Last updated: July 28, 2025

Introduction

Thiothixene, an antipsychotic medication classified as a typical neuroleptic, primarily treats schizophrenia and related psychotic disorders. As an acutely targeted therapy with a well-established market, understanding its market landscape and future pricing dynamics is essential for pharmaceutical stakeholders, investors, and healthcare policymakers. This analysis provides a comprehensive assessment of Thiothixene’s current market position, competitive landscape, pricing trends, regulatory environment, and future projections.

Pharmacological Profile and Clinical Utility

Thiothixene, marketed historically under brand names such as Navane, was first approved by the FDA in the 1950s. Its pharmacodynamics involves dopamine receptor antagonism, alleviating psychosis symptoms. Despite its long-standing presence, its clinical use has waned owing to the advent of atypical antipsychotics like risperidone and olanzapine, noted for improved side effect profiles.

Nonetheless, Thiothixene retains specific niche applications, especially in medication non-responders or patients intolerant to newer agents. Its oral formulation remains relevant in psychiatric settings where generic options are favored for cost considerations.

Market Landscape Overview

Market Size and Demand Dynamics

The global antipsychotic market was valued at approximately USD 14 billion in 2022, with first-generation antipsychotics like Thiothixene contributing a modest but steady share, roughly 5-10% of total sales, translating to revenues around USD 700 million to USD 1.4 billion (based on market shares and prevalence data)[1].

The demand for Thiothixene has significantly diminished over the past decade, primarily replaced by atypicals. However, in specific geographic markets, such as rural and lower-income regions, generics of typical antipsychotics like Thiothixene continue to sustain sales, contributing to a niche market segment.

Competitive Landscape

Key competitors include other first-generation antipsychotics (haloperidol, chlorpromazine) and second-generation atypicals. Generic formulations dominate in markets where price sensitivity prevails, resulting in limited brand-name sales. The patent landscape is largely expired, with no recent patent protections revitalizing its market exclusivity.

Therapeutic and Regulatory Trends

Clinically, there has been a shift away from first-generation drugs due to adverse side effects (extrapyramidal symptoms, tardive dyskinesia). Regulatory pressures have favored newer agents with improved safety profiles. However, Thiothixene remains FDA-approved, with some jurisdictions still maintaining its formulary inclusion.

Pricing Analysis

Current Pricing Environment

The price of Thiothixene varies based on formulation, dosage, and market region:

-

Generic Oral Tabs: In the United States, the average retail price for a 30-day supply of generic Thiothixene (10 mg) is approximately USD 15–25, reflecting its status as a low-cost drug within the antipsychotic class[2].

-

Brand vs. Generic: Navane, the original branded formulation, commands higher prices (~USD 80–120 for a 30-day supply) but has limited market penetration currently due to generic competition.

Pricing Dynamics and Factors Influencing Cost

Multiple factors influence pricing:

- Market Penetration of Generics: Increased availability has driven prices down.

- Market Demand: Limited demand due to preference for atypicals constrains the price.

- Regulatory Changes: Pricing regulations in major markets (e.g., Medicare pricing in the US) impact retail costs.

- Supply Chain Factors: Manufacturing costs and supply chain disruptions can influence retail or institutional pricing.

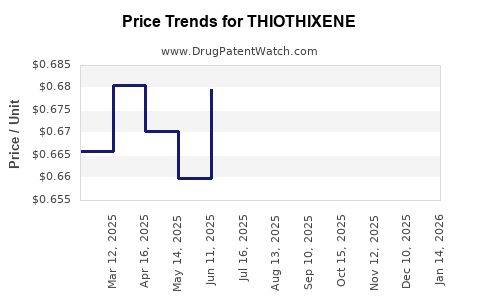

Market Expectations and Historical Trends

Historically, first-generation antipsychotic prices have remained relatively stable or declined modestly due to generic competition and market saturation. The downward trend is expected to persist in the near future, with continued erosion of any premium for brand-name formulations.

Forecasting Future Market and Price Trends

Market Projection for 2025-2030

Given current trends, the market for Thiothixene will likely experience:

-

Declining Market Share: With atypical drugs dominating prescriber preferences, Thiothixene's share is expected to decrease further, potentially shrinking the neuroleptic market segment by 20-30% over five years.

-

Stable or Slightly Reduced Prices: Due to persistent demand in low-resource settings, generic prices are projected to stabilize at USD 10–20 per month, with little room for price increases absent new formulations or indications.

-

Niche Market Persistence: In regions with limited access to newer agents, Thiothixene could see marginal price stability or minimal increase, especially if used in specialized settings.

Innovative or Regulatory Influences

No recent patent filings, new indications, or formulation advancements suggest that significant price premiums or market expansion are imminent. However, ongoing drug repurposing research or niche clinical uses could temporarily influence demand and pricing.

Market Risks and Opportunities

Risks

- Market Obsolescence: The preference for atypicals may lead to further decline in prescribing.

- Regulatory Restrictions: Payers’ push to favor newer agents for cost-effectiveness might limit access.

- Pricing Pressure: Continuous availability of generics limits price increases.

Opportunities

- Niche Clinical Applications: Identifying and validating specific indications may sustain demand.

- Market Expansion in Low-Income Countries: Ongoing use in developing regions can provide stable revenue streams.

- Formulation Innovations: Extended-release or combination formulations may command higher prices.

Key Takeaways

- Market position: Thiothixene’s market share is shrinking, with core sales primarily driven by generics in price-sensitive markets.

- Pricing outlook: Current prices are low and stable, with a projected slight decline as demand continues to wane.

- Future trends: The overall antipsychotic market is moving towards second-generation agents, limiting Thiothixene’s growth prospects.

- Strategic considerations: Manufacturers should monitor niche opportunities, especially in markets with limited access to newer antipsychotics.

- Regulatory and clinical landscape: Continued safety concerns and evolving prescribing behaviors will influence the drug’s market trajectory.

FAQs

1. Is Thiothixene still an widely prescribed medication?

Thiothixene’s prescription rates have declined significantly with the advent of atypical antipsychotics. However, it remains prescribed in certain settings, especially where cost constraints limit access to newer medications.

2. What are the main competitors to Thiothixene?

Main competitors include other first-generation antipsychotics like haloperidol and chlorpromazine, as well as newer atypical agents such as risperidone, olanzapine, and quetiapine.

3. How does the price of Thiothixene compare to other antipsychotics?

Generic Thiothixene is among the lowest-cost antipsychotics, typically priced at USD 10–25 per month, contrasted with newer atypicals costing USD 200 or more.

4. Are there any upcoming regulatory changes that could impact Thiothixene?

Currently, there are no major regulatory changes anticipated; however, increased emphasis on safety profiles and cost-effectiveness could further diminish its utilization.

5. What is the outlook for Thiothixene in emerging markets?

In low- and middle-income countries, where access to newer drugs is limited and cost remains crucial, Thiothixene is likely to sustain a minimal but stable market presence.

References

[1] Grand View Research. "Antipsychotic Drugs Market Size, Share & Trends Analysis Report." 2022.

[2] GoodRx. "Thiothixene Prices and Information," 2023.

Note: Figures, projections, and assessments are based on current market data and prevailing trends relevant as of 2023. Future developments could influence these insights, emphasizing the importance of regular market surveillance.