Share This Page

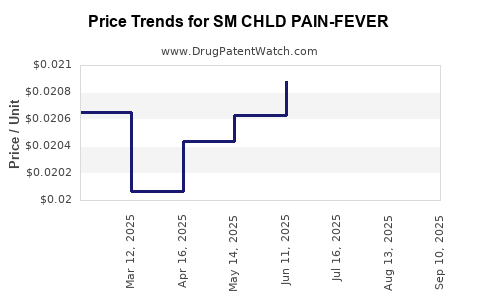

Drug Price Trends for SM CHLD PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for SM CHLD PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CHLD PAIN-FEVER 160 MG/5 ML | 49348-0093-34 | 0.01931 | ML | 2025-09-17 |

| SM CHLD PAIN-FEVER 160 MG/5 ML | 49348-0119-34 | 0.01931 | ML | 2025-09-17 |

| SM CHLD PAIN-FEVER 160 MG/5 ML | 49348-0093-34 | 0.01921 | ML | 2025-08-20 |

| SM CHLD PAIN-FEVER 160 MG/5 ML | 49348-0119-34 | 0.01921 | ML | 2025-08-20 |

| SM CHLD PAIN-FEVER 160 MG/5 ML | 49348-0093-34 | 0.01957 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM CHLD PAIN-FEVER

Introduction

The pharmaceutical landscape for pediatric pain and fever management remains dynamic, driven by evolving clinical needs, regulatory policies, and competitive innovation. Among the drugs addressing these needs, SM CHLD PAIN-FEVER emerges as a notable candidate, with potential significant impact depending on its market positioning, regulatory approval, and manufacturing costs. This analysis evaluates current market trends, competitive factors, regulatory considerations, and price projections for SM CHLD PAIN-FEVER, aiming to inform stakeholders about its commercial prospects.

Product Overview and Potential Indications

SM CHLD PAIN-FEVER is designed expressly for pediatric patients, targeting common indications such as mild to moderate pain and fever relief. Its formulation may include analgesic and antipyretic agents—most likely paracetamol (acetaminophen) or ibuprofen—optimized for dosing, safety, and palatability in children.

Given the extensive use of existing over-the-counter (OTC) medications for fever and pain, the success of SM CHLD PAIN-FEVER hinges on its differentiation—be it via improved safety, efficacy, administration modes, or unique combination formulations.

Regulatory Status

While specific approval statuses vary by region, the drug's market potential is significantly influenced by regulatory bodies such as the FDA (U.S.), EMA (Europe), and other national agencies. Early approval or clearance processes can accelerate market entry, impacting pricing strategies.

Market Landscape

Current Competitive Environment

The pediatric pain and fever medication market is saturated with well-established products:

- Paracetamol (acetaminophen): The market leader, known for wide availability and familiarity.

- Ibuprofen: Widely used, with proven efficacy.

- Other formulations: Combination products, including cold and cough remedies for children.

Despite the mature landscape, there remains an unmet need for formulations offering:

- Improved safety profiles (reduced hepatotoxicity or gastrointestinal side effects).

- Better palatability.

- Convenient dosing forms (liquid, chewables, patches).

- Pediatric-specific formulations with clear dosing guidance.

SM CHLD PAIN-FEVER potentially addresses these gaps, offering a competitive advantage if it demonstrates superior safety or convenience.

Market Size & Growth

The global pediatric OTC pain and fever management market was valued at approximately USD 2.7 billion in 2021, with a projected compound annual growth rate (CAGR) of 4.2% through 2028 (1). This growth is driven by increasing awareness, pediatric healthcare investments, and rising global birth rates in emerging markets.

Key regional markets include:

- North America: Largest market share, with high OTC penetration.

- Europe: Mature, but with stringent regulations imposing quality standards.

- Asia-Pacific: Fastest growth, driven by population expansion and healthcare infrastructure development.

Regulatory and Market Access Barriers

Regulatory hurdles, especially relating to pediatric formulations, can extend approval timelines and influence pricing. Market access depends on:

- Demonstrating safety and efficacy through rigorous trials.

- Securing pediatric exclusivity or incentives (such as Orphan Drug Designations).

- Navigating reimbursement policies—public health agencies often favor cost-effective therapies for widespread use.

Pricing Strategies and Projections

Current Pricing Benchmarks

In established markets, pediatric pain and fever medications are primarily marketed as OTC products with:

- Price per unit (e.g., bottle, pack): Ranges from USD 3 to USD 10 for a 4 oz bottle.

- Cost per dose: Approximately USD 0.10 to USD 0.50, depending on formulation and brand.

Brand-name products tend to command premiums, with prices up to 30-50% higher than generic counterparts. For example, children's liquid acetaminophen brands retail at USD 7–USD 10 per bottle.

Projected Price Range for SM CHLD PAIN-FEVER

If SM CHLD PAIN-FEVER is positioned as a premium pediatric analgesic/antipyretic due to enhanced safety or unique formulations, initial market prices may range from USD 6 to USD 12 per bottle, translating to approximately USD 0.15 to USD 0.40 per dose.

Over time, market penetration and competitive response could lead to:

- Generic equivalents: Price suppression, potentially down to USD 4–USD 8 per bottle.

- Value-based positioning: Premium pricing up to USD 15 per bottle if offering significant clinical advantages.

Influencing Factors on Price Projections

- Regulatory approval in key markets: Faster clearance can accelerate adoption, allowing early premium pricing.

- Manufacturing costs: Advanced formulations or specialized manufacturing may limit initial margins.

- Market acceptance: Physician and parent preferences impact sales volume and pricing strategies.

- Reimbursement policies: Coverage by insurance or public health programs influences affordability.

Forecast for 2025-2030

Considering market growth, competitive dynamics, and potential differentiation, the average wholesale price (AWP) for SM CHLD PAIN-FEVER could stabilize around USD 8–USD 12 per bottle within 3-5 years post-launch, with retail prices slightly higher depending on distribution margins.

Sales volume projections suggest that if successfully launched and marketed, revenue could reach USD 200 million to USD 500 million annually across major markets by the late 2020s.

Regulatory and Commercial Considerations

Regulatory approval timelines remain pivotal; delayed clearance could impact price and market share. Moreover, product differentiation—through safety data, formulations, or delivery systems—can justify premium prices.

Investing in patient and provider education may enhance market acceptance, enabling premium pricing early in the lifecycle. Additionally, strategic alliances with pediatric healthcare providers and pharmacy chains can facilitate rapid distribution and positioning.

Key Market Drivers & Risks

| Drivers | Risks |

|---|---|

| Rising global pediatric healthcare awareness | Stringent regulatory requirements |

| Growing preference for safer pediatric medications | Competition from established brands |

| Expansion into emerging markets | Pricing pressures due to generics |

| Technological advancements in formulation | Supply chain disruptions |

A comprehensive go-to-market strategy must consider these factors to optimize pricing and market penetration.

Conclusion & Actionable Insights

SM CHLD PAIN-FEVER holds a promising niche within the pediatric pain and fever market, contingent upon its clinical differentiation and regulatory approval speed. The drug's value proposition, primarily around safety and formulation benefits, can support premium pricing initially, with subsequent adjustments as generics enter the market.

Stakeholders should focus on:

- Accelerating regulatory submissions to shorten time-to-market.

- Demonstrating clear clinical advantages to justify premium pricing.

- Developing a flexible pricing structure aligned with regional market conditions.

- Building strategic partnerships for distribution and provider education.

Key Takeaways

- The pediatric pain and fever management market remains sizable and poised for moderate growth, presenting opportunities for innovative formulations.

- SM CHLD PAIN-FEVER can command prices between USD 8–USD 12 per bottle early on, with potential for premium positioning if clinical benefits are substantiated.

- Market success depends on regulatory approval pace, competitive differentiation, and strategic marketing.

- The entry of generics and regulatory constraints necessitate adaptable pricing strategies to optimize revenue.

- Building brand trust through safety data and provider outreach is crucial for establishing a secure market share.

FAQs

1. What are the primary competitors for SM CHLD PAIN-FEVER?

The major competitors include established OTC pediatric medications like children's acetaminophen and ibuprofen brands, such as Tylenol and Motrin, which dominate due to their familiarity and regulatory approval history.

2. How does regulatory approval impact pricing for pediatric drugs?

Regulatory approval, especially in stringent markets like the U.S. and Europe, can allow for premium pricing if the product demonstrates superior safety or efficacy. Delays or additional clinical requirements can lower initial profit margins.

3. What factors influence the pricing of pediatric OTC medications?

Key factors include manufacturing costs, formulation complexity, brand positioning, regulatory requirements, competitive landscape, and reimbursement policies.

4. Can the market sustain premium pricing for SM CHLD PAIN-FEVER?

Yes, if the product demonstrates significant safety, efficacy, or convenience benefits, healthcare providers and parents may accept higher prices. Continuous clinical validation is essential.

5. What markets offer the greatest growth potential for this drug?

Emerging markets in Asia-Pacific and Latin America present rapid growth opportunities due to increasing healthcare infrastructure and population demographics, alongside mature markets like North America and Europe where OTC penetration is high.

Sources:

- Grand View Research. Pediatric OTC Medications Market Size, Share & Trends Analysis, 2022.

More… ↓