained-release tablets offer avenues for premium pricing.

- Expanding Indications: Use in pediatric, elderly, or treatment-resistant populations can augment market size.

- Digital Therapeutics Integration: Complementary non-drug therapies could influence prescribing patterns and demand.

Key Takeaways

- The market for escitalopram oxalate remains sizable, driven by global mental health needs and growing awareness.

- Patent expirations and the proliferation of generics have led to significant price reductions, especially in developed economies.

- Emerging markets are poised for growth, with increasing prescription rates potentially offsetting price pressures.

- Formulation innovation and new indications present opportunities to sustain or raise prices in a competitive environment.

- Regulatory and geopolitical factors will shape market dynamics and pricing during the 2023–2030 period.

FAQs

1. How has patent expiration affected the pricing of escitalopram?

Patent expiration has led to the entry of generic manufacturers, drastically reducing prices—up to an 80–90% decrease in some regions—making escitalopram more accessible but also intensifying market competition.

2. What are the prospects for biosimilars impacting escitalopram's market?

While biosimilars are more relevant for biologics, ongoing research into advanced formulations and delivery methods could introduce new, higher-priced options that influence overall market dynamics in the future.

3. Will demand for escitalopram increase in emerging markets?

Yes. As mental health awareness grows and healthcare infrastructure improves, demand in Asia, Africa, and Latin America is expected to rise, potentially outpacing generic price declines.

4. Are there upcoming formulations or indications that could influence pricing?

Extended-release versions and combination therapies are under development, promising higher efficacy or compliance, which could command premium prices.

5. How might regulatory shifts influence future costs?

Stricter regulatory standards can increase manufacturing costs but also curb counterfeit and substandard products. Conversely, streamlined approval pathways for generics and biosimilars may continue to drive prices downward.

References

[1] Fortune Business Insights. "Antidepressant Market Size, Share & Industry Analysis." 2022.

[2] IQVIA. "Global Outlook for Psychiatric Medications." 2022.

[3] U.S. Food and Drug Administration (FDA). "Lexapro Drug Approval and Patent History." 2011.

[4] MarketWatch. "Escitalopram Price Trends and Future Outlook." 2023.

[5] WHO. "Global Mental Health and Medication Use," 2022.