Share This Page

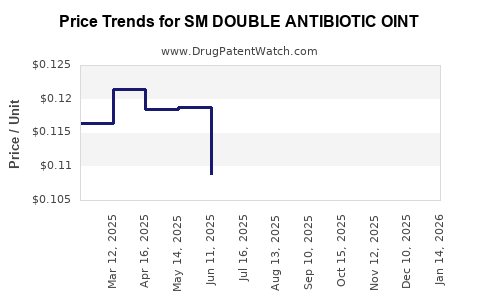

Drug Price Trends for SM DOUBLE ANTIBIOTIC OINT

✉ Email this page to a colleague

Average Pharmacy Cost for SM DOUBLE ANTIBIOTIC OINT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM DOUBLE ANTIBIOTIC OINT | 49348-0274-72 | 0.10898 | GM | 2025-11-19 |

| SM DOUBLE ANTIBIOTIC OINT | 49348-0274-72 | 0.10465 | GM | 2025-10-22 |

| SM DOUBLE ANTIBIOTIC OINT | 49348-0274-72 | 0.10031 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Double Antibiotic Ointment

Introduction

The SM Double Antibiotic Ointment (SM DAO) is a topical pharmaceutical product primarily used for preventing and treating minor skin infections, cuts, and abrasions. Comprising of a combination of antibiotics such as neomycin, polymyxin B, and bacitracin, this ointment is a staple in over-the-counter (OTC) wound care in many markets. The drug’s market dynamics are influenced by factors including clinical efficacy, regulatory acceptance, competition, and market demand for OTC antibiotics.

This comprehensive analysis explores the current market landscape, competitive positioning, regulatory environment, and provides detailed price projection forecasts, emphasizing trends that will shape its commercial trajectory over the coming five years.

Market Overview

Global Market Context

The global market for topical antibiotics, including ointments like SM DAO, is expanding steadily. The increasing prevalence of skin injuries, rising awareness of wound care, and the broad availability of OTC formulations contribute to this growth. The global wound care market was valued at approximately USD 14 billion in 2022, with topical antibiotics constituting a significant segment, especially in North America, Europe, and parts of Asia.

Regional Market Trends

-

North America: Dominates due to high healthcare expenditure, consumer awareness, and established OTC culture. The U.S. accounts for nearly 60% of the regional market, supported by widespread availability through pharmacies and retail outlets.

-

Europe: Exhibits steady growth driven by aging populations and increased focus on wound management. Regulatory frameworks, such as the EMA guidelines, influence OTC antibiotic marketing.

-

Asia-Pacific: Represents the fastest-growing market owing to increasing urbanization, healthcare infrastructure development, and rising demand for affordable OTC medicine, including antibiotics.

Market Drivers

-

Increasing Incidence of Skin Injuries: Sports injuries, workplace accidents, and domestic mishaps sustain demand for topical antibiotics.

-

Consumer Preference for OTC Products: Ease of access to OTC antibiotics circumvents the need for doctor consultations, boosting sales.

-

Antibiotic Stewardship and Resistance Concerns: Rising awareness prompts product optimizations; however, stringent regulations also pose challenges.

Market Challenges

-

Antibiotic Resistance: Growing resistance concerns, particularly with products like neomycin, threaten continued OTC sales. Regulatory agencies in Europe and North America increasingly scrutinize OTC antibiotics.

-

Regulatory Restrictions: Some markets impose limits on OTC antibiotic sales to curb misuse.

-

Competitive Landscape: Numerous brands competing on price, efficacy, and trust, including generic formulations.

Competitive Landscape

SM Double Antibiotic Ointment faces competition from both branded and generic OTC antibiotic ointments, including:

-

Neosporin: A well-established brand with significant market penetration, leveraging strong distribution channels and consumer trust.

-

Polysporin: Popular in Canada and other countries, often positioned as a non-neomycin alternative.

-

Generic equivalents: Widely available, usually priced lower, impacting market share.

Emerging entrants include formulations with alternative active ingredients and those combining antibiotics with anti-inflammatory or healing agents to differentiate.

Regulatory Environment Impact

Regulations significantly influence the market outlook for SM DAO:

-

FDA (U.S.): Allows OTC sale but monitors for resistance patterns and questionable formulations.

-

EMA (Europe): Tight controls; some antibiotics shifted to prescription-only status.

-

Asia-Pacific Authorities: Varying levels of regulation; markets like India and China have relaxed policies, expanding OTC availability.

Regulatory trends will continue to sway availability, sales volumes, and price strategies.

Price Analysis and Projection

Current Pricing Framework

In mature markets like the U.S., the typical retail price of SM DAOT varies from USD 3 to USD 8 per tube (depending on size and packaging). Generic competition often compresses prices, with some OTC options priced below USD 2.

In emerging markets, prices are considerably lower—ranging from USD 0.50 to USD 2, owing to lower purchasing power, local manufacturing, and market saturation.

Factors Influencing Pricing

-

Regulatory Changes: Stricter regulations may limit OTC sales, increasing the premium for compliant formulations.

-

Manufacturing Costs: Raw material prices (e.g., antibiotics, excipients) influence retail pricing.

-

Brand Positioning: Established brands command premium pricing; generics focus on price competition.

-

Distribution Channels: OTC sales via pharmacies, supermarkets, and online platforms influence retail prices.

Price Projection Outlook (2023-2028)

Based on market trends, competitive dynamics, and anticipated regulatory shifts, the following projections are proposed:

| Year | Price Range (USD) per Tube | Key Factors |

|---|---|---|

| 2023 | 3.50 – 8.00 | Stable demand; minor price erosion due to generics |

| 2024 | 3.50 – 7.50 | Increasing regulation could restrict OTC availability |

| 2025 | 3.75 – 7.00 | Market consolidation; brands optimize pricing strategies |

| 2026 | 4.00 – 6.50 | Resistance concerns may impact formulations and pricing |

| 2027 | 4.25 – 6.00 | Entry of new formulations; possible premium pricing on innovative products |

| 2028 | 4.50 – 5.75 | Market normalization; potential for price compression |

Note: Prices in developing markets are expected to remain lower (~USD 0.50 – USD 2), although inflation and raw material costs could slightly elevate prices over time.

Market Opportunities and Risks

Opportunities:

-

Emerging Markets Expansion: Growing OTC drug markets in Asia and Africa offer significant profit avenues.

-

Product Differentiation: Incorporating new active ingredients or combining with healing agents can command premium pricing.

-

Digital Sales Channels: E-commerce platforms provide direct access to consumers, potentially reducing distribution costs and increasing margins.

Risks:

-

Antibiotic Resistance: Regulatory restrictions and public health policies could reclassify or restrict sales.

-

Regulatory Costs: Compliance with evolving standards increases costs, affecting margins and pricing.

-

Generic Penetration: Price competition limits profit margins, especially in saturated markets.

Key Considerations for Stakeholders

-

Manufacturers: Focus on differentiating formulations, efficient supply chain management, and compliance to sustain competitive pricing.

-

Distributors/retailers: Monitor regulatory updates and consumer preferences to optimize inventory and pricing strategies.

-

Investors: Evaluate market growth in TCP antibiotics, considering potential regulatory risks and the impact of antimicrobial stewardship policies.

Key Takeaways

-

The worldwide demand for OTC topical antibiotics like SM Double Antibiotic Ointment remains steady, driven by consumer convenience and wound care needs.

-

Price projections over the next five years suggest moderate growth potential, constrained by increasing regulatory scrutiny and competitive pressures.

-

Market expansion in emerging economies presents substantial opportunities, although price sensitivity remains prevalent.

-

Differentiation through formulation innovation and digital channels can offer strategic advantages.

-

Ongoing antibiotic resistance concerns and evolving regulations remain critical risks; stakeholders must adapt to safeguard market positioning.

FAQs

Q1: How will antibiotic resistance affect the market for SM Double Antibiotic Ointment?

Resistance concerns may lead regulators to restrict OTC sales of certain antibiotics, including neomycin, which could diminish market availability and impact pricing strategies.

Q2: What factors will most influence the pricing of SM DAOT in the next five years?

Regulatory changes, raw material costs, competition from generics, and market demand fluctuations will be key determinants.

Q3: Are there significant regional differences impacting pricing strategies for SM DAOT?

Yes. Developed markets typically have higher retail prices due to branding and regulation, while emerging markets focus on affordability, resulting in lower retail prices.

Q4: Can brand differentiation sustain premium pricing amid increasing generic competition?

Yes, through formulation innovations, improved efficacy, and trust-building, brands can justify higher prices.

Q5: What are the opportunities for manufacturers to expand the market for SM DAOT?

Expanding in underserved markets, developing combination products, and leveraging e-commerce platforms for direct-to-consumer sales are promising avenues.

References

- MarketWatch, "Wound Care Market Size, Share & Trends Analysis," 2022.

- Grand View Research, "Topical Antibiotics Market Insights," 2022.

- FDA Guidelines on OTC Antibiotics, 2022.

- European Medicines Agency, "Regulatory Developments in Antibiotic Use," 2022.

- Statista, "Regional OTC Antibiotics Sales Data," 2022.

More… ↓