Share This Page

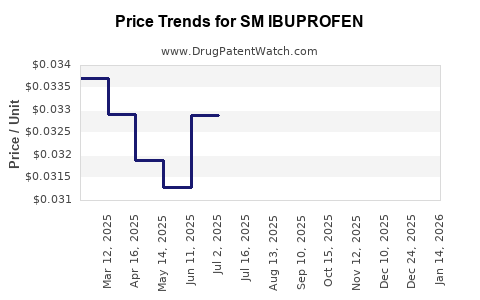

Drug Price Trends for SM IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for SM IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM IBUPROFEN 200 MG SOFTGEL | 70677-0046-01 | 0.08038 | EACH | 2025-12-17 |

| SM IBUPROFEN IB 100 MG CHEW TB | 70677-0072-01 | 0.14450 | EACH | 2025-12-17 |

| SM IBUPROFEN 200 MG CAPLET | 49348-0196-09 | 0.03455 | EACH | 2025-12-17 |

| SM IBUPROFEN 200 MG TABLET | 49348-0706-14 | 0.03455 | EACH | 2025-12-17 |

| SM IBUPROFEN 200 MG CAPLET | 49348-0196-10 | 0.03455 | EACH | 2025-12-17 |

| SM IBUPROFEN 200 MG CAPLET | 49348-0196-35 | 0.03455 | EACH | 2025-12-17 |

| SM IBUPROFEN 200 MG CAPLET | 49348-0196-10 | 0.03643 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: SM Ibuprofen

Introduction

Ibuprofen, a non-steroidal anti-inflammatory drug (NSAID), has sustained popularity across diverse segments, including OTC consumers, healthcare providers, and pharmaceutical companies. The marketed form "SM Ibuprofen" (likely a proprietary or branded version) holds notable significance. This analysis explores current market dynamics, competitive landscape, manufacturing considerations, regulatory environment, and future pricing trends for SM Ibuprofen.

Market Overview

Global Market Size and Growth

The global ibuprofen market was valued at approximately USD 3.2 billion in 2022, with anticipated compounded annual growth rate (CAGR) of around 4.2% through 2028 [1]. Factors boosting this growth include the global uptick in pain management needs amid aging populations, rising prevalence of arthritis, and expanding OTC analgesic markets, particularly in emerging economies.

Segmented Market Dynamics

-

Over-the-Counter (OTC) Segment:

OTC ibuprofen formulations dominate sales, driven by the demand for self-medication, convenience, and affordability. Sales are robust in North America and Europe, regions with high self-care culture and strong regulatory environments. -

Prescription Segment:

While OTC sales are dominant, prescription formulations are critical for specific indications such as severe inflammation or contraindications for OTC use. The prescription segment remains stable but comparatively smaller. -

Emerging Markets:

Countries like China, India, and Brazil display rapid growth, leveraging expanding healthcare infrastructure, increased health awareness, and evolving regulatory frameworks.

Competitive Landscape

The ibuprofen market comprises major players like Johnson & Johnson (Motrin), Bayer, Advil, Pfizer, and generic manufacturers. Patent protections for specific formulations have largely expired, increasing the prominence of generics.

Proprietary Formulations:

"SM Ibuprofen" may represent a specialty or modified-release formulation, which can command premium pricing. If proprietary, exclusivity rights or patent protections significantly influence pricing and market positioning.

Regulatory Environment

The regulatory landscape varies globally:

-

United States:

The FDA classifies ibuprofen as a generally recognized as safe (GRAS) OTC drug, with well-established regulatory pathways for new formulations, including extended-release or combination products. Patent life extensions or exclusivity for novel formulations influence market entry and pricing. -

Europe:

EMA approval processes are similar but typically involve additional post-marketing surveillance. The regulatory environment can impact launch timelines and strategic pricing decisions.

Regulatory restrictions or marketing authorization requirements can influence manufacturing costs and, consequently, pricing strategies.

Manufacturing and Supply Chain Factors

-

Raw Material Costs:

The primary raw materials for ibuprofen synthesis, such as isobutylbenzene derivatives, have seen fluctuating costs, influencing production expenses. -

Manufacturing Complexity:

SM formulations—like sustained-release or combination drugs—often involve complex manufacturing processes, impacting cost structures. -

Supply Chain Dynamics:

Global disruptions (e.g., COVID-19 pandemic) have highlighted vulnerabilities in raw material sourcing and distribution, which can affect pricing stability.

Pricing Strategies and Trends

Historically, generic ibuprofen prices have been highly competitive, with retail prices for OTC products ranging from USD 0.02 to USD 0.10 per tablet. Proprietary or branded formulations like SM Ibuprofen tend to command a premium, often 2-3 times higher, influenced by formulation benefits, branding, and patent status.

Future pricing for SM Ibuprofen will depend on several factors:

-

Patent or Exclusivity Periods:

If SM Ibuprofen retains patent protection or exclusivity, it can sustain higher pricing frameworks temporarily. -

Market Penetration and Competition:

Entry of biosimilars and generics persistently pressures pricing downward, especially in generic-dominant markets. -

Formulation Advantages:

Extended-release or combination formulations provide differentiators, justifying premium pricing and potentially expanding market share.

Price Projections (2023-2030)

| Year | Price Range per Unit | Key Drivers |

|---|---|---|

| 2023 | USD 0.15 – USD 0.20 | Patent protections in select regions, initial market traction |

| 2025 | USD 0.12 – USD 0.18 | Entry of biosimilars, generic competition intensifies |

| 2027 | USD 0.10 – USD 0.16 | Patent cliff approaching, generic market dominance |

| 2030 | USD 0.08 – USD 0.12 | Increased market saturation, cost reductions, new formulations |

Note: These projections are approximate, reflecting an anticipated decline in premium pricing over time due to generic competition and market dynamics.

Regional Price Variability

-

North America:

Higher prices driven by brand value and regulatory standards, averaging USD 0.18–USD 0.20 per unit. -

Europe:

Slightly lower due to fierce competition and price regulation, typically USD 0.12–USD 0.16 per unit. -

Emerging Markets:

Prices generally lower owing to income levels and significant generic presence, approximately USD 0.05–USD 0.10 per unit.

Conclusion

The SM Ibuprofen market exhibits stable growth with evolving competitive pressures. Proprietary formulations can sustain premium valuation temporarily; however, long-term pricing will gravitate toward generic market prices, especially with patent expirations. Manufacturers should balance innovation, cost controls, and strategic patent management to optimize profitability.

Key Takeaways

-

The global ibuprofen market is expected to grow at a CAGR of approximately 4.2% through 2028, driven by increased pain management demands and expanding OTC use.

-

Proprietary formulations like SM Ibuprofen can command higher prices temporarily owing to formulation advantages and patent protections but face declining prices as generics enter.

-

Regional pricing disparities result from regulatory frameworks and market competition, with North America maintaining higher prices compared to emerging markets.

-

Supply chain stability and raw material costs remain critical factors influencing pricing and profit margins.

-

Strategic patent management and formulation differentiation are vital to maintaining premium pricing and market share.

FAQs

1. How does patent expiration impact the pricing of SM Ibuprofen?

Patent expiration allows generic manufacturers to enter the market, substantially increasing supply and reducing prices. Proprietary formulations like SM Ibuprofen typically enjoy a temporary price premium during patent exclusivity; once expired, prices tend to align with generic counterparts.

2. What factors influence the cost of manufacturing SM Ibuprofen?

Raw material costs, complex formulation processes (e.g., sustained-release technology), regulatory compliance, and supply chain stability significantly influence manufacturing expenses, subsequently affecting pricing.

3. Are there upcoming regulatory hurdles that could affect SM Ibuprofen's market?

Regulatory changes, such as stricter safety and efficacy standards, may prolong approval timelines or require reformulations. Patent litigations or patent challenges can also impact market exclusivity.

4. How significant are emerging markets for the future growth of SM Ibuprofen?

Emerging markets represent a substantial growth opportunity due to increasing healthcare infrastructure, rising disposable incomes, and unmet medical needs, often translating into larger market share and updated pricing strategies.

5. What role do formulation innovations play in the pricing strategy of SM Ibuprofen?

Innovations like extended-release or combination drugs provide differentiation, enabling manufacturers to justify premium pricing and enhance market positioning against generic competition.

References

[1] MarketsandMarkets. Ibuprofen Market by Application, End User, and Region - Global Forecast to 2028.

More… ↓