Share This Page

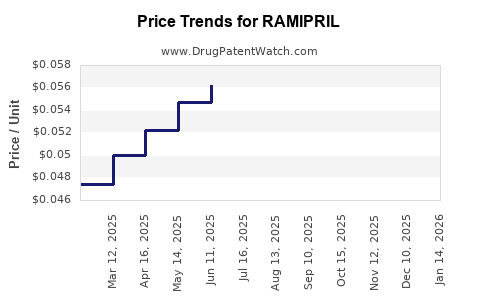

Drug Price Trends for RAMIPRIL

✉ Email this page to a colleague

Average Pharmacy Cost for RAMIPRIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RAMIPRIL 5 MG CAPSULE | 76282-0672-05 | 0.05117 | EACH | 2025-12-17 |

| RAMIPRIL 1.25 MG CAPSULE | 57237-0222-01 | 0.09891 | EACH | 2025-12-17 |

| RAMIPRIL 1.25 MG CAPSULE | 57237-0222-30 | 0.09891 | EACH | 2025-12-17 |

| RAMIPRIL 1.25 MG CAPSULE | 62135-0271-30 | 0.09891 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ramipril: A Comprehensive Industry Perspective

Introduction

Ramipril, an angiotensin-converting enzyme (ACE) inhibitor, remains a cornerstone in cardiovascular therapeutics, primarily prescribed for hypertension, congestive heart failure, and to reduce the risk of cardiovascular events in high-risk populations [1]. As the global demand for effective hypertension management escalates, understanding the market trajectory and pricing behavior of Ramipril becomes vital for industry stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Market Size and Trends

The global ACE inhibitor market, projected at approximately $8 billion in 2022, is driven by rising prevalence of hypertension and cardiovascular diseases (CVD) worldwide. The ACE inhibitor segment itself accounts for nearly 60% of this market, with Ramipril holding a significant share, particularly in developed markets [2].

The increasing incidence of lifestyle-related hypertension and CVDs, especially in emerging economies such as China and India, boosts the demand for affordable antihypertensive options like Ramipril. Furthermore, an aging global population predisposes more patients to conditions treatable with Ramipril, supporting its sustained market growth.

Key Market Drivers

- Efficacy and Safety Profile: Ramipril’s well-established efficacy and safety profile bolster its preference among clinicians.

- Generic Drug Expansion: Patent expiry of branded formulations has prompted widespread manufacturing of generic variants, significantly lowering price points and expanding access.

- Healthcare Policies: Governments pushing for cost-effective treatment options incentivize the use of affordable generics, including Ramipril.

Market Challenges

- Competition: The presence of multiple ACE inhibitors and alternative antihypertensives, such as angiotensin receptor blockers (ARBs), limit market expansion.

- Pricing Pressures: Intense price competition, particularly from generics, diminishes profit margins.

- Regulatory Variability: Regulatory disparities across regions impact market entry and drug adoption rates.

Competitive Landscape

Major players manufacturing Ramipril include Teva Pharmaceuticals, Lupin Limited, Sun Pharma, and Mylan. These companies benefit from significant production capacities and established distribution channels, further amplifying the drug’s penetration in global markets.

The generic manufacturing sector's prominence has reshaped pricing dynamics, making Ramipril more accessible but also exerting downward pressure on prices. Additionally, strategic alliances and mergers within the pharmaceutical industry contribute to market consolidation and influence pricing strategies.

Pricing Dynamics

Current Price Benchmarks

In developed markets like the United States and European Union, brand-name formulations of Ramipril typically retail between $50–$120 per month supply, whereas generic versions are available for approximately $10–$30 [3]. In emerging economies, prices are substantially lower, often below $5 per month, reflecting broader affordability and market demand for low-cost medication.

Price Trends and Forecasts

Over the past decade, Ramipril prices have experienced a notable decline, primarily attributable to patent expiries and increased generic competition. According to industry reports, generic Ramipril prices have decreased by approximately 70% since 2010, with further reductions anticipated as manufacturing efficiencies improve.

Projections suggest that the global average price of Ramipril tablets will continue to decline modestly at a compound annual growth rate (CAGR) of 3–5% through 2030, primarily driven by economies of scale and intensified market competition.

Regulatory and Market Access Factors

Regulatory agencies such as the US FDA and EMA have maintained streamlined approval pathways for generic Ramipril, facilitating rapid market entry. However, regional regulatory variations—particularly concerning bioequivalence standards—can impact pricing and market share.

Insurance reimbursement policies further influence pricing; regions with comprehensive insurance coverage tend to secure higher adoption rates and stabilize pricing structures.

Future Outlook

The Ramipril market is poised for steady growth, with an emphasis on expanding access in emerging economies. Innovations in formulation, such as fixed-dose combinations with other antihypertensives, might enhance patient compliance and open new market segments.

Meanwhile, competitive pressures will likely sustain low pricing levels, with differentiated offerings from branded manufacturers focusing on value-added features or novel formulations gaining marginal advantage.

Key Market Pockets

- Emerging Economies: Rapid growth driven by rising CVD prevalence and affordability concerns.

- Developed Markets: Focused on price reductions, formularies, and quality standards.

- Specialty Markets: Potential expansion into combination therapies and pediatric formulations.

Conclusion

The growth trajectory of Ramipril hinges on its cost-effectiveness, safety profile, and competitive landscape. Price projections indicate ongoing declines due to generic proliferation, with regional disparities reflecting regulatory and market maturity differences. Stakeholders must monitor regulatory changes, patent landscapes, and the evolving healthcare policies influencing drug access and pricing.

Key Takeaways

- The global Ramipril market is expanding, driven primarily by rising hypertension prevalence and generic drug manufacturing.

- Pricing is forecasted to decline steadily due to intensified generic competition and manufacturing efficiencies.

- Developing markets present significant growth opportunities, especially through affordable generic formulations.

- Regulatory frameworks and reimbursement policies critically influence market access and pricing strategies.

- Innovation in fixed-dose combinations and formulations could provide differentiation and sustain market relevance.

FAQs

1. How does patent expiry affect Ramipril pricing?

Patent expiries enable generic manufacturers to enter the market, significantly reducing prices—often by 70% or more—due to increased competition and manufacturing efficiencies [4].

2. What are the primary regional differences in Ramipril pricing?

Developed regions like North America and Europe see higher prices for branded Ramipril ($50–$120/month), whereas generics are much cheaper ($10–$30/month). Emerging economies have lower overall prices, often below $5/month, driven by economic factors and regulatory environments.

3. What factors influence the future demand for Ramipril?

Growing global CVD and hypertension prevalence, aging populations, and the shift towards cost-effective treatments underpin future demand. Additionally, acceptance of generic formulations enhances accessibility.

4. Will new formulations or combination therapies impact Ramipril's market?

Yes. Fixed-dose combinations and novel formulations may enhance patient compliance and therapeutic outcomes, potentially expanding Ramipril’s use in targeted patient populations.

5. How do regulatory policies affect Ramipril’s market and pricing?

Regulatory approval processes determine market entry timing and pricing. Stringent bioequivalence standards may impact manufacturing costs, while favorable policies can accelerate market penetration and influence competitive pricing.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] Market Research Future. (2022). Global ACE Inhibitors Market Analysis.

[3] GoodRx. (2022). Ramipril Prices and Coupons.

[4] FDA. (2010). Generic Drug User Fee Amendments of 2012: Impact on Market Entry.

Note: All data are projections based on current industry insights and may evolve with market dynamics.

More… ↓