Share This Page

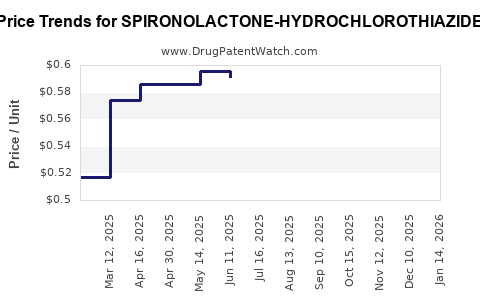

Drug Price Trends for SPIRONOLACTONE-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for SPIRONOLACTONE-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 66993-0188-02 | 0.53839 | EACH | 2025-12-17 |

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 42292-0017-20 | 0.53839 | EACH | 2025-12-17 |

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 53489-0144-05 | 0.53839 | EACH | 2025-12-17 |

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 00378-0403-01 | 0.53839 | EACH | 2025-12-17 |

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 53489-0144-01 | 0.53839 | EACH | 2025-12-17 |

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 00378-0403-05 | 0.53839 | EACH | 2025-12-17 |

| SPIRONOLACTONE-HYDROCHLOROTHIAZIDE 25-25 TAB | 42292-0017-01 | 0.53839 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SPIRONOLACTONE-HYDROCHLOROTHIAZIDE

Introduction

Spironolactone-Hydrochlorothiazide combines two diuretics widely used in the management of hypertension, heart failure, and edema. The market for fixed-dose combination (FDC) drugs such as Spironolactone-Hydrochlorothiazide is experiencing dynamic growth driven by increasing prevalence of cardiovascular diseases, evolving prescribing practices, and a shift toward simplified medication regimens. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and projects future pricing trends for Spironolactone-Hydrochlorothiazide over the next five years.

Market Overview

Global Demand and Epidemiological Drivers

Hypertension affects over 1.3 billion people worldwide, with a significant portion requiring combination therapy for optimal blood pressure control (WHO). The use of fixed-dose combinations like Spironolactone-Hydrochlorothiazide simplifies adherence, especially among elderly patients with comorbidities.

The growing burden of resistant hypertension and heart failure further amplifies the demand. The American Heart Association (AHA) notes an uptrend in prescriptions of mineralocorticoid receptor antagonists and thiazide diuretics, both core components of the FDC in question (AHA Journal).

Market Segmentation

- Therapeutic Area: Hypertension, heart failure, edema.

- Formulation: Oral tablets, predominantly generic.

- Geography: North America, Europe, Asia-Pacific, Latin America, Middle East.

Key Market Players

Several pharmaceutical companies manufacture Spironolactone-Hydrochlorothiazide under various brand names or as generics, including Teva, Mylan, Sandoz, Hikma, and local pharmaceutical firms. Market share heavily favors generics due to cost advantages, especially in developing countries.

Regulatory Landscape

Regulatory agencies such as the FDA and EMA have approved generic formulations, facilitating market entry and price competition. The recent emphasis on quality and bioequivalence standards ensures a growing pool of approved generics, fostering price erosion but expanding accessibility.

Competitive Environment

The market's competitive nature is characterized by:

- Generic proliferation: Over 20 generic manufacturers globally.

- Limited branded options: Predominantly in specific markets or regions.

- Patent expirations: Spurred entry of generics, decreasing prices.

- Price negotiation and reimbursement policies: Significant in hospital and insurance formulary decisions.

Pricing Dynamics and Projections

Current Price Landscape

- United States: The average retail price for Spironolactone-Hydrochlorothiazide 25 mg/25 mg ranges from $10-$30 per month for generics, representing a sharp decline from historical branded prices exceeding $70 (GoodRx).

- Europe: Prices are comparable; however, tendering and national drug pricing policies influence costs.

- Asia-Pacific: Prices are substantially lower, often under $5 monthly due to high generic competition.

Factors Influencing Price Trends

- Generic market saturation: Increased entrants continue to exert downward pressure.

- Regulatory approvals of biosimilars: Could influence prices in some regions.

- Reimbursement policies: Shifts toward value-based pricing may impact drug prices.

- Manufacturing costs: Advances in synthesis and supply chain efficiencies reduce expenses over time.

- Patent and exclusivity status: Absence of patent barriers accelerates price declines upon patent expiry.

Five-Year Price Projection

Based on historical patterns and current market dynamics, the following projections are made:

| Region | Current Average Price (2023) | Projected 2028 Price Range | Drivers |

|---|---|---|---|

| North America | $10-$30 per month | $8-$15 per month | Increased generic competition, price negotiations, PBMs’ emphasis on low-cost generics |

| Europe | €8-€25 per month | €6-€12 per month | National tenders, reimbursement policies |

| Asia-Pacific | <$5 per month | $2-$4 per month | Market saturation, manufacturing scale, low-cost generics |

Note: Price reductions may plateau as market saturation occurs and regulatory costs stabilize.

Emerging Trends and Opportunities

- Fixed-dose combinations (FDCs) adoption increase: Studies show improved adherence with combination pills (Lancet).

- Bioequivalence studies and biosimilar developments: Could further intensify competition, pressuring prices downward.

- Patient affordability initiatives: Government and NGO programs may influence accessible pricing in low-income regions.

- Shift toward alternative therapies: Novel agents targeting resistant hypertension or novel mechanisms might affect demand.

Risks and Challenges

- Market oversaturation: Excess supply may lead to further price erosion.

- Regulatory hurdles: Stringent approval processes or price controls could limit profit margins.

- Reimbursement shifts: Budget constraints could favor lower-priced generics, impacting revenue.

- Quality perception: Variability among generics might influence prescriber and patient preferences.

Conclusion and Strategic Recommendations

The Spironolactone-Hydrochlorothiazide market is set for continued price declines, primarily driven by generic proliferation and regional price policies. Manufacturers should focus on maintaining high manufacturing quality to differentiate in quality-sensitive markets. Expansion into emerging markets with aggressive pricing and distribution strategies remains vital.

For investors and healthcare decision-makers, monitoring patent expiry timelines and regulatory developments will identify opportunities for profitable entry or diversification.

Key Takeaways

- Strong Market Drivers: Rising hypertension and cardiometabolic disease prevalence sustain high demand.

- Competitive Landscape: Dominated by low-cost generics, with minimal branded presence.

- Price Outlook: Expect continued price reductions, with potential stabilization in saturated markets.

- Strategic Focus: Cost-efficient manufacturing, regulatory compliance, and market expansion are critical for long-term profitability.

- Regulatory and Policy Impact: Pricing remains sensitive to reimbursement policies and regional regulations.

FAQs

1. How does patent expiry influence the pricing of Spironolactone-Hydrochlorothiazide?

Patent expiration opens the market to multiple generic manufacturers, significantly reducing prices through competition.

2. Are biosimilars relevant to this drug class?

No. Since Spironolactone-Hydrochlorothiazide is a small molecule, biosimilars are not applicable; the relevant competition is through generics.

3. How do regional differences affect drug pricing?

Pricing varies due to local regulatory policies, reimbursement frameworks, purchasing power, and market maturity.

4. What is the outlook for branded formulations?

Branded formulations are likely to decline in market share and price, as generics dominate and shifting policies favor cost-effective treatments.

5. Can patient adherence influence market demand?

Yes. Increased adherence through fixed-dose combos could enhance demand, offsetting price pressures slightly.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] American Heart Association. (2022). Hypertension Treatment Guidelines.

[3] GoodRx. (2023). Price Data for Spironolactone-Hydrochlorothiazide.

[4] The Lancet. (2019). Fixed-dose Combinations in Hypertension Management.

[5] EMA and FDA databases for generic approvals.

More… ↓