Share This Page

Drug Price Trends for ZYLET EYE DROPS

✉ Email this page to a colleague

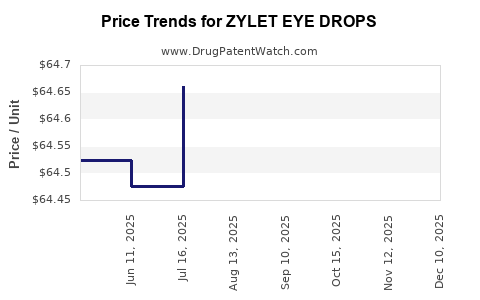

Average Pharmacy Cost for ZYLET EYE DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZYLET EYE DROPS | 24208-0358-05 | 64.45825 | ML | 2025-12-17 |

| ZYLET EYE DROPS | 24208-0358-05 | 64.53824 | ML | 2025-11-19 |

| ZYLET EYE DROPS | 24208-0358-05 | 64.51868 | ML | 2025-10-22 |

| ZYLET EYE DROPS | 24208-0358-05 | 64.57900 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZYLET Eye Drops

Introduction

ZYLET Eye Drops, a combination topical ophthalmic medication, is widely used for treating inflammatory ocular conditions such as conjunctivitis, keratitis, and postoperative inflammation. Comprising of an antibiotic (Sulfamethoxazole) and corticosteroid (Betamethasone), ZYLET targets bacterial infections and inflammation simultaneously. Its clinical efficacy and widespread application make it a key product within the ophthalmic pharmaceutical market. Analyzing its market dynamics and price trends offers essential insights for stakeholders, including pharmaceutical companies, investors, ophthalmologists, and healthcare policymakers.

Market Landscape

Global Ophthalmic Drug Market Overview

The global ophthalmic drug market has experienced steady growth, driven by an aging population, rising prevalence of eye disorders, and technological advancements in drug delivery systems. According to a report by Grand View Research, the market valuation reached approximately $22 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2% from 2023 to 2030 [1].

Product Positioning of ZYLET Eye Drops

ZYLET positions itself at the intersection of anti-inflammatory and antibacterial therapy, filling a niche for combination treatments in ocular health. Its patent status and regulatory approvals (US FDA, EMA) influence market penetration. The drug primarily competes with other fixed-dose combination eye drops, such as PredForte Plus and Tobradex, though its unique composition makes it a preferred choice in specific clinical scenarios.

Market Drivers

- Rising Ophthalmic Disease Burden: Increased incidence of bacterial conjunctivitis, postoperative inflammation, and dry eye syndrome.

- Aging Population: Greater risk of ocular inflammatory conditions among the elderly.

- Advances in Ophthalmic Pharmacology: New formulations improving drug bioavailability and reducing side effects.

- Expanding Access and Awareness: Growing healthcare infrastructure in emerging markets enhances product reach.

Market Challenges

- Regulatory Hurdles: Stringent approval processes complicate market entry, especially in emerging economies.

- Generic Competition: Patent expirations lead to increased availability of lower-cost generics.

- Side Effect Profile: Potential adverse effects from corticosteroids necessitate careful patient monitoring.

Pricing Dynamics

Current Pricing Overview

In the US, ZYLET Eye Drops typically retail at approximately $120–$180 per 10 mL bottle, depending on the pharmacy and regional factors. The premium pricing reflects brand recognition, quality assurance, and patent protections, though prices vary significantly across regions.

Factors Influencing Price

- Regulatory Status: Patent protection maintains premium pricing; patent expirations generally lead to price reductions.

- Manufacturing Costs: Production complexity influences retail price, especially for combination drugs requiring precise formulation.

- Market Competition: The presence of generics and alternative therapies exerts downward pressure on prices.

- Reimbursement Policies: Insurance coverage and formulary placements significantly affect patient access and drug pricing.

- Distribution Channels: Direct-to-consumer sales tend to be more expensive than wholesale or hospital procurement.

Potential Future Price Trajectories

- Post-Patent Expiry: Historical trends suggest a 15–30% decrease in generic entry leads to a corresponding reduction in brand-name drug prices.

- Emerging Markets: Price points are often 50–70% lower than in developed economies due to regulatory and economic factors.

- Innovative Formulations: Development of sustained-release devices or preservative-free formulations may command premium prices, counterbalancing generic competition.

Market Projections (2023–2030)

Revenue Outlook

Based on current demand and market expansion, global sales of ZYLET Eye Drops are projected to reach ~$200 million annually by 2025, with continued growth driven by emerging markets and increasing clinical indications. Post-2025, patents expiration in key jurisdictions (US, Europe) may lead to revenue decline unless new formulations or indications emerge.

Pricing Forecast

- Next 3 Years: Price stabilization expected, with slight fluctuations (~2–3%) driven by inflation and manufacturing efficiencies.

- 2030 and Beyond: A potential decrease of 20–35% in price per unit following widespread generic entry, unless differentiated by novel delivery systems or extended patent protections.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Invest in formulation innovation or new therapeutic combinations to extend market exclusivity.

- Investors: Monitor patent expiration timelines and pipeline developments to evaluate long-term profitability.

- Healthcare Providers: Balance considerations of drug efficacy, safety, and cost-effectiveness in prescribing practices.

- Regulators: Facilitate streamlined approval processes for generics to ensure affordability and competition.

Conclusion

ZYLET Eye Drops occupy a robust position within the ophthalmic pharmaceutical landscape, buoyed by clinical demand and an expanding global market. However, pricing strategies must adapt to patent landscapes, generic competition, and regional economic factors. Stakeholders projecting future growth should consider product differentiation and innovation as key avenues for maintaining market share and profitability.

Key Takeaways

- The global ophthalmic drug market, valued at ~$22 billion in 2022, continues to grow, with ZYLET Eye Drops serving a significant niche.

- Current US retail prices for ZYLET range from $120–$180 per 10 mL, with regional and competitive factors influencing prices.

- Patent protections sustain higher prices; expiry timelines forecast a 20–35% price reduction over the next five years due to generic entry.

- Emerging markets present growth opportunities but often at lower price points.

- Strategic innovation and regulatory navigation are essential to prolong product lifecycle and optimize pricing.

FAQs

1. When is the patent for ZYLET Eye Drops expected to expire, and how will that impact pricing?

Patent expiration in major markets is anticipated around 2024–2025. Post-expiry, increased generic competition typically leads to significant price reductions, potentially 20–35% over subsequent years.

2. Are there generic versions of ZYLET Eye Drops currently available?

As of 2023, generic equivalents are limited due to recent patent protections. However, the market is expected to see generic entries shortly after patent expiry.

3. What clinical advantages does ZYLET hold over alternative treatments?

ZYLET combines corticosteroid and antibiotic therapy in a single formulation, offering efficient management of ocular inflammation coupled with infection prevention, potentially reducing treatment complexity and improving adherence.

4. How do healthcare policies influence the pricing and availability of ZYLET?

Reimbursement policies, formulary placements, and regulatory approvals directly impact patient access and provider prescribing habits, thereby influencing retail and institutional pricing.

5. What future innovations could affect ZYLET's market position?

Development of preservative-free formulations, sustained-release delivery systems, or new combination therapies could extend its lifecycle and command premium pricing.

References

[1] Grand View Research. (2022). Ophthalmic Drugs Market Size, Share & Trends Analysis Report.

More… ↓