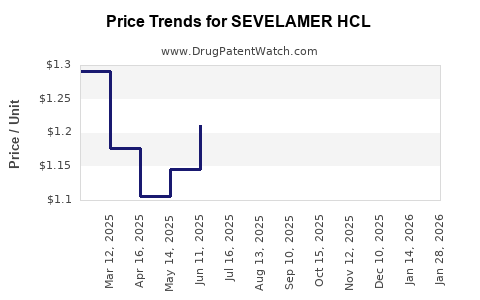

Drug Price Trends for SEVELAMER HCL

✉ Email this page to a colleague

Average Pharmacy Cost for SEVELAMER HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SEVELAMER HCL 800 MG TABLET | 72603-0148-01 | 1.34871 | EACH | 2024-11-20 |

| SEVELAMER HCL 800 MG TABLET | 00955-1048-18 | 1.34871 | EACH | 2024-11-20 |

| SEVELAMER HCL 800 MG TABLET | 59651-0088-18 | 1.34871 | EACH | 2024-11-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Best Wholesale Price for SEVELAMER HCL

| Drug Name | Vendor | NDC | Count | Price ($) | Price/Unit ($) | Unit | Dates | Price Type |

|---|---|---|---|---|---|---|---|---|

| SEVELAMER HCL 800MG TAB | AvKare, LLC | 68462-0447-18 | 180 | 307.27 | 1.70706 | EACH | 2023-06-15 - 2028-06-14 | FSS |

| SEVELAMER HCL 800MG TAB | Sanofi Aventis U.S. LLC | 00955-1048-18 | 180 | 91.66 | 0.50922 | EACH | 2024-01-01 - 2028-05-31 | Big4 |

| SEVELAMER HCL 800MG TAB | Sanofi Aventis U.S. LLC | 00955-1048-18 | 180 | 128.04 | 0.71133 | EACH | 2024-01-01 - 2028-05-31 | FSS |

| >Drug Name | >Vendor | >NDC | >Count | >Price ($) | >Price/Unit ($) | >Unit | >Dates | >Price Type |