Share This Page

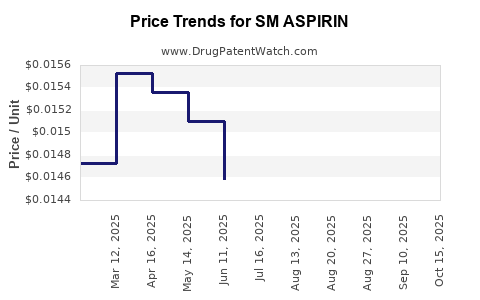

Drug Price Trends for SM ASPIRIN

✉ Email this page to a colleague

Average Pharmacy Cost for SM ASPIRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ASPIRIN 81 MG CHEWABLE TAB | 49348-0757-07 | 0.02664 | EACH | 2025-12-17 |

| SM ASPIRIN 81 MG CHEWABLE TAB | 49348-0757-07 | 0.02692 | EACH | 2025-11-19 |

| SM ASPIRIN EC 81 MG TABLET | 49348-0981-15 | 0.01492 | EACH | 2025-10-22 |

| SM ASPIRIN 81 MG CHEWABLE TAB | 49348-0757-07 | 0.02688 | EACH | 2025-10-22 |

| SM ASPIRIN 81 MG CHEWABLE TAB | 49348-0757-07 | 0.02599 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Aspirin

Overview of SM Aspirin

SM Aspirin, a proprietary formulation of acetylsalicylic acid (aspirin), positions itself in a mature but evolving pharmaceutical segment. While aspirin has a long-standing history as an analgesic, antipyretic, and anti-inflammatory agent, newer formulations and delivery systems, including those marked under proprietary names like SM Aspirin, aim to optimize bioavailability, reduce side effects, or target specific patient populations. As of 2023, the drug remains a cornerstone in cardiovascular protection and pain management, with emerging uses expanding its market footprint.

1. Current Market Landscape

Global Market Size

The global aspirin market was valued at approximately USD 1.9 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2%, projected to reach USD 2.5 billion by 2028 (Source: Mordor Intelligence, 2023). The segment includes both branded and generic aspirin formulations, with generics dominating due to cost-effectiveness.

Key Therapeutic Areas

- Cardiovascular Disease Prevention: Aspirin is a mainstay in secondary prevention of myocardial infarction and stroke (American Heart Association, 2022).

- Pain and Fever Management: Over-the-counter (OTC) usage remains significant, especially in North America and Europe.

- Emerging Uses: Recent studies explore aspirin’s role in cancer prevention and neurodegenerative disease modulation, broadening its clinical utility.

Market Drivers

- Established Efficacy and Safety Profile: Lends stability and trust across healthcare providers.

- Growing Geriatric Population: Increases prevalence of cardiovascular conditions necessitating aspirin use.

- Enhanced Formulations: Innovations such as controlled-release versions and buffered aspirin increase patient compliance.

- Regulatory Environment: Stringent guidelines for over-the-counter sales influence distribution and sales.

Market Restraints

- Bleeding Risks: Elevated bleeding potential limits prolonged or high-dose use.

- Generic Competition: Intensity in price competition, especially from low-cost generics.

- Regulatory Scrutiny: Potential restrictions on indications or formulations.

2. Proprietary Position of SM Aspirin

SM Aspirin distinguishes itself through proprietary formulation techniques that claim to enhance tolerability, bioavailability, or targeted delivery. These formulations potentially command premium pricing and access niche markets, such as sustained-release formulations or pediatric-specific versions.

Patent and Regulatory Status

- Patent Status: Pending or granted patents protect specific formulations, delivery mechanisms, or combinations aimed at extended release or reduced gastrointestinal irritation.

- Regulatory Pathways: Likely classified as OTC or prescription depending on formulation and regional regulatory nuances (FDA, EMA, etc.).

Competitive Edge

- Enhanced Patient Compliance: Proprietary formulations may improve adherence through reduced side effects.

- Clinical Data: Demonstrations of improved pharmacokinetic profiles or reduced adverse events bolster market differentiation.

3. Competitive Landscape

Key Players

- Major Pharmaceutical Companies: Bayer, Johnson & Johnson, Teva, and Novartis dominate aspirin production.

- Generic Manufacturers: Market share is significantly dispersed among multiple small to mid-sized companies leveraging cost advantages.

- Innovators in Proprietary Formulations: Companies focusing on extended-release or combination formulations hold promising niche positions.

Pricing Strategies

- Branded premium pricing for SM Aspirin’s proprietary formulations seeks to offset R&D and patent protection costs.

- Generics maintain aggressive pricing, exerting downward pressure in mature markets.

4. Price Projections

Factors Influencing Future Pricing

- Patent Lifecycle: The remaining patent life for SM Aspirin’s proprietary formulations significantly influences pricing power.

- Market Penetration and Reimbursement: Reimbursement policies and healthcare coverage affect consumer prices and access.

- Regulatory Changes: Introduction of new safety warnings or restrictions could impact demand and pricing.

- Competitive Innovations: Entry of comparable formulations or alternative therapies can compress pricing margins.

Projection Scenarios

Optimistic Scenario

- Timeline: Within five years, SM Aspirin captures 20-25% of the proprietary aspirin market segment due to robust clinical data and favorable regulatory outcomes.

- Price Point: Premium pricing maintained at a 15-20% margin above generics, with prices reaching USD 0.20–0.30 per tablet in developed markets.

- Market Growth Contribution: Increased focus on patient tolerability and compliance enhances adoption.

Conservative Scenario

- Timeline: Patent expiry or replacement within three years leads to increased generic competition.

- Price Point: Prices adjust downward to USD 0.10–0.15 per tablet, matching market averages of generic aspirin.

- Market Growth Contribution: Limited premium for proprietary formulation, relying heavily on existing indications and established markets.

Long-term Outlook

- Medium to Long Term (5-10 Years): As patent protections wane, price erosion is expected, but niche applications or improved formulations could sustain higher pricing in specialized markets (e.g., pediatric, cardiovascular).

- Innovative Delivery Systems: Sustained-release or combination therapies may command premium prices, offsetting generic competition.

5. Regional Market Dynamics

North America

- Market Size: Largest regional market, driven by high healthcare spending, widespread OTC availability, and advanced cardiovascular care.

- Price Trends: Premium formulations retail at higher per-unit prices due to reimbursement and brand recognition.

Europe

- Market Characteristics: Rigorous regulatory landscape that favors proven formulations.

- Pricing: Moderate, with variations across countries based on healthcare policies.

Asia-Pacific

- Growth Potential: Rapid economic growth and expanding healthcare access fuel demand.

- Price Sensitivity: Greater price elasticity favors generic formulations; proprietary options may have limited penetration initially.

6. Key Challenges and Opportunities

Challenges

- Market Saturation: Mature aspirin markets face limited growth potential.

- Patent Expiry Risks: Generic manufacturing pressures, especially post-patent expiry, threaten premium pricing.

- Regulatory Hurdles: Variations across regions require strategic navigation.

Opportunities

- Niche Indications: Expanded use in cancer prevention, neuroprotection, or other emerging applications can drive premium pricing.

- Proprietary Formulations: Innovations targeted at specific patient populations can sustain higher margins.

- Partnerships: Collaborations with healthcare providers and payers can improve access and adoption.

7. Strategic Recommendations

- Focus on Clinical Data: Demonstrate differentiated efficacy or tolerability to justify premium pricing.

- Leverage Patent Portfolio: Maximize patent protection duration, especially for unique formulations or delivery mechanisms.

- Market Diversification: Target emerging markets with adaptable pricing strategies.

- Regulatory Vigilance: Stay ahead in compliance to prevent market disruptions.

Key Takeaways

- SM Aspirin possesses a promising position in a globally mature yet evolving aspirin market, driven by proprietary formulation advantages.

- The market's evolution hinges upon patent protection, clinical differentiation, and regional regulatory landscapes.

- Price projections suggest potential for sustained premium pricing in niche, differentiated formulations, particularly within specialized indications.

- Competitive pressures from generics and regulatory modifications necessitate strategic innovation and diversification.

- Long-term growth depends on the ability to innovate, expand indications, and penetrate emerging markets.

FAQs

1. How does SM Aspirin differentiate itself from generic aspirin formulations?

SM Aspirin's proprietary formulations aim to improve tolerability, bioavailability, or delivery mechanisms, providing clinical benefits beyond standard aspirin. These enhancements justify premium pricing and target specific patient populations.

2. What are the main factors influencing the price of SM Aspirin over the next decade?

Factors include patent expiration timelines, regulatory approvals, clinical differentiation, regional healthcare policies, generic competition, and emerging indications that expand market relevance.

3. How does regional regulation impact the market potential of SM Aspirin?

Regional regulations influence formulation approval pathways, OTC versus prescription status, reimbursement structures, and pricing strategies. Strict regulatory environments may limit rapid market expansion, while regions with supportive policies can accelerate growth.

4. What are the primary market risks for SM Aspirin?

Patent expiry leading to increased generic competition, safety concerns, regulatory restrictions, and evolving clinical guidelines are significant risks that could pressure prices and market share.

5. What opportunities exist for increasing the demand for SM Aspirin?

Expanding use in emerging therapeutic areas (e.g., cancer prevention), developing targeted formulations, forming strategic partnerships, and entering underserved markets present substantial growth avenues.

Sources:

- Mordor Intelligence. "Aspirin Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast." 2023.

- American Heart Association. "Aspirin Use in Cardiovascular Disease Prevention." 2022.

More… ↓