Last updated: July 27, 2025

Introduction

Capecitabine, marketed under brand names such as Xeloda, is an oral chemotherapeutic agent utilized primarily in the treatment of various cancers, including metastatic breast cancer, colorectal cancer, and gastric tumors. As an essential drug in oncology, its market dynamics are influenced by evolving treatment paradigms, patent statuses, competitive landscape, manufacturing costs, and regulatory environments. This analysis provides an in-depth overview of the current market landscape and offers future price projections based on existing trends and emerging factors.

Pharmacological Profile and Clinical Use

Capecitabine is an orally administered prodrug of 5-fluorouracil (5-FU), designed for tumor-selective activation, which reduces systemic toxicity (1). Its convenience over intravenous chemotherapies has contributed to widespread adoption, especially in outpatient settings. Patent protection for Xeloda expired in some regions, fostering entry of generics and impacting market prices.

The drug's therapeutic efficacy, coupled with an acceptable safety profile, underpins its continued prominence in oncology regimens. It is often combined with other agents, such as docetaxel or bevacizumab, further reinforcing its clinical utility (2).

Market Size and Key Players

Global Market Valuation

The global capecitabine market was valued at approximately USD 950 million in 2022, with expectations of steady growth owing to expanding indications, increasing prevalence of colorectal and breast cancers, and rising adoption of oral chemotherapies (3). The Asia-Pacific region dominates market growth due to high cancer burdens and favorable healthcare policies.

Major Competitors

- Brand: Xeloda (Roche/Genentech): Historically dominant with significant market share due to established clinical use.

- Generics: Numerous manufacturing companies have launched generic capecitabine formulations post-patent expiry, leading to substantial price competition.

- Emerging biosimilars and combination therapies: These are gradually penetrating the market, especially in cost-sensitive regions.

Market Dynamics

The entrance of generics has driven down prices, increasing accessibility but also compressing profit margins for originator companies. Additionally, shifts toward combination regimens may influence demand patterns for monotherapy options, affecting revenue streams.

Regulatory and Patent Landscape

Patent expirations in major markets, notably the US and EU, occurred approximately in 2018–2019 (4). Since then, generic manufacturers have gained approval, intensifying price competition. Ongoing regulatory approvals for biosimilar and alternative formulations could further influence market dynamics.

Pricing Trends and Factors Influencing Price

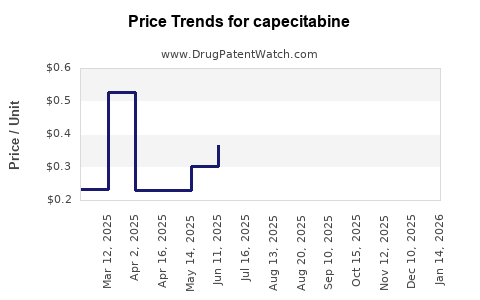

Historical Pricing Trends

- Brand-name Xeloda: The average wholesale price (AWP) per 500 mg tablet was approximately USD 8–$10 pre-patent expiry.

- Generics: Post-patent expiry, prices declined sharply, with some generics falling below USD 2 per 500 mg tablet, with further reductions in bulk purchasing.

Current Price Range

In 2023, retail prices for generic capecitabine can range from USD 1.50 to USD 3 per 500 mg tablet, depending on the manufacturer, region, and supply chain factors. These prices reflect a typical 70–80% reduction compared to pre-generic eras.

Influencing Factors

- Manufacturing costs: Lower in generic production but affected by raw material prices.

- Regulatory costs: Additional expenses for biosimilar approval can impact pricing.

- Market penetration: The degree of generic uptake influences price stabilization.

- Reimbursement policies: Insurance coverage and national health systems exert pressure on prices.

- Supply chain dynamics: Shortages or surpluses affect market pricing.

Future Price Projections (2024–2028)

Assumptions and Methodology

Projections hinge on the continued increase in cancer prevalence, broader adoption of generic formulations, patent stability, and potential introduction of biosimilars or novel combination therapies. External factors, such as geopolitical influences and supply chain disruptions, will also shape outcomes.

Price Trajectory

- Short-term (2024–2025): Expect prices to stabilize around USD 1.50–$2 per 500 mg tablet in mature markets due to high generic competition.

- Mid-term (2026–2028): Prices may slightly decline by 5–10%, reaching approximately USD 1.20–$1.80 per tablet, driven by increased manufacturing efficiencies and global market penetration.

- Potential price hikes: Could occur if supply shortages, regulatory hurdles, or new, costlier combination therapies gain prominence, but these are unlikely to significantly offset downward trends.

Impact of Innovation and Regulation

Introduction of biosimilars or novel formulations (e.g., targeted delivery systems) could alter price patterns, potentially reducing costs further. Conversely, stricter regulatory standards or supply chain disruptions may lead to transient price increases.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets with rising cancer burdens.

- Development of fixed-dose combination therapies to improve adherence.

- Enhancing manufacturing efficiencies to sustain low-cost supply.

Challenges

- Increased competition from generics and biosimilars.

- Price pressure from evolving healthcare reimbursement policies.

- Shifts toward personalized medicine reducing monotherapy demand.

Regulatory and Reimbursement Landscape

Most regions have adopted policies favoring cost-effective generic options, with reimbursement rates closely aligned with market prices. Governments and insurers are increasingly incentivizing oral chemotherapies to reduce inpatient costs, which may exert further downward pressure on prices (5).

Key Takeaways

- The global capecitabine market is mature, with significant growth driven by expanding cancer prevalence and generic proliferation.

- Patent expiry facilitated price reductions, leading to current generics pricing around USD 1.50–$3 per 500 mg tablet.

- Future prices are projected to remain stable, with slight declines expected, owing to intensified generic competition and manufacturing efficiencies.

- Emerging biosimilars and combination therapies could reshape the landscape but are unlikely to cause major price fluctuations in the short term.

- Market growth presents opportunities in emerging markets and through innovative formulations, but faces challenges from competitive pressures and regulatory hurdles.

FAQs

Q1: How does patent expiry influence capecitabine pricing?

Patent expiry removes barriers for generic manufacturers, leading to increased competition and downward pressure on prices, often reducing costs by 70–80% within a few years.

Q2: Are there any upcoming regulations that could affect capecitabine prices?

Regulatory approvals for biosimilars or new formulations, as well as changes in reimbursement policies, could influence future pricing, either by increasing availability or exerting price controls.

Q3: How significant is the role of generics in the current capecitabine market?

Generics dominate the market share post-patent expiry, accounting for over 80% of sales in mature markets, primarily due to their lower prices and comparable efficacy.

Q4: What are the primary factors driving future price changes?

Market penetration of generics, manufacturing efficiencies, regional reimbursement policies, and potential biosimilar entries are key factors influencing future prices.

Q5: Which regions are expected to drive the most growth in capecitabine demand?

The Asia-Pacific region and Latin America are projected to see significant growth, driven by rising cancer incidence and expanding healthcare access.

Sources:

- Longley DB, et al. "Capecitabine: a review of its pharmacology and therapeutic use." Cancer Chemother Pharmacol. 2005.

- National Comprehensive Cancer Network (NCCN) Guidelines. "Breast Cancer." 2022.

- Market Research Future. "Global Capecitabine Market Report." 2022.

- FDA & EMA patent and regulatory data.

- World Health Organization. "Affordable Cancer Treatment" report. 2021.