Last updated: July 27, 2025

Introduction

Amoxicillin, a penicillin-class antibiotic, remains one of the most prescribed drugs worldwide for treating bacterial infections. Its affordability, broad-spectrum efficacy, and extensive use in both outpatient and inpatient settings underpin its sustained market presence. As antimicrobial resistance (AMR) escalates and patent landscapes shift, understanding current market dynamics and future price trajectories of amoxicillin has become vital for stakeholders—manufacturers, healthcare providers, policymakers, and investors.

This analysis dissects the current market landscape of amoxicillin, explores key drivers influencing its pricing, evaluates evolving regulatory environments, and projects future pricing trends over the next five years.

Current Market Landscape

Global Market Size and Growth Trends

The global amoxicillin market was valued at approximately USD 4.8 billion in 2022, with a compound annual growth rate (CAGR) of around 2.8% projected through 2027 [1]. Its extensive utilization, spanning respiratory, urinary, and skin infections, anchors its market stability. Developed markets, including North America and Europe, account for nearly 60% of sales, driven by high antibiotic consumption and advanced healthcare infrastructure.

Emerging markets—Asia-Pacific, Latin America, and Africa—are experiencing accelerated growth due to increasing healthcare access, rising disease prevalence, and expanding pharmaceutical manufacturing capacities [2].

Manufacturing and Supply Chain Dynamics

Major producers include multinational pharmaceutical firms (e.g., GlaxoSmithKline, Sandoz), third-party generic manufacturers, and regional players, with manufacturing increasingly shifting to India and China to capitalize on cost efficiencies. Supply chain disruptions, especially during COVID-19, highlighted vulnerabilities, leading to occasional shortages.

The patent landscape has shifted. Although original patents expired in many regions by 2005, formulation patents and proprietary delivery methods can influence market exclusivity temporarily. Generics dominate over 80% of market volume, exerting downward pressure on prices.

Pricing Landscape

In high-income countries, the retail price of amoxicillin varies widely, ranging from USD 0.10 to USD 1 per 500 mg capsule, influenced by formulation, brand, and regulatory settings [3]. Generic versions, however, can be priced as low as USD 0.05 per capsule in bulk purchases.

In contrast, in low- and middle-income countries (LMICs), procurement prices through global supply programs can dip below USD 0.02 per dose, driven by high-volume procurement and subsidies.

Key Drivers Influencing Price Dynamics

Antimicrobial Resistance and Prescribing Trends

The rise of AMR has led to more cautious prescribing behaviors, increased use of combination therapies, and, paradoxically, both price inflation and reduction opportunities. The need for combination drugs or new formulations (e.g., extended-release) can elevate prices, whereas a shift toward first-line generics in some regions exerts downward pressure.

Regulatory Environment and Patent Expiry

Patent expirations in numerous geographies have spurred generic entry, lowering prices. However, regulatory complexities—such as approval delays or import restrictions—can distort market prices or create regional disparities.

Healthcare Policy and Reimbursement Dynamics

Government procurement policies, insurance reimbursements, and antimicrobial stewardship programs directly influence drug pricing. In many countries, price caps and tendering systems serve as mechanisms for cost containment.

Manufacturing Costs and Raw Material Availability

Sterile manufacturing requirements, quality standards, and raw material (penicillin G derivatives) availability impact pricing. Recent shortages and increased raw material costs can temporarily elevate prices.

Emerging Innovations and Formulation Changes

Development of new formulations — such as chewables, dispersibles, or extended-release versions — typically bear higher price tags, though market penetration depends on regulatory approvals and clinical demand.

Future Price Projections (2023-2028)

Market Growth and Price Trends

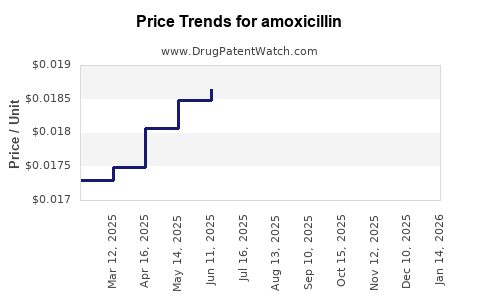

While overall market volume is expected to grow modestly (~2-3% CAGR), unit prices are forecasted to decline gradually, influenced primarily by increased generic competition. However, localized factors such as regulatory bottlenecks or raw material costs could induce variability.

Factors Supporting Price Stability or Increases

- Rising AMR and stewardship programs may promote the development and adoption of stewardship-friendly formulations, potentially increasing per-unit costs.

- Supply chain fragility and raw material shortages could result in short-term price spikes.

- Emerging combination therapies incorporating amoxicillin, such as amoxicillin-clavulanate, are likely to command higher margins.

Factors Supporting Price Declines

- Patent expirations will continue to buoy generic competition in mature markets.

- Global procurement initiatives in LMICs will sustain low prices.

- Regulatory harmonization and accelerated approval pathways may further commoditize amoxicillin.

Projected Price Ranges

By 2028, the average retail price of standard amoxicillin capsules in high-income markets could decrease to USD 0.05–0.20 per capsule, reflecting intensified generic competition. In LMICs, prices are expected to remain stable or even decline, often below USD 0.02 per dose, due to scale and subsidy programs.

Impact of Antimicrobial Stewardship and Innovation

Enhanced stewardship policies may dampen overall volume growth, but innovations targeting resistant strains or novel delivery systems could sustain or elevate prices in specific niches. Furthermore, minimally or non-patentable modifications—such as fixed-dose combinations—may command premium pricing in select markets.

Regulatory and Policy Outlook

Stringent regulatory standards, especially in developed countries, will influence market entry for new formulations or generics, shaping price stability and competition levels. Governments’ emphasis on antimicrobial stewardship and resistance mitigation may impose additional costs on manufacturers, indirectly affecting pricing strategies.

Conclusion

Amoxicillin's market remains fundamentally driven by generics, ensuring persistent affordability. Future price movements hinge on patent landscapes, resistance trends, raw material access, and regulatory environments. The next five years are characterized by price stabilization or modest declines in mature markets, with localized variations driven by policy and supply chain factors.

Key Takeaways

- The amoxicillin market is mature with steady growth, mainly driven by generics, and is expected to see gradual price declines.

- Patent expirations and increasing generic availability will pressure prices downward, but raw material costs and supply chain issues could cause short-term fluctuations.

- Emerging markets offer considerable growth opportunities, with low prices supporting access but risking margin compression.

- Innovations—such as combination therapies and new formulations—may create premium segments, subtly altering traditional price dynamics.

- Policymakers’ antimicrobial stewardship efforts and global health initiatives significantly influence future supply chains and pricing strategies.

FAQs

1. What factors are most influencing amoxicillin prices globally?

Global prices are mainly affected by patent expiry, generic competition, raw material costs, supply chain stability, regulatory hurdles, and antimicrobial stewardship policies.

2. Will the price of amoxicillin increase due to antimicrobial resistance?

While resistance may lead to higher treatment costs and demand for newer formulations, the impact on raw amoxicillin prices is limited as generics dominate, keeping prices relatively stable or declining.

3. How do patent expirations affect amoxicillin prices?

Expirations open markets to generic manufacturers, increasing competition and reducing prices, especially in mature markets.

4. Are there upcoming innovations that could raise the price of amoxicillin?

Yes, formulations targeting resistant strains or offering extended-release make formulations can command higher prices, but their market penetration remains limited.

5. What regional differences should stakeholders consider?

High-income markets typically see higher retail prices and more regulatory hurdles, whereas LMICs benefit from lower procurement costs due to subsidies and bulk purchasing, influencing global price trends.

Sources:

[1] Grand View Research, "Antibiotics Market Size, Share & Trends Analysis Report," 2022.

[2] World Health Organization, "Antimicrobial Market Reports," 2021.

[3] IQVIA, "Global Antibiotics Pricing & Market Data," 2022.