Share This Page

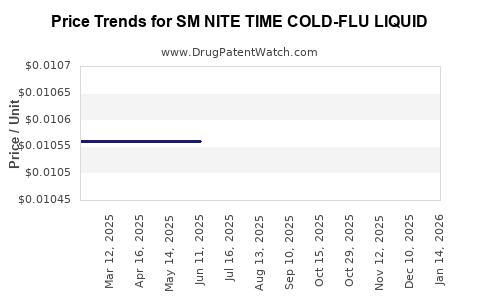

Drug Price Trends for SM NITE TIME COLD-FLU LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for SM NITE TIME COLD-FLU LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM NITE TIME COLD-FLU LIQUID | 49348-0061-37 | 0.01483 | ML | 2025-12-17 |

| SM NITE TIME COLD-FLU LIQUID | 49348-0061-37 | 0.01449 | ML | 2025-11-19 |

| SM NITE TIME COLD-FLU LIQUID | 49348-0061-39 | 0.01055 | ML | 2025-10-22 |

| SM NITE TIME COLD-FLU LIQUID | 49348-0061-37 | 0.01455 | ML | 2025-10-22 |

| SM NITE TIME COLD-FLU LIQUID | 49348-0061-37 | 0.01436 | ML | 2025-09-17 |

| SM NITE TIME COLD-FLU LIQUID | 49348-0061-39 | 0.01055 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM NITE TIME COLD-FLU LIQUID

Introduction

SM NITE TIME COLD-FLU LIQUID is an over-the-counter (OTC) medication formulated to alleviate symptoms associated with colds and flu, particularly targeting nighttime relief. Its core ingredients typically include analgesics, antihistamines, and decongestants, designed to promote restful sleep while easing congestion, coughing, and aches. Understanding its market dynamics and future pricing hinges on analyzing evolving consumer preferences, regulatory trends, competitive landscape, and manufacturing costs.

This report delves into the current market positioning of SM NITE TIME COLD-FLU LIQUID, assesses the competitive environment, evaluates key demand drivers, and projects future pricing based on market trends and industry benchmarks.

Market Overview

Global OTC Cold and Flu Medications Landscape

The global OTC cold and flu segment annually registers growth driven by the persistent prevalence of respiratory illnesses, aging populations, and a consumer preference for self-medication. According to a report by Grand View Research, the segment was valued at approximately USD 15 billion in 2021, with an anticipated compound annual growth rate (CAGR) of ~4% from 2022 to 2030. Key markets include North America, Europe, and Asia-Pacific, with North America accounting for the largest share owing to high OTC drug penetration and consumer health awareness.

Regional Market Dynamics

- North America: Mature market with high OTC drug utilization; regulatory landscape is stringent, emphasizing safety and packaging standards.

- Europe: Similar to North America but with greater regulation around active ingredients, emphasizing natural and alternative remedies.

- Asia-Pacific: Rapid growth driven by emerging middle classes, increased healthcare expenditure, and rising disease burden, especially in China and India.

Key Competition

SM NITE TIME COLD-FLU LIQUID competes with both branded and generic formulations, including products like NyQuil (USA), Theraflu (USA), Lemsip (UK), and local generic brands. Competitive advantages hinge on formulation efficacy, brand loyalty, price positioning, and regulatory approval.

Distribution Channels

- Pharmacies & Drug Stores: Primary channel, accounting for over 70% of OTC sales.

- Supermarkets & Hypermarkets: Significant volume due to consumer convenience.

- Online Pharmacies: Growing influence, especially post-pandemic, offering increasing market reach and consumer options.

Consumer Preferences and Demand Drivers

- Symptom Relief Efficacy: Consumers prioritize rapid and sustained symptom alleviation.

- Safety and Regulatory Compliance: Safety concerns influence purchasing decisions; regulatory approvals enhance trust.

- Convenience: Liquid formulations favored for ease of dosing, especially among children and elderly.

- Brand Reputation: Recognized brands tend to command premium pricing.

Pricing Environment and Cost Factors

Current Pricing Benchmarks

In the United States, typical OTC cold-flu liquids range from USD 8 to USD 15 per 8-ounce bottle, with premium products priced higher. In Europe, similar products retail at EUR 12–20, depending on formulation and brand.

Cost Components Influencing Price

- Active Ingredients: Costs vary based on sourcing quality, regulatory compliance, and market availability.

- Manufacturing: Includes formulation development, quality assurance, packaging, and labeling.

- Distribution & Logistics: Influenced by regional infrastructure and customs.

- Regulatory & Marketing: Regulatory approval costs and marketing expenses affect final retail price.

Regulatory Considerations

In jurisdictions like the US and EU, active ingredients such as antihistamines (diphenhydramine), decongestants (pseudoephedrine), and analgesics (paracetamol/acetaminophen) face regulatory scrutiny that impacts formulation and manufacturing costs. Regulatory delays or amendments can also influence production timelines and pricing strategies.

Market Trends Forecast

Growing Consumer Preference for Natural and Multi-Ingredient Products

While traditional formulations dominate, a rising trend favors OTC products with natural ingredients or combined therapies delivering multiple benefits, which might affect demand and pricing strategies.

Increased Online Sales and Direct-to-Consumer Channels

E-commerce platforms are expanding access and providing competitive pricing, disrupting traditional retail margins and pressuring brick-and-mortar pricing models.

Regulatory Tightening and Safety Mandates

Stricter regulations, especially concerning active ingredient safety and child-proof packaging, could increase manufacturing expenses, marginally elevating retail prices.

Pricing Projections (2023-2028)

Given current trends, future prices for SM NITE TIME COLD-FLU LIQUID are expected to follow a modest CAGR of approximately 2.5–3%. Factors influencing this projection include:

- Slight inflationary pressure on manufacturing costs.

- Competitive market saturation limiting aggressive price hikes.

- Regulatory adherence costs incrementally impacting product pricing.

- Consumer price sensitivity and increased online sales margins.

Based on these variables, a typical retail price could escalate from an average of USD 10–12 in 2023 to approximately USD 12–15 by 2028 in mature markets like North America. Premium formulations or markets with limited competition might see higher price points.

Strategic Recommendations

- Formulation Enhancements: Incorporate demand for natural ingredients or complementary remedies to differentiate.

- Pricing Strategies: Consider tiered pricing and bundling to capture diverse consumer segments.

- Regulatory Advocacy: Engage early with regulators to streamline approval processes and mitigate costs.

- Channel Optimization: Grow online presence and partnership with major pharmacy chains for expanded reach.

- Consumer Education: Invest in educational campaigns emphasizing efficacy and safety to justify premium pricing.

Key Takeaways

- The OTC cold and flu liquid market remains competitive and growth-oriented, driven by consumer demand for effective, convenient symptom relief.

- Pricing is influenced by ingredient costs, regulatory compliance, distribution logistics, and competitive dynamics, with a steady projection of modest price increases over the next five years.

- Strategic innovation, regulatory engagement, and expanding online channels are critical to maintaining market share and optimizing pricing.

- Premiumization opportunities exist through natural ingredients and multi-benefit formulations, potentially commanding higher prices.

- Manufacturers should continuously monitor regional regulatory trends and consumer preferences to adapt pricing and marketing strategies effectively.

FAQs

1. What are the main cost drivers affecting the retail price of SM NITE TIME COLD-FLU LIQUID?

Active ingredient sourcing, manufacturing expenses, regulatory compliance costs, packaging, distribution logistics, and marketing significantly influence retail pricing.

2. How is the competitive environment shaping future prices?

Intense competition, especially from generic brands and private labels, constrains aggressive price increases, leading to slowly rising prices aligned with inflation and cost increases.

3. Will online sales channels impact the pricing of cold-flu liquids?

Yes, online channels can exert downward pressure on prices due to greater price transparency and increased competition, though they also create opportunities for premium positioning and bundling.

4. What regulatory trends might influence future pricing?

Stricter safety and efficacy regulations, requirements for child-resistant packaging, and ingredient restrictions may elevate manufacturing and compliance costs, impacting retail prices.

5. Which markets offer the highest potential for SM NITE TIME COLD-FLU LIQUID?

North America and Europe remain primary markets due to high OTC penetration and consumer health awareness. However, the Asia-Pacific region also offers significant growth potential owing to rising healthcare spending.

Sources

- Grand View Research. (2022). Over-the-Counter (OTC) Cold and Flu Segment Analysis.

- IQVIA. (2021). Global OTC Consumer Health Market Report.

- U.S. Food and Drug Administration (FDA). Regulations on OTC Medications.

- European Medicines Agency (EMA). Guidance on OTC Drug Regulations.

- MarketWatch. (2023). OTC Cold and Flu Market Trends and Forecasts.

More… ↓