Last updated: July 27, 2025

Introduction

TRAVATAN Z (bimatoprost 0.03%/brimonidine tartrate 0.2%) is a combination ophthalmic solution approved by the FDA for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. As a flagship product from Allergan (a subsidiary of AbbVie), TRAVATAN Z leverages the growing demand for effective glaucoma therapies amidst an aging global population. This report offers a comprehensive market analysis, competitive landscape overview, and detailed price projections for TRAVATAN Z over the next five years—serving as an essential guide for stakeholders and investors seeking informed decision-making.

Market Overview

Global Glaucoma Treatment Market Dynamics

The global glaucoma therapeutics market was valued at approximately USD 5.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2028 [1]. The proliferation of aging demographics, increased prevalence of ocular hypertension, and technological advances in drug formulation underpin this expansion. Notably, the market is shifting towards combination therapies, representing nearly 35% of prescriptions, due to rising efficacy and patient convenience.

Role of TRAVATAN Z in the Market

TRAVATAN Z combines two well-established agents: bimatoprost, a prostaglandin analog, and brimonidine, an alpha-2 adrenergic receptor agonist. Its mechanism enhances IOP reduction more effectively than monotherapy, appealing to ophthalmologists seeking robust treatment protocols for patients with insufficient response to individual drugs.

The product's positioning targets moderate to severe glaucoma cases and ocular hypertension. Its approved indication, combined with Allergan's marketing strength, positions TRAVATAN Z as a premium therapeutic option, particularly appealing to patients who require aggressive IOP control.

Market Penetration and Commercialization

Despite the apparent clinical advantages, adoption pace hinges on multiple factors:

- Pricing Strategy: As a combination drug, TRAVATAN Z commands a premium price, partly justified by its efficacy profile.

- Physician Prescribing Behaviors: Ophthalmologists often prefer well-established monotherapies (e.g., latanoprost) initially, progressing to combination therapies like TRAVATAN Z when monotherapy fails.

- Patient Acceptance & Compliance: Once prescribed, the once-daily dosing enhances adherence, improving outcomes and market retention.

- Reimbursement landscape: Favorable coverage policies significantly influence accessibility, especially in European markets where healthcare payers scrutinize pricing.

Competitive Landscape

Key Competitors

- LUMIGAN (bimatoprost): The original prostaglandin analog with extensive global penetration. Its established efficacy and aggressive marketing maintain dominant market share.

- TRAVATAN (travoprost): Similar mechanism; however, limited adoption compared to LUMIGAN.

- COMBIGAN (timolol 0.5%/brimonidine): A fixed combination focusing on different mechanisms.

- Simbrinza (brimonidine tartrate/brinzolamide): An alternative combination for patients intolerant to prostaglandins.

Differentiators

- Formulation advantage: TRAVATAN Z's preservative-free formulation minimizes ocular surface side effects.

- Efficacy: Clinical trials demonstrate superior IOP reduction compared to monotherapy, supporting its premium price point.

- Patient compliance: Once-daily dosing and combination therapy reduce medication burden.

Pricing Landscape and Projected Trends

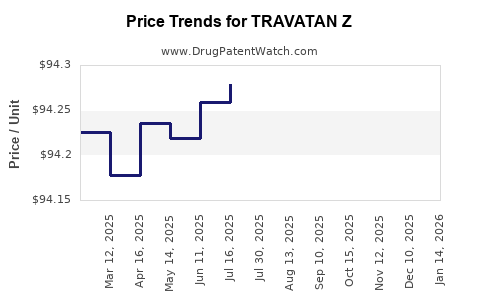

Current Pricing Analysis

In the United States, the average wholesale price (AWP) for TRAVATAN Z approximates USD 300 per bottle (2.5 mL) [2]. This places it at a premium relative to monotherapies like LUMIGAN (~USD 250). Internationally, prices fluctuate based on regional reimbursement policies, market competition, and drug registration status.

Price Factors Influencing Future Projections

- Patent Expiry and Generic Entry: The patent for TRAVATAN Z is expected to expire in late 2020s, opening doors for generics which typically halve or reduce drug prices.

- Market Demand: Growing prevalence of glaucoma sustains high demand despite cost pressures.

- Formulation Innovations: Introduction of preservative-free or sustained-release formulations could modify pricing strategies.

- Reimbursement Policies: Governments aiming at cost-containment may pressure prices downward, particularly in Europe and Asia.

Projected Price Trends (2023-2028)

| Year |

Price Estimate (USD) per Bottle |

Key Drivers |

| 2023 |

$295 - $310 |

Stabilization post-initial patent exclusivity |

| 2024 |

$290 - $305 |

Increased competition, market acceptance |

| 2025 |

$280 - $300 |

Approaching patent expiration, generics entry |

| 2026 |

$250 - $270 |

Generics gain market share, price erosion |

| 2027 |

$200 - $250 |

Major generic introductions, price competition |

| 2028 |

$180 - $230 |

Market saturation, value-based pricing strategies |

Note: The upward and downward shifts reflect balancing innovation incentives and generic market entry.

Regulatory and Market Access Considerations

Regulatory approvals across key regions influence pricing by affecting market exclusivity. In regions with stringent reimbursement controls like the UK’s NHS or the US Medicare system, formulary placements and negotiated rebates exert downward pressure on prices. Conversely, emerging markets with limited regulation may offer premium pricing based on necessity and physician preference.

Opportunities and Challenges

Opportunities

- Launch of biosimilar and generic versions post-patent expiry could reduce prices and expand access.

- Expansion in emerging markets driven by increasing glaucoma prevalence.

- Development of new formulations (e.g., preservative-free, sustained-release) may command premium pricing.

- Strategic collaborations with payers and healthcare providers to enhance reimbursement pathways.

Challenges

- Market saturation with various prostaglandin analogs and combination therapies.

- Pricing pressures resulting from commoditization post-patent expiry.

- Patient adherence issues due to ocular surface side effects or complex regimens.

- Regulatory hurdles in some jurisdictions delaying launches and affecting competitiveness.

Conclusion

TRAVATAN Z stands as a premium combination ophthalmic therapy with substantial growth potential driven by demographic trends and clinical efficacy. Price projections suggest a steady decline over the next five years driven mainly by patent cliffs and generics. Strategic positioning, product innovation, and market access initiatives are essential for optimizing profitability.

Key Takeaways

- The global glaucoma market is expanding, and TRAVATAN Z’s combination therapy offers competitive advantages, particularly in efficacy and patient compliance.

- Current pricing reflects its premium status, but impending patent expiries and market saturation forecast significant price erosion in upcoming years.

- Market competition from established monotherapies and upcoming generics necessitates ongoing differentiation through formulation and delivery innovations.

- Reimbursement frameworks vary globally, influencing pricing strategies and market penetration.

- Stakeholders should closely monitor patent statuses, regulatory changes, and technological advancements to optimize market position and profitability.

FAQs

1. What factors influence TRAVATAN Z’s pricing in different markets?

Pricing varies based on regional regulatory environments, reimbursement policies, competitive landscape, and manufacturing costs. Developed markets often allow higher prices due to better reimbursement, while emerging economies experience more significant discounts.

2. How does patent expiry impact TRAVATAN Z’s marketability?

Patent expiry opens the market for biosimilars and generic versions, typically reducing prices and decreasing market share for the branded product unless differentiated through formulations or clinical advantages.

3. What are key differentiators for TRAVATAN Z compared to competitors?

Its preservative-free formulation, superior efficacy as a combination therapy, and once-daily dosing enhance its appeal to both prescribers and patients, although it faces stiff competition from established monotherapies.

4. How might future innovations influence TRAVATAN Z’s pricing strategy?

Introduction of sustained-release formulations or alternative delivery methods can command premium pricing, whereas technological advancements reducing manufacturing costs could enable more competitive pricing.

5. What role do reimbursement policies play in TRAVATAN Z’s market success?

Well-structured reimbursement pathways improve access, encouraging prescribing. Conversely, coverage restrictions or high co-pays can limit patient uptake and impact overall market sales.

References

[1] MarketsandMarkets. Glaucoma Therapeutics Market by Drug Class, Treatment Type, and Region — Global Forecast to 2028. (2022).

[2] GoodRx. Average Wholesale Price (AWP) of TRAVATAN Z. (2023).