Last updated: July 28, 2025

Introduction

Tramadol hydrochloride (HCl) is a widely prescribed opioid analgesic used for managing moderate to severe pain. As a centrally acting synthetic opioid, Tramadol's unique dual mechanism—agonism at the μ-opioid receptor and inhibition of serotonin and norepinephrine reuptake—positions it distinctly in pain management therapy. The drug's broad application across varied healthcare settings, coupled with regulatory considerations and market dynamics, necessitates a comprehensive analysis to inform stakeholders. This report delineates current market trends, regulatory landscapes, competitive positioning, and future price projections for Tramadol HCl.

Market Overview

Global Demand and Consumption Trends

The global demand for Tramadol HCl has experienced consistent growth over the past decade, driven by expanding pain management needs attributable to aging populations and rising chronic pain conditions. According to IQVIA data [1], global analgesic sales, including Tramadol, surpassed USD 12 billion in 2022 with an annual compound growth rate (CAGR) of approximately 4.5%.

Developed markets such as North America and Europe account for nearly 60% of the global Tramadol market, leveraging high prescription rates and widespread acceptance. Emerging markets in Asia, Latin America, and Africa demonstrate rapid growth trajectories, supported by increased healthcare infrastructure and awareness.

Key Market Drivers

-

Broad Indication Spectrum: Tramadol is employed in post-operative pain, osteoarthritis, neuropathic pain, and other conditions, broadening its utilization scope.

-

Cost-Effectiveness: Compared to other opioids like morphine or oxycodone, Tramadol often offers a cheaper alternative, especially in outpatient settings.

-

Regulatory Policies: Restrictions on other potent opioids have occasionally shifted prescriber preference toward Tramadol as a perceived less-addictive option.

-

Generic Penetration: The patent expiration of brand formulations has led to widespread generic availability, reducing both acquisition costs and retail prices.

Market Challenges

-

Regulatory Scrutiny and Control: Increasing regulatory oversight due to concerns over misuse has led to scheduling adjustments in several jurisdictions, impacting availability and prescribing patterns [2].

-

Abuse and Dependence Risks: Reports of misuse have precipitated tighter controls, affecting market stability.

-

Alternative Modalities: The advent of non-opioid analgesics and novel pain management approaches pose competitive threats.

Regulatory Landscape

Current Classification and Control Measures

In the United States, Tramadol is classified as a Schedule IV controlled substance [3], reflecting moderate dependency potential. The European Union classifies it variably across member states, with some countries imposing stricter controls.

Recent policy shifts have targeted tramadol misuse:

-

In 2014, the FDA issued warnings about abuse potential [4].

-

Several countries have increased restrictions, influencing prescription volumes and pharmacy stocking.

Implication for Market Dynamics

Regulatory constraints influence both supply chain and pricing strategies. Tighter controls often elevate procurement costs due to compliance measures, but they can also limit oversupply and abuse, thereby stabilizing prices over the long term.

Competitive Market Environment

Generic Dominance and Brand Competition

The expiration of patents on primary formulations has led to a surge in generic Tramadol suppliers. As of 2022, over 50 pharmaceutical manufacturers globally produce Tramadol HCl, resulting in price compression.

Manufacturers and Suppliers

Major players include Teva Pharmaceuticals, Mylan, Sun Pharmaceutical, and local generics producers. Their strategies center on maintaining market share through cost minimization and distribution expansion.

Pricing Strategies

Pricing varies geographically, influenced by regulatory environment, reimbursement policies, and healthcare infrastructure. In the US, the average wholesale price (AWP) for 50 mg Tramadol tablets hovers around USD 0.10–0.20 per tablet [5]. In less regulated markets, prices can be substantially lower.

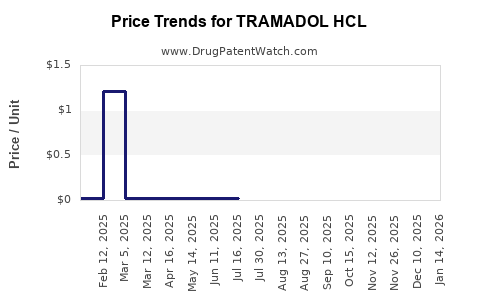

Price Projection Analysis

Factors Influencing Price Trends

-

Regulatory Changes: Stricter controls could inflate costs associated with compliance, distribution, and procurement, possibly increasing retail prices marginally.

-

Market Saturation: High generic competition sustains a downward pressure on prices, especially in mature markets.

-

Supply Chain Dynamics: Manufacturing costs, raw material availability (notably for opioids), and geopolitical factors influence pricing.

-

Demand Fluctuations: Changes in prescribing patterns, driven by clinical guidelines or safety warnings, impact overall volumes and prices.

-

Reimbursement Policies: Shifts toward value-based healthcare models and government-funded programs can influence ultimate patient prices.

Short to Medium-Term Price Outlook (Next 3–5 Years)

-

Continued Price Erosion: In established markets with high generic penetration, expect prices to decline by approximately 2–4% annually, reflecting market saturation and competitive pricing.

-

Potential Price Stabilization or Mild Increase: Regulatory measures that limit supply or impose new compliance costs could temper annual declines or lead to modest increases of 1–2%, particularly in emerging markets where generics are less prevalent.

-

Premiumization Risks in Certain Markets: In jurisdictions with recent scheduling or borderline reclassification, there may be initial price spikes owing to supply constraints, but these are likely to normalize.

Long-Term Projections (5+ Years)

-

Depending on the evolution of abuse mitigation policies and alternative analgesic developments, the Tramadol market may stabilize at lower prices. However, regional disparities will persist; Asian markets tend to sustain lower prices relative to North American and European counterparts.

-

Innovation or reformulations targeting abuse deterrence could command premium pricing, though such developments are currently limited for Tramadol.

Strategic Recommendations

-

Manufacturers should optimize cost structures for generic production to leverage market share expansion in emerging markets.

-

Distributors need to focus on compliance to mitigate risks associated with regulatory shifts, ensuring stable supply chains.

-

Investors and Stakeholders should monitor legislative developments, especially in jurisdictions with evolving opioid regulations, to anticipate supply and price fluctuations.

Key Takeaways

-

The global Tramadol HCl market is mature but continues to grow, driven by high demand for pain management solutions.

-

Market penetration of generics has significantly depressed prices, with a general downward trend forecast for the next five years.

-

Regulatory scrutiny and potential reclassification pose risks, potentially influencing both supply and pricing.

-

Geographic disparities favor higher prices in North America and Europe, with emerging markets maintaining lower price points.

-

Strategic positioning focusing on compliance, cost leadership, and regional expansion can maximize profitability in the evolving landscape.

FAQs

1. How will regulatory reclassification impact Tramadol prices?

Reclassification into stricter control schedules could increase compliance costs and limit supply, potentially raising prices temporarily. However, long-term effects depend on policy enforcement and market adaptation.

2. Are there concerns about the abuse potential of Tramadol?

Yes. Although considered less addictive than other opioids, reports of misuse have led to increased regulation, influencing prescribing habits and market availability.

3. What is the forecast for generic Tramadol pricing?

Prices are expected to decline gradually due to sustained generic competition, with an estimated annual decrease of 2–4% in mature markets over the coming five years.

4. How do regional differences affect Tramadol market dynamics?

Developed regions offer higher prices due to regulatory strictness and higher healthcare spending, whereas emerging markets benefit from lower manufacturing costs but face regulatory and supply chain challenges.

5. Is there potential for innovation in Tramadol formulations?

Currently limited, but future developments might include abuse-deterrent formulations, which could command premium pricing and alter traditional market dynamics.

References

[1] IQVIA. Global Analysis of Analgesic Market Trends, 2022.

[2] U.S. Food and Drug Administration. Drug Safety Communication, 2014.

[3] DEA Diversion Control Division. Schedules of Controlled Substances.

[4] FDA. Drug Abuse and Dependence Data Summary, 2014.

[5] Red Book Online. Wholesale Pricing Data for Tramadol HCl, 2022.