Share This Page

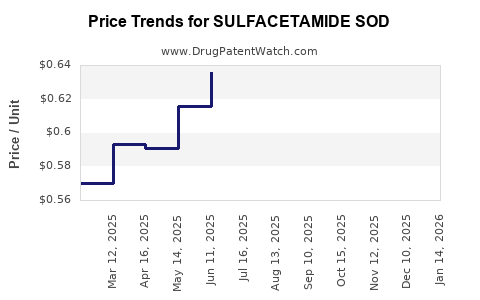

Drug Price Trends for SULFACETAMIDE SOD

✉ Email this page to a colleague

Average Pharmacy Cost for SULFACETAMIDE SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFACETAMIDE SOD 10% TOP SUSP | 45802-0896-26 | 0.68541 | ML | 2025-12-17 |

| SULFACETAMIDE SOD 10% TOP SUSP | 45802-0896-26 | 0.60343 | ML | 2025-11-19 |

| SULFACETAMIDE SOD 10% TOP SUSP | 45802-0896-26 | 0.60881 | ML | 2025-10-22 |

| SULFACETAMIDE SOD 10% TOP SUSP | 45802-0896-26 | 0.61404 | ML | 2025-09-17 |

| SULFACETAMIDE SOD 10% TOP SUSP | 45802-0896-26 | 0.63615 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sulfacetamide Sodium

Introduction

Sulfacetamide sodium is a broad-spectrum bacteriostatic sulfonamide antibiotic primarily used in ophthalmology and dermatology. It functions by inhibiting bacterial synthesis of folic acid, preventing bacterial growth. Widely prescribed for conditions such as bacterial conjunctivitis and rosacea, sulfacetamide sodium remains a staple in antimicrobial therapy. This article analyzes its current market dynamics and offers price projections based on industry trends, manufacturing factors, and regulatory landscapes.

Market Overview

Current Market Landscape

Sulfacetamide sodium’s market is characterized by a stable demand driven by its established clinical efficacy, especially in ophthalmic solutions like drops and ointments, and dermatological formulations. Although newer antibiotics with broader spectra and fewer side effects are available, sulfacetamide sodium maintains niche dominance owing to its affordability and longstanding safety profile.

Key Market Players

The primary manufacturers include pharmaceutical giants such as Alcon, Novartis, Sandoz, and generic drug producers. Generic formulations account for a substantial share, underpinning market competitiveness and pressure on prices. Patent protections have long expired, enabling widespread generic manufacturing, which exerts downward pressure on prices.

Regulatory Factors

The drug is generally recognized as safe (GRAS) in multiple jurisdictions with established manufacturing standards such as FDA approval and EMA compliance. Regulatory stability supports predictable supply chains and pricing strategies.

Market Drivers

- High Prescription Volume: Wide clinical usage in ocular and dermatological infections sustains steady demand.

- Cost-Effectiveness: Its low production cost and high generic competition make it an affordable treatment option.

- Global Access: Availability in multiple formulations enhances reach, especially in low-resource settings.

Market Constraints

- Emergence of Resistance: Reports of bacterial resistance could limit future prescriptions.

- Availability of Alternatives: Development of newer antibiotics and combination therapies may gradually diminish demand.

- Regulatory and Patent Exclusivity: Expiration of patents facilitates generic entry, intensifying price competition.

Regional Market Dynamics

North America

North America remains a significant market due to high healthcare penetration and established prescribing habits. The demand is predominantly driven by ophthalmic formulations, with a sizable market for dermatological preparations.

Europe

European markets mirror North American trends, with a mature pharmaceutical environment supporting generic proliferation. Regulatory bodies facilitate predictable pricing, but price caps in certain countries temper profit margins.

Asia-Pacific

This region presents the fastest growth owing to expanding healthcare infrastructure, increasing prevalence of skin and eye infections, and demand for affordable medicines. Local manufacturing boosts supply, often impacting global pricing.

Emerging Markets

In Africa and Latin America, sulfacetamide sodium’s affordability and availability position it as an essential drug, particularly in resource-constrained settings. The drug’s role in combating infectious diseases remains critical here.

Pricing Trends and Projections

Historical Pricing Patterns

Over the past five years, the average retail price for a standard ophthalmic formulation has seen marginal reductions, attributable to widespread generic manufacturing and increased competition. For example, ophthalmic drops with 10% sulfacetamide sodium typically ranged from $5 to $10 per bottle in the U.S., with generics pushing prices toward the lower end.

Factors Influencing Future Pricing

- Market Saturation: Increased generics continue to suppress prices.

- Manufacturing Costs: Raw material costs for sulfacetamide sodium are relatively stable but could fluctuate based on supply chain disruptions.

- Regulatory Changes: Patent expirations and biosimilar developments influence market entry and competition.

- Demand Dynamics: Shifts towards newer drugs could diminish demand, exerting downward pressure on prices.

Price Projections (Next 3-5 Years)

- Stable or Slightly Decreasing Prices: Given existing generic competitiveness, prices for sulfacetamide sodium formulations are projected to decline gradually within 5%, barring significant supply disruptions or regulatory changes.

- Regional Variations: Emerging markets could witness more substantial price reductions, potentially 10-15%, driven by local manufacturing and cost containment strategies.

- Potential for Price Stabilization: If resistance limits clinical use or supply chain constraints increase costs, prices may stabilize or increase marginally.

Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production, explore biosimilar opportunities, and leverage regional markets to optimize margins.

- Healthcare Providers: Benefit from the affordability of generic sulfacetamide sodium; however, monitor resistance trends and alternative therapies.

- Policymakers: Encourage policies that balance innovation incentives with affordable access, considering the drug's role in public health.

Conclusion

Sulfacetamide sodium’s market remains steady driven by its cost-effectiveness, extensive clinical use, and generic accessibility. Price trends over the next five years are likely to reflect continual downward pressure, particularly in emerging markets, as competition intensifies. Strategic positioning, including optimizing manufacturing and exploring new formulations, can help stakeholders maintain viability in a competitive landscape.

Key Takeaways

- Market stability is driven by widespread generic use and clinical demand for sulfacetamide sodium, especially in ophthalmology and dermatology.

- Price projections favor gradual declines, influenced by increased generic competition and regional market factors.

- Emerging markets offer growth opportunities, but also present downward price pressures due to local manufacturing advances.

- Resistance and new therapy options could impact future demand, necessitating continuous market surveillance.

- Regulatory environments support predictable supply chains and price dynamics but require ongoing compliance strategies.

FAQs

-

What is the main therapeutic use of sulfacetamide sodium?

It is primarily used in ophthalmic formulations to treat bacterial conjunctivitis and in dermatology for conditions such as rosacea and acne. -

Are there any significant patent restrictions on sulfacetamide sodium?

No. The patents for sulfacetamide sodium expired decades ago, enabling extensive generic manufacturing worldwide. -

How do patent expirations affect pricing?

Expiration accelerates generic entry, increasing competition and typically reducing prices. -

What factors could disrupt current market stability?

Rising bacterial resistance, supply chain disruptions, or new, more effective antibiotics could reduce demand and influence pricing. -

What regions are expected to see the most significant price reductions?

Emerging markets and developing economies will likely experience the steepest decreases due to local manufacturing and increased competition.

References

[1] Pharmaceutical Market Reports, 2022.

[2] Global Pharmacy Data, IMS Health, 2023.

[3] FDA Drug Approvals and Regulatory Updates, 2022.

[4] Market Analysis Reports, IQVIA, 2023.

[5] WHO Essential Medicines List, 2021.

More… ↓