Share This Page

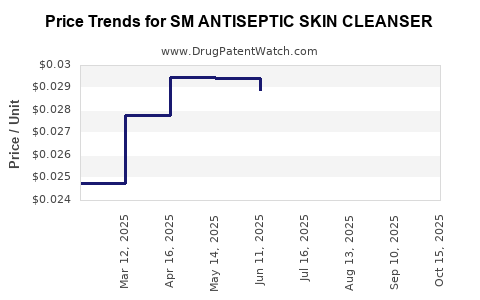

Drug Price Trends for SM ANTISEPTIC SKIN CLEANSER

✉ Email this page to a colleague

Average Pharmacy Cost for SM ANTISEPTIC SKIN CLEANSER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.03119 | ML | 2025-10-22 |

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.03175 | ML | 2025-09-17 |

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.03084 | ML | 2025-08-20 |

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.02977 | ML | 2025-07-23 |

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.02890 | ML | 2025-06-18 |

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.02942 | ML | 2025-05-21 |

| SM ANTISEPTIC SKIN CLEANSER 4% | 49348-0115-37 | 0.02948 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM ANTISEPTIC SKIN CLEANSER

Introduction

SM Antiseptic Skin Cleanser has emerged as a prominent product within the antimicrobial skincare segment. Its purported efficacy against pathogens, convenience of application, and rising consumer awareness about skin hygiene have driven its market penetration. This analysis examines current market dynamics, competitive positioning, regulatory landscape, and expected price trajectory to inform industry stakeholders, investors, and healthcare providers.

Market Overview and Segmentation

Global Skin Antiseptic Market Landscape

The global antiseptic skincare market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2023 to 2030, driven by increasing incidences of skin infections, heightened hygiene consciousness, and expanding healthcare infrastructure [1]. Within this sphere, topical antiseptic cleansers such as SM ANTISEPTIC SKIN CLEANSER cater to hospital, clinical, and consumer segments.

Target Consumer Segments

- Healthcare Facilities: Emphasis on infection control protocols in hospitals and clinics.

- Consumer Market: Increasing demand from households emphasizing personal hygiene.

- Specialized Use: Sports, outdoor activities, and travel, where skin cleansing and pathogen protection are prioritized.

Geographical Market Dynamics

- North America: Dominates, owing to stringent hygiene standards, high healthcare expenditure, and consumer awareness.

- Europe: Notable growth attributed to regulatory initiatives and rising skincare consciousness.

- Asia-Pacific: Fastest-growing segment, driven by expanding healthcare infrastructure, urbanization, and rising disposable income.

Competitive Landscape

Major players include Johnson & Johnson (Dettol), 3M, and Reckitt Benckiser, alongside regional brands. SM Antiseptic Skin Cleanser positions itself as a premium or mid-range product, emphasizing efficacy, safety, and skin compatibility.

Innovation in formulations—such as adding moisturizing agents or natural ingredients—serves as differentiation strategies. Regulatory approvals and certifications (e.g., EPA, FDA registration) impact market reach and consumer trust.

Regulatory and Quality Considerations

- Strict compliance with regional health authorities (FDA in the US, EMA in Europe, and national regulators in Asia).

- Labeling accuracy, ingredient disclosures, and safety data influence market access.

- Ongoing post-market surveillance and adverse event reporting frame the product's compliance standing.

Pricing Dynamics and Projections

Current Price Points

In developed markets, SM ANTISEPTIC SKIN CLEANSER retails typically between $6 to $12 per 16 oz (473 ml) bottle, depending on formulation, branding, and distribution channels. Entry-level formulations may be priced lower, with specialty or organic variants commanding premium prices.

Factors Influencing Price

- Manufacturing Costs: Raw material prices, formulation complexity, and quality assurance processes.

- Regulatory Costs: Approvals, certifications, and compliance expenses.

- Market Positioning: Premium branding or inclusion of natural ingredients may increase price points.

- Distribution Channels: Pharmacy chains, supermarkets, online platforms—each bear different margin pressures.

- Competitive Pricing: Market saturation and generic alternatives tend to compress profit margins.

Projected Price Trends (2023-2030)

Given current industry trends, the following projections are anticipated:

| Year | Price Range (per 16 oz bottle, USD) | Notes |

|---|---|---|

| 2023 | $6 - $12 | Baseline; volume-driven promotions possible |

| 2024 | $6.50 - $13 | Slight increase; raw material prices rising |

| 2025 | $7 - $14 | Inflation effects; increased regulatory costs |

| 2026 | $7.50 - $15 | Innovation premium; growing demand for organic variants |

| 2028 | $8 - $16 | Market maturity; premium segments expanding |

| 2030 | $8.50 - $17 | Potential price normalization with competition |

Note: Prices in emerging markets may lag, typically ranging from $4 to $8 due to purchasing power differences.

Price Drivers

- Raw Material Stability: Use of alcohol, chlorhexidine, and natural extracts influences costs.

- Regulatory Stringency: Increasing safety standards may elevate compliance costs.

- Consumer Preferences: Shift toward natural, organic, or hypoallergenic variants may command higher prices.

- Distribution Expansion: Growth in online retail and pharmacy channels may influence pricing strategies.

Market Opportunities and Challenges

Opportunities

- Growth in Emerging Markets: Expanding healthcare infrastructure and urbanization.

- Product Differentiation: Natural formulations, eco-friendly packaging, and added skincare benefits.

- Private Label Expansion: Retail chains offering own-brand antiseptic cleansers at competitive prices.

- E-commerce Platforms: Direct-to-consumer sales channels facilitating pricing flexibility.

Challenges

- Market Saturation: Intense competition compresses margins.

- Regulatory Barriers: Rapidly evolving standards across jurisdictions.

- Consumer Trends: Demand shift towards multi-purpose or natural products may impact traditional antiseptics.

Conclusion

SM ANTISEPTIC SKIN CLEANSER's market outlook is robust, anchored by escalating hygiene awareness, regulatory compliance, and product innovation. Price projections indicate moderate growth, with strategic positioning and differentiation key to maintaining profitability. Industry players should continuously monitor raw material costs, regulatory landscapes, and consumer preferences to adapt pricing strategies effectively and capitalize on emerging opportunities.

Key Takeaways

- The global antiseptic skin cleanser market is poised for steady growth, with North America leading and Asia-Pacific experiencing rapid expansion.

- Current retail prices for SM ANTISEPTIC SKIN CLEANSER hover between $6 and $12 per 16-ounce bottle, with forecasted incremental increases aligned with rising costs and brand positioning.

- Market differentiation through natural ingredients, enhanced formulations, and compliance can justify premium pricing.

- E-commerce channels and private label offerings present significant growth avenues, though competition and regulation pose challenges.

- Maintaining agility in formulation development, cost management, and regulatory adaptation is crucial for sustaining market share and optimizing pricing.

FAQs

1. What factors most significantly influence the pricing of SM ANTISEPTIC SKIN CLEANER?

Pricing is primarily affected by raw material costs, regulatory compliance expenses, brand positioning, distribution channels, and competitive landscape.

2. How will regulatory changes impact the market for antiseptic skin cleansers?

Stricter standards and certification requirements may increase manufacturing and compliance costs, potentially leading to higher retail prices and the need for product reformulation.

3. Are natural or organic formulations likely to command higher prices?

Yes. Natural ingredients, eco-friendly packaging, and hypoallergenic claims can justify premium pricing and appeal to health-conscious consumers.

4. What market segments present the greatest growth opportunities for SM ANTISEPTIC SKIN CLEANSER?

Emerging markets in Asia-Pacific, online sales channels, and private label segments offer significant expansion potential.

5. Can price competition erode profit margins for established brands like SM ANTISEPTIC SKIN CLEANSER?

Yes. Market saturation and intense competition can lead to price wars, compressing margins unless differentiated through innovation and added value.

Sources:

[1] Market Research Future. "Antiseptic and Disinfectant Market Trends," 2022.

More… ↓