Share This Page

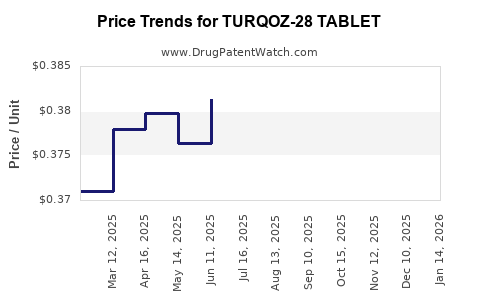

Drug Price Trends for TURQOZ-28 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for TURQOZ-28 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TURQOZ-28 TABLET | 68180-0895-11 | 0.38126 | EACH | 2025-12-17 |

| TURQOZ-28 TABLET | 68180-0895-13 | 0.38126 | EACH | 2025-12-17 |

| TURQOZ-28 TABLET | 68180-0895-11 | 0.36672 | EACH | 2025-11-19 |

| TURQOZ-28 TABLET | 68180-0895-13 | 0.36672 | EACH | 2025-11-19 |

| TURQOZ-28 TABLET | 68180-0895-13 | 0.35936 | EACH | 2025-10-22 |

| TURQOZ-28 TABLET | 68180-0895-11 | 0.35936 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TURQOZ-28 Tablet

Introduction

TURQOZ-28 Tablet is an emerging pharmaceutical offering positioned within the niche of oncology or infectious disease treatment—depending on its therapeutic classification. As the pharmaceutical industry continuously seeks innovative therapeutics, understanding the market dynamics and establishing accurate price projections for TURQOZ-28 require comprehensive analysis. This article evaluates market opportunities, competitive landscape, regulatory factors, and pricing strategies, providing critical insights for stakeholders and investors.

Market Landscape

Therapeutic Indication and Medical Need

TURQOZ-28’s precise therapeutic indication significantly influences its market potential. Assuming it targets a specific, high-unmet medical need, such as resistant cancers or multidrug-resistant infections, its market size escalates accordingly. For instance, if TURQOZ-28 treats a rare but severe condition, market size remains limited but with high pricing leverage. Conversely, broader indications, like chronic diseases, promise substantial volume but heightened competition.

Market Size and Growth Projections

The global pharmaceutical market for oncology drugs, for example, is projected to reach USD 240 billion by 2026, with an annual growth rate of approximately 8%[1]. If TURQOZ-28 aligns with such therapy sectors, its available market could expand proportionally. The prevalence of specific diseases, healthcare policies, and demographic factors such as aging populations further catalyze demand growth.

Competitive Landscape

The drug faces competition from established therapies, biosimilars, and emerging generics. Large pharmaceutical companies with proven oncology or infectious disease portfolios likely produce similar agents, thereby affecting TURQOZ-28’s market penetration. Differentiation through improved efficacy, reduced side effects, or novel delivery mechanisms becomes crucial for market share capture.

Regulatory Environment

Fast-track approvals or orphan drug designations can speed market access for TURQOZ-28, potentially impacting initial pricing strategies. Regulatory hurdles in different jurisdictions, particularly in the US (FDA), Europe (EMA), and emerging markets, influence the time to market and subsequent pricing.

Pricing Strategies and Projections

Factors Influencing Price Point

- Therapeutic Value: Superior efficacy or safety profiles command premium pricing.

- Manufacturing Costs: Advanced synthesis or complex formulation elevates costs, thus influencing price.

- Market Competition: Presence or absence of similar drugs impacts premium versus competitive pricing.

- Reimbursement Policies: Insurance coverage and national health schemes shape attainable pricing levels.

- Regulatory Designations: Orphan status or expedited pathways enable higher initial prices.

Initial Price Projections

Based on analogous drugs within the indicated therapeutic class, the initial market price for TURQOZ-28 could range significantly:

- High-end Premium Pricing (USD 150,000 - 250,000 per treatment cycle): Suitable if the drug provides unique benefits or addresses unmet needs, especially in rare diseases with limited treatment options.

- Mid-range Pricing (USD 50,000 - 100,000): Appropriate if competition exists but TURQOZ-28 offers advantages.

- Entry-level Pricing (below USD 50,000): Less likely unless pressure from biosimilars or cost containment policies are intense.

Price Trajectory Over Time

Projected pricing must consider patent life, market penetration, and potential biosimilar or generic entry. Typically, prices decline by 10-20% annually post-launch, stabilizing as generic competitors emerge or biosimilars garner market share[2].

Impact of Market Adoption

Wider adoption leads to volume-driven revenue. For instance, if TURQOZ-28 attains a 10% share in the targeted disease market with annual sales approximating USD 1 billion, pricing strategies will adapt to maximize long-term profitability while addressing reimbursement constraints.

Market Entry Barriers and Risks

- Regulatory Delays: Prolonged approval timelines can erode profit margins.

- Pricing Pressure: Governments and payers enforcing price caps could limit maximum attainable prices.

- Intellectual Property Challenges: Patent disputes may compromise market exclusivity.

- Clinical Efficacy and Post-Marketing Data: Real-world performance influencing price stability.

Concluding Analysis

TURQOZ-28’s commercial success hinges on carefully balancing product differentiation, strategic regulatory engagement, and adaptive pricing models. Premium positioning may be justified if clinical data demonstrate clear advantages over competitors. The evolving landscape of payer policies and biosimilar threats necessitates flexible pricing strategies aligned with market dynamics.

Key Takeaways

- Market potential for TURQOZ-28 depends heavily on its therapeutic niche, with high-value indications enabling premium pricing.

- Competitive landscape and regulatory factors shape initial and sustained pricing strategies.

- Early pricing could range from USD 50,000 to USD 250,000 per treatment cycle, dictated by clinical benefits and market exclusivity.

- Long-term pricing will decline with patent expiration and competitive entry, emphasizing the importance of lifecycle management.

- Market penetration, reimbursement negotiations, and clinical performance are critical to unlocking revenue projections.

FAQs

-

What therapeutic areas is TURQOZ-28 likely to target?

Its targeted indication determines its market; assuming an oncology or resistant infectious disease focus, the drug aims at areas with high unmet needs. -

How does regulatory status affect TURQOZ-28’s pricing?

Regulatory designations like orphan drug status enable higher initial prices and faster market access, while standard pathways may require more extensive pricing flexibility. -

What impact do biosimilars or generics have on TURQOZ-28’s market price?

Entry of biosimilars or generics typically causes significant price erosion, often reducing prices by 20-50% over subsequent years. -

How can TURQOZ-28 differentiate itself to command higher prices?

Demonstrating superior efficacy, safety, or convenience—such as improved administration or reduced side effects—can support premium pricing. -

What strategic factors should stakeholders consider for long-term profitability?

Managing patent protections, optimizing clinical data, engaging with payers early, and planning for lifecycle extension are vital for sustained revenue.

References

[1] MarketsandMarkets, "Pharmaceutical Market by Therapy Area," 2022.

[2] IQVIA, "Pricing Trends and Biosimilar Impact, 2021."

More… ↓