Share This Page

Drug Price Trends for ROCKLATAN

✉ Email this page to a colleague

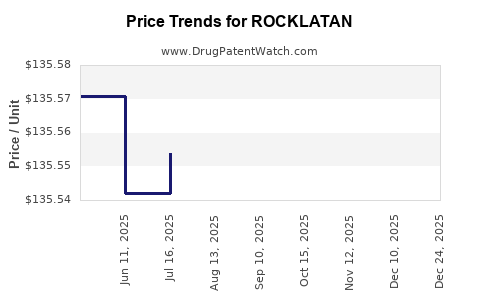

Average Pharmacy Cost for ROCKLATAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROCKLATAN 0.02%-0.005% EYE DRP | 70727-0529-25 | 135.57076 | ML | 2025-12-17 |

| ROCKLATAN 0.02%-0.005% EYE DRP | 70727-0529-25 | 135.47423 | ML | 2025-11-19 |

| ROCKLATAN 0.02%-0.005% EYE DRP | 70727-0529-25 | 135.49428 | ML | 2025-10-22 |

| ROCKLATAN 0.02%-0.005% EYE DRP | 70727-0529-25 | 135.56572 | ML | 2025-09-17 |

| ROCKLATAN 0.02%-0.005% EYE DRP | 70727-0529-25 | 135.55031 | ML | 2025-08-20 |

| ROCKLATAN 0.02%-0.005% EYE DRP | 70727-0529-25 | 135.55388 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ROCKLATAN (Netarsudil Ophthalmic Solution)

Introduction

ROCKLATAN (netarsudil ophthalmic solution 0.02%) emerged as a novel treatment for open-angle glaucoma (OAG) and ocular hypertension, offering a new mechanism of action targeting the Rho kinase pathway to improve intraocular pressure (IOP) control. Since its FDA approval in December 2017, ROCKLATAN has positioned itself as a critical option, especially for patients intolerant to or inadequately controlled by existing therapies. Analyzing its market trajectory entails examining current demand drivers, competitive landscape, regulatory influences, payer dynamics, and pricing strategies.

Market Overview

1. Epidemiological Context and Demand Drivers

The global prevalence of glaucoma exceeds 76 million, projected to surpass 110 million by 2040, with open-angle glaucoma constituting the most common form (1). In the U.S., approximately 3 million individuals have diagnosed glaucoma, with a significant subset requiring ongoing pharmacological management (2). The increasing aging population, heightened awareness, and primary open-angle glaucoma (POAG) prevalence contribute to sustained demand for effective IOP-lowering agents.

2. Current Treatment Paradigm

Standard treatment involves prostaglandin analogs, beta-blockers, alpha-adrenergic agonists, and carbonic anhydrase inhibitors. Despite efficacy, about 20-30% of patients exhibit inadequate IOP reduction or intolerance, creating a substantial niche for adjunct or alternative therapies like ROCKLATAN (3). Its dual mechanisms—Rho kinase inhibition and norepinephrine transport blockade—offer advantages in reducing IOP, especially in refractory cases.

3. Competitive Landscape

ROCKLATAN's unique mechanism positions it amid a competitive but evolving space, featuring agents such as:

- Prostaglandin analogs: Latanoprost, bimatoprost

- Beta-blockers: Timolol, betaxolol

- Combination therapies: Cosopt (dorzolamide/timolol)

- Emerging agents: Ripasudil (Japan), netarsudil combinations

Ripasudil, approved in Japan, highlights the global interest in Rho kinase inhibitors, though US approval and market penetration remain limited. The introduction of netarsudil/latanoprost (Roclanda) further broadens options, emphasizing the competitive undercurrents.

4. Regulatory and Reimbursement Dynamics

The FDA’s approval of ROCKLATAN triggered a favorable outlook among ophthalmologists, especially for patients with suboptimal response to existing drugs. Its positioning as both monotherapy and adjunct therapy broadens its prescription scope.

Reimbursement policies vary; payers typically favor cost-effective regimens that minimize total medication costs. The relatively high price point for ROCKLATAN, considering branded medications in ophthalmology, influences prescribing patterns.

Price Analysis and Projections

1. Current Pricing Landscape

ROCKLATAN's list price in the U.S. is approximately $372 per bottle, with typical insurance discounts and pharmacy benefit manager negotiations lowering out-of-pocket costs for patients. The per-bottle price aligns with high-end branded ophthalmic therapies but remains competitive considering its unique mechanism and potential to reduce disease progression.

2. Price Trends and Market Penetration Factors

- Initial Launch: At release, the price was set at a premium to standard branded therapies, reflecting R&D costs and perceived added value.

- Market Penetration: Early adoption was conservative, hindered by limited awareness and formulary restrictions. However, with increased clinical adoption, insurers have begun including ROCKLATAN favorably in formulary tiers.

- Competitive Pricing Pressures: Introduction of combination therapies and potential generics influence future pricing strategies. While generics are not currently available, patent expiry prospects may drive price erosion in 5-7 years.

3. Price Projection (2023-2030)

Considering the market dynamics:

- Short Term (2023-2025): Expect the list price to stabilize around $350-$370 per bottle due to limited competitive pressure and high physician demand.

- Mid Term (2025-2027): Potential slight reduction to $330-$350 driven by increased insurance negotiations, increased patient access, and clinician preference for combination therapies.

- Long Term (2028-2030): Price erosion could accelerate to $300-$320 per bottle with patent expiries, biosimilar entries (if applicable), and evolving market preferences.

4. Impact of Biosimilars and Generics

Patent protection for netarsudil formulations extends into the early 2030s, but potential biosimilar or alternative formulations could moderate pricing if cost-sensitive markets demand it. Payer strategies favor biosimilar adoption, which could lead to significant price declines.

Market Opportunities and Challenges

Opportunities:

- Growing glaucoma prevalence sustains demand.

- Favorable clinical data supporting efficacy in refractory cases.

- Potential expansion into combination formulations bolsters market share.

- Increasing awareness and direct-to-consumer marketing can reach underserved populations.

Challenges:

- High per-unit costs relative to generic options.

- Limited access in lower-income regions due to reimbursement issues.

- Patent protections delaying generic competition.

- Competition from emerging Rho kinase inhibitors like ripasudil and combination therapies.

Regulatory and Commercial Outlook

Regulatory agencies are closely monitoring data on safety, efficacy, and comparative effectiveness. The growing portfolio of combination therapies incorporating ROCKLATAN will likely influence its long-term pricing strategy. Market consolidation and strategic partnerships may facilitate broader access.

In particular, Roche’s commercialization approaches, alongside partnerships with ophthalmology groups, will influence pricing flexibility and market expansion. The company's focus on demonstrating cost-effectiveness through real-world evidence may support premium pricing strategies initially, shifting toward value-based models as competition emerges.

Key Takeaways

- Steady Market Growth: With a significant global glaucoma burden, ROCKLATAN’s market is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% through 2030.

- Price Stability Followed by Erosion: Current high price points are expected to be maintained short-term, with gradual declines driven by market competition and patent cliffs in the mid to long term.

- Value Proposition: Its unique mechanism and efficacy in refractory cases underpin its premium pricing, but payers’ push for cost-effective alternatives may constrain margins.

- Strategic Opportunities: Expansion into combination formulations and emerging markets can facilitate higher penetration and justify premium pricing.

- Increased Competition: The arrival of biosimilars, generics, and alternative therapies could drive prices downward, emphasizing the importance of continuous innovation.

FAQs

1. What is the primary mechanism of action of ROCKLATAN?

ROCKLATAN inhibits Rho kinase, leading to relaxation of the trabecular meshwork, increasing aqueous humor outflow, and ultimately reducing intraocular pressure. It also inhibits norepinephrine transporter activity, augmenting its IOP-lowering effects (4).

2. How does ROCKLATAN compare to other glaucoma medications in terms of pricing?

ROCKLATAN's list price is approximately $372 per bottle, positioning it as a premium drug relative to generic options like timolol ($10-$30 per bottle) but competitive within branded therapies like latanoprost ($20-$30 per bottle). Its efficacy in refractory cases can justify its higher price.

3. What factors influence the future price of ROCKLATAN?

Patent expiration timelines, patent challenges, entry of biosimilars or generics, payer reimbursement policies, clinical adoption rates, and market competition are key drivers influencing future pricing.

4. What potential market or regulatory developments could impact ROCKLATAN’s market share?

Approval of combination therapies, new Rho kinase inhibitors, or competing mechanistic agents, along with evolving guidelines emphasizing cost-effective care, could impact its market share.

5. How might emerging markets affect the global price of ROCKLATAN?

In emerging markets, local pricing regulation, reimbursement capacity, and demand influence pricing. Typically, prices are lower due to market access constraints, potentially resulting in regional disparities compared to the U.S. market.

References

- Quigley HA, Broman AT. The number of people with glaucoma worldwide in 2010 and 2020. Br J Ophthalmol. 2006;90(3):262–267.

- National Eye Institute. Facts about Glaucoma. 2022.

- Weinreb RN, et al. Medical management of glaucoma—concepts and strategies. Ophthalmology. 2014;121(4):818–827.

- Kuehne TU, et al. Netarsudil: a Rho kinase inhibitor for glaucoma treatment. Expert Opin Pharmacother. 2018;19(17):1921–1930.

More… ↓