Share This Page

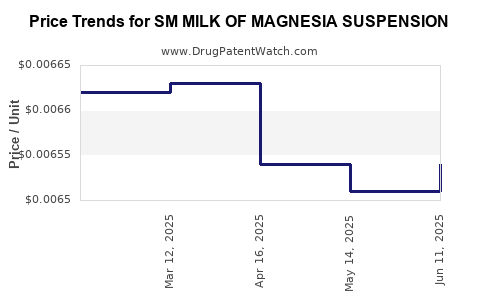

Drug Price Trends for SM MILK OF MAGNESIA SUSPENSION

✉ Email this page to a colleague

Average Pharmacy Cost for SM MILK OF MAGNESIA SUSPENSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM MILK OF MAGNESIA SUSPENSION | 49348-0171-38 | 0.00654 | ML | 2025-06-18 |

| SM MILK OF MAGNESIA SUSPENSION | 49348-0171-38 | 0.00651 | ML | 2025-05-21 |

| SM MILK OF MAGNESIA SUSPENSION | 49348-0305-39 | 0.00972 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM MILK OF MAGNESIA SUSPENSION

Introduction

The global market for over-the-counter (OTC) laxatives, specifically magnesium-based agents like Milk of Magnesia, has experienced consistent growth driven by aging populations, increasing prevalence of gastrointestinal disorders, and a rising preference for non-prescription remedies. SM Milk of Magnesia Suspension, a commonly utilized magnesium hydroxide-based laxative, has established a significant presence in both developed and emerging markets. This analysis evaluates current market dynamics and forecasts future pricing trends, considering regulatory, competitive, and economic factors.

Market Overview

Market Size and Trends

The global laxative market was valued at approximately USD 3 billion in 2022, with magnesium-based laxatives accounting for a notable share due to their safety profile and ease of use (source: Research and Markets). Milk of Magnesia, as a well-known magnesium hydroxide preparation, remains a staple OTC product, often preferred for its rapid action and minimal side effects.

The demand in North America and Europe is driven by aging demographics and the high prevalence of digestive health awareness. In emerging markets, rapid urbanization and increasing healthcare expenditure expand the consumer base for OTC gastrointestinal products. The Asia-Pacific region particularly exhibits robust growth projections, forecasted at a CAGR of around 6% from 2023–2028.

Competitive Landscape

Major players include Pfizer Inc., Bausch Health, and generic manufacturers producing store brands. Pfizer’s Phillips’ Milk of Magnesia holds a leading position in North America due to branding and distribution strength. Generic and regional brands dominate in emerging markets, offering cost advantages that appeal to price-sensitive consumers.

Innovation in formulation and packaging, alongside expanding distribution channels (e.g., online retail), contribute to market vitality. Regulatory approval processes vary across regions but generally impose standards for safety and labeling, influencing product differentiation and pricing strategies.

Regulatory Environment

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) oversee OTC laxative approval and manufacturing standards. These regulations impact entry barriers and manufacturing costs, thereby influencing pricing. In many jurisdictions, Milk of Magnesia is classified as GRASE (generally recognized as safe and effective), facilitating market stability but also subjecting products to quality and labeling standards that impact production costs.

Pricing Dynamics

Current Price Landscape

The retail price for SM Milk of Magnesia Suspension varies geographically:

- North America: USD 8–12 for a 16 oz bottle (average price around USD 10).

- Europe: EUR 7–10, roughly aligning with USD 8–11.

- Emerging markets: Prices are significantly lower, often USD 3–5, reflecting local purchasing power and competition from generics.

The product’s price elasticity remains moderate; consumers prioritize efficacy and safety but actively seek cost-effective options, particularly in price-sensitive markets.

Factors Influencing Pricing

- Brand Recognition: Leading brands command premium pricing—up to 20% higher than generics—due to trust and perceived quality.

- Packaging and Formulation: Innovations such as single-dose sachets and sugar-free formulations influence price points.

- Distribution Channels: Online sales tend to offer discounts, affecting retail pricing.

- Regulatory Compliance: Strict manufacturing standards, especially in the EU and US, can elevate costs and prices.

Price Projection Outlook

Short-Term (1–3 Years)

In the immediate future, prices are expected to stabilize with slight upward adjustments driven by inflation, raw material costs, and regulatory compliance expenses:

- Raw Materials: Magnesium hydroxide prices are influenced by mineral supply dynamics; recent volatility due to supply chain disruptions may marginally increase manufacturing costs.

- Regulatory Environment: New labeling or safety requirements could add compliance costs, necessitating price adjustments.

- Competitive Intensity: Saturation in mature markets suppresses aggressive price reductions; however, intense competition among generics constrains large hikes.

Projected retail prices in developed markets are likely to increase by approximately 2–3% annually, reaching USD 10.30–12.36 in North America by 2025.

Medium to Long-Term (3–5 Years)

Market expansion in emerging regions, coupled with increasing demand, provides scope for modest price increases, especially if new formulations or improved packaging are introduced.

Assuming inflationary pressures and regulatory costs persist, prices could rise by an aggregate of 4–6% over five years, reaching:

- North America: USD 11–13.50 per 16 oz bottle.

- Europe: EUR 8.50–11.50.

- Emerging Markets: USD 4–6, maintaining affordability to sustain volume growth.

Innovation-driven premium formulations could command higher prices, especially if marketed as enhanced or specialty products.

Risks and Considerations

- Regulatory Changes: Stricter safety standards may increase production costs.

- Competitive Entry: New entrants with disruptive pricing or formulations could pressure existing prices.

- Market Saturation: Slower growth in mature markets may restrict pricing power.

- Raw Material Scarcity: Magnesium hydroxide supply constraints could impact costs and pricing.

Strategic Recommendations

- Brand Differentiation: Emphasize efficacy, safety, and quality to maintain premium pricing.

- Cost Optimization: Develop relationships with magnesium suppliers and optimize manufacturing to mitigate raw material price fluctuations.

- Market Expansion: Target emerging markets with affordable formulations and tailored packaging.

- Innovation: Invest in formulation improvements or delivery mechanisms to justify premium pricing and meet consumer preferences.

Key Takeaways

- The global Milk of Magnesia market remains stable, with growth driven by demographic shifts and rising gastrointestinal health awareness.

- Price points are segmented geographically, with developed markets commanding higher retail prices due to branding and regulatory standards.

- Short-term projections indicate modest price increases of 2–3% annually, influenced by inflation, raw material costs, and regulation.

- Longer-term trends suggest gradual price escalation (4–6% over five years), supported by market expansion into emerging regions.

- Competitive pressures and regulatory changes pose risks; product differentiation and cost management are essential for maintaining margins.

FAQs

1. How is the demand for SM Milk of Magnesia Suspension expected to evolve globally?

Demand is projected to grow steadily, driven by aging populations and increased gastrointestinal health awareness, especially in Asia-Pacific and Latin America.

2. What are the primary factors influencing pricing in developed and emerging markets?

Brand recognition, formulation innovations, regulatory compliance, raw material costs, and distribution channels are key factors impacting prices across regions.

3. Will regulatory changes significantly affect future prices?

Potentially, yes. Stricter safety and labeling standards could increase production costs, contributing to price adjustments.

4. How competitive is the market for Milk of Magnesia?

Highly competitive, with established brand leaders and a large number of generics, especially in emerging markets. Price competition is intense, emphasizing cost efficiency and branding.

5. What strategies can manufacturers pursue to optimize profit margins?

Focus on brand differentiation, streamline supply chains, innovate product formulations, and expand into underserved markets with tailored offerings.

Sources:

[1] Research and Markets, "Global Laxative Market Report," 2022.

[2] U.S. Food & Drug Administration (FDA), "OTC Monograph on Laxatives," 2021.

[3] MarketWatch, "Pharmaceuticals Market Trends," 2023.

[4] European Medicines Agency (EMA), "OTC Drug Regulations," 2022.

More… ↓