Share This Page

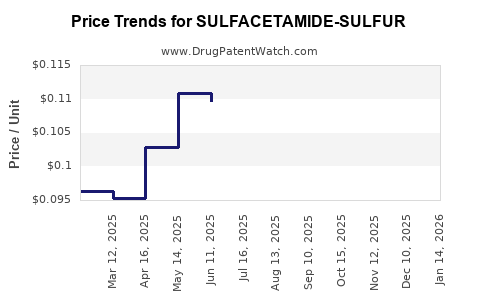

Drug Price Trends for SULFACETAMIDE-SULFUR

✉ Email this page to a colleague

Average Pharmacy Cost for SULFACETAMIDE-SULFUR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFACETAMIDE-SULFUR 10-5% CRM | 42192-0149-02 | 0.61797 | GM | 2025-12-17 |

| SULFACETAMIDE-SULFUR 8-4% SUSP | 58657-0469-16 | 0.07132 | ML | 2025-12-17 |

| SULFACETAMIDE-SULFUR 10-5% CRM | 58657-0468-01 | 1.52945 | GM | 2025-12-17 |

| SULFACETAMIDE-SULFUR 10-5% CRM | 58657-0468-02 | 0.61797 | GM | 2025-12-17 |

| SULFACETAMIDE-SULFUR 8-4% SUSP | 69367-0245-16 | 0.07132 | ML | 2025-12-17 |

| SULFACETAMIDE-SULFUR 8-4% SUSP | 42192-0133-16 | 0.07132 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sulfacetamide-Sulfur

Introduction

Sulfacetamide-sulfur combines a broad-spectrum sulfonamide antimicrobial with keratolytic sulfur, primarily used in dermatological treatments for conditions such as acne vulgaris and seborrheic dermatitis. As the demand for effective topical therapies increases, understanding market dynamics and projective pricing is crucial for stakeholders, including manufacturers, investors, and healthcare policymakers.

This report provides an in-depth market analysis of sulfacetamide-sulfur, evaluating current demand, key market drivers, competitive landscape, regulatory environment, and forecasted price trends over the next five years.

Market Overview

Sulfacetamide-sulfur formulations are predominantly available as prescriptions or over-the-counter topical preparations in various forms such as creams, gels, and lotions. The product's dual-action—antimicrobial activity from sulfacetamide and keratolytic effect from sulfur—renders it versatile for treating common dermatological conditions.

Current Market Size

Globally, the dermatology segment exhibits steady growth, driven by escalating incidences of acne and seborrheic dermatitis. The global dermatology drugs market was valued at approximately USD 35 billion in 2022, with treatments for acne covering a significant share[1].

While detailed sales figures specifically for sulfacetamide-sulfur are scarce, estimates suggest that its subset within topical antimicrobials accounts for a modest but stable percentage. The global antiseborrheic and anti-acne agents market valued at USD 2.3 billion in 2021 is projected to grow at a CAGR of 4.2% through 2028, partly attributable to the use of sulfacetamide-sulfur-based products[2].

Regional Market Dynamics

-

North America: Dominates the market due to high healthcare expenditure, widespread awareness, and the prevalence of dermatologic conditions. The U.S. accounts for approximately 45% of global sales of topical acne treatments.

-

Europe: Exhibits robust growth, supported by modern healthcare infrastructure and over-the-counter availability in some countries.

-

Asia-Pacific: Fastest-growing region, driven by increasing urbanization, changing lifestyle patterns, and expanding skincare markets. India and China show significant growth potential.

Key Market Drivers

Rising Prevalence of Dermatological Conditions

The global burden of skin conditions such as acne impacts an estimated 85% of adolescents and persists into adulthood for many. The increasing prevalence fuels demand for topical treatments like sulfacetamide-sulfur.

Shift Toward Over-the-Counter (OTC) Availability

Regulatory environments in countries like the U.S. and European nations facilitate OTC access to certain dermatological products, including sulfacetamide-sulfur formulations, fueling sales and consumer adoption.

Advancements in Topical Formulations

Innovations in delivery mechanisms—such as nanoemulsions and liposomal carriers—improve drug penetration and efficacy, boosting market appeal.

Cost-Effectiveness

Sulfacetamide-sulfur therapies are generally affordable compared to systemic treatments, making them attractive in resource-limited settings and for long-term management.

Competitive Landscape

Key players include:

- Bausch Health (Sulfacetamide-sulfurs products)

- Galderma (licensed formulations)

- Local generics manufacturers in emerging markets

Generic brands dominate sales due to lower cost and widespread availability. Patent expirations in recent years have accelerated the proliferation of generics, intensifying price competition.

Regulatory Environment and Patent Status

Sulfacetamide-sulfur combinations exist as off-patent drugs, allowing generic manufacturers to produce comparable formulations. Regulatory approvals vary by region but are generally straightforward in mature markets, facilitating rapid entry for generic versions.

Market Challenges

- Limited Innovation: Lack of new formulations or combination therapies hampers growth potential.

- Patient Compliance: Some formulations have issues related to odor or cosmetic acceptability.

- Emerging Resistance: Concerns about antimicrobial resistance could impact long-term use and formulation development.

Price Projections

Historical Pricing Trends

In mature markets, the average retail price for a 15g tube of sulfur-based formulations ranged between USD 4-8, with generics priced lower. Over the past decade, price erosion has been evident; for instance, in the U.S., prices dropped roughly 20% due to increased generic competition.

Forecasted Price Trends (2023–2028)

- Growth Factors: Rising demand, expanding market access, and potential formulation innovations could modestly increase prices in regions with limited generic penetration.

- Price Stabilization/Decline: In highly competitive markets like North America and Europe, prices are expected to remain stable or decline slightly, averaging USD 3.50-6 per 15g tube by 2028.

- Emerging Markets: Prices may be lower, around USD 2-4, due to higher generic competition and purchasing power disparities.

Impact of Policy and Market Entry

Potential regulatory changes, such as reclassification of topical antimicrobials or patent restrictions, could influence pricing strategies and margins.

Future Opportunities and Threats

Opportunities

- Development of combination products with improved tolerability and cosmetic appeal.

- Entry into underserved markets with high dermatological disease burdens.

- Incorporation of innovative delivery systems to enhance efficacy.

Threats

- Competition from other topical antimicrobials and systemic therapies.

- Regulatory barriers or shifts that favor newer, patented agents.

- Increasing concerns about antimicrobial resistance prompting reassessment of topical antimicrobials' role.

Conclusion

The sulfacetamide-sulfur market is characterized by steady demand, primarily driven by acne and seborrheic dermatitis treatments. The presence of established generics, moderate growth in emerging markets, and limited innovation suggest a mature market with stable but declining pricing trajectories.

Strategic Recommendations

- Stakeholders should focus on differentiating formulations through improved tolerability or delivery systems.

- Cost optimization and expanding manufacturing capacity in emerging markets could enhance competitiveness.

- Monitoring regulatory developments is vital to adapt pricing and marketing strategies effectively.

Key Takeaways

-

Market Size & Growth: The global topical antimicrobials segment, including sulfacetamide-sulfur, is expected to grow at a CAGR of around 4-5% until 2028, fueled by increasing dermatologic conditions worldwide.

-

Pricing Trends: Prices for sulfacetamide-sulfur formulations are projected to decline modestly due to generic competition, stabilizing around USD 3.50-6 per 15g tube in developed markets by 2028.

-

Regional Insights: North America remains mature with stable prices; Asia-Pacific offers significant growth opportunities with lower price points.

-

Competitive Landscape: The market is highly commoditized, with limited innovation but opportunities in formulation improvements and market expansion.

-

Challenges & Opportunities: Addressing antimicrobial resistance, enhancing product tolerability, and expanding into underserved regions stand as avenues for growth.

FAQs

-

What are the main dermatological conditions treated with sulfacetamide-sulfur?

Acne vulgaris, seborrheic dermatitis, and scalp seborrhea are primary indications, leveraging its antimicrobial and keratolytic properties. -

How does the patent landscape influence pricing?

Since sulfacetamide-sulfur formulations are off-patent, generic competition drives prices down, leading to increased accessibility and market saturation. -

Are there emerging alternatives to sulfacetamide-sulfur?

Yes, newer agents like benzoyl peroxide, topical retinoids, and antibiotics are increasingly used, which may impact sulfacetamide-sulfur demand over time. -

What role does regulation play in market dynamics?

Regulatory ease of approval in certain regions facilitates rapid generic entry, intensifying price competition and affecting profit margins. -

Can innovation revitalize this market?

Yes, formulations with improved cosmetic profiles, sustained-release systems, or combination therapies could reinvigorate interest and utility.

References

[1] MarketWatch. "Global Dermatology Drugs Market Size, Share & Trends Analysis Report." 2022.

[2] Grand View Research. "Antiseborrheic and Anti-Acne Agents Market Size & Forecast." 2021.

More… ↓