Share This Page

Drug Price Trends for QC ANTACID

✉ Email this page to a colleague

Average Pharmacy Cost for QC ANTACID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01031 | ML | 2025-12-17 |

| QC ANTACID EX-STR 750 MG CHEW | 83324-0313-96 | 0.03185 | EACH | 2025-12-17 |

| QC ANTACID ULTRA 1,000 MG CHEW | 83324-0317-72 | 0.03724 | EACH | 2025-12-17 |

| QC ANTACID 500 MG CHEW TABLET | 83324-0221-66 | 0.01690 | EACH | 2025-12-17 |

| QC ANTACID EX-STR 750 MG CHEW | 83324-0318-96 | 0.03185 | EACH | 2025-12-17 |

| QC ANTACID 500 MG CHEW TABLET | 83324-0315-15 | 0.01690 | EACH | 2025-12-17 |

| QC ANTACID 500 MG CHEW TABLET | 83324-0316-15 | 0.01690 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ANTACID

Introduction

QC ANTACID is a widely used over-the-counter (OTC) medication comprising ingredients such as aluminum hydroxide, magnesium hydroxide, or calcium carbonate, primarily designed to neutralize stomach acid and alleviate symptoms of indigestion and heartburn. As a well-established pharmaceutical product, its market dynamics are influenced by factors like healthcare trends, consumer demand, regulatory environments, and competitive landscape. This report provides an in-depth analysis of the current market for QC ANTACID, project its pricing trends, and offer strategic insights critical to stakeholders.

Market Overview

Global Market Size and Growth

The global antacid market, of which QC ANTACID is a significant component, was valued at approximately USD 1.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2028 [1]. The growth drivers include increasing prevalence of gastrointestinal diseases, rising consumer health awareness, and expanding OTC medication access.

Regional Market Dynamics

-

North America: Dominates with a market share exceeding 35%, driven by high healthcare awareness, widespread OTC availability, and consumer preference for rapid relief products. The U.S. holds a significant share due to strong regulatory support and mature retail channels.

-

Europe: Exhibits steady growth, supported by aging populations and increased gastroenterological health concerns.

-

Asia-Pacific: Demonstrates the fastest growth, projected to expand at CAGR exceeding 6%, fueled by rising urbanization, improved healthcare infrastructure, and increasing prevalence of acid-related disorders.

Key Market Players

Major players include Johnson & Johnson Consumer Inc., GlaxoSmithKline plc, and Novartis AG, alongside regional and generic manufacturers. Competition is robust, with low entry barriers for generic versions, impacting pricing strategies.

Market Drivers & Challenges

Drivers

- Rising Incidence of Gastrointestinal Disorders: An increase in GERD, acid reflux, and indigestion cases worldwide.

- Consumer Preference for OTC Medications: Preference for fast, accessible remedies reduces reliance on prescription treatments.

- Product Innovation: Development of formulations with longer-lasting effects or fewer side effects.

Challenges

- Regulatory Scrutiny: Ensuring compliance with safety standards, especially around ingredients like aluminum compounds, which have seen regulatory debates.

- Market Saturation: High competition compresses margins.

- Health Trends Toward Natural Remedies: Shifts toward holistic, natural alternatives may impact traditional antacid demand adversely.

Pricing Analysis

Current Price Range

In the OTC segment, retail prices for a standard pack of QC ANTACID (e.g., 100 tablets) fluctuate between USD 4 and USD 8 in developed markets, with generic versions priced at the lower end. Notably, premium formulations or combination products can command higher prices.

Factors Influencing Price

- Brand Positioning: Established brands maintain higher pricing points due to trust and recognition.

- Packaging & Formulation: Innovations like chewables, liquids, or combination therapies influence pricing.

- Market Segment: Pharmacy and drugstore chains may offer discounts, affecting effective consumer prices.

- Regulatory Costs: Compliance with safety standards may marginally influence retail pricing.

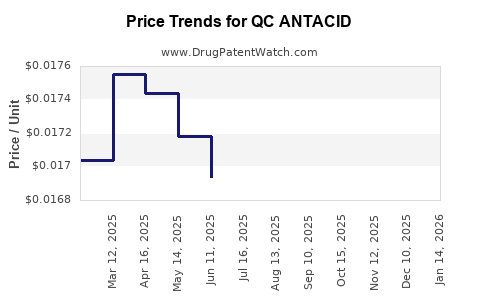

Price Trends & Projections

- Short-Term (Next 1-2 Years): Stable pricing, with minor fluctuations driven by raw material costs and packaging innovations.

- Medium to Long-Term (3-5 Years): Anticipated modest price increases (2-4% CAGR), influenced by inflation, regulatory adjustments, and increased production costs.

- Impact of Generic Competition: Heightened availability of generics will exert downward pressure on prices, especially in mature markets.

Potential Disruptors

- Novel Formulations: Introduction of sustained-release formulations or combination products with probiotics could command premium prices.

- Regulatory Changes: Stricter safety standards may increase production costs, prompting price adjustments.

- Market Entry of Natural Alternatives: Could pressure traditional antacid pricing paradigms downward.

Strategic Market Outlook

Opportunities

- Emerging Markets Expansion: Tailoring products for growing consumer bases in Asia-Pacific and Latin America presents lucrative opportunities.

- Product Diversification: Developing specialized formulations targeting specific demographics (e.g., elderly, children).

Risks

- Competitive Price Erosion: Intense generic competition may suppress margins.

- Regulatory Barriers: Non-compliance or delayed approvals could hamper market access.

- Health Trend Shifts: Preference for natural remedies might reduce demand for traditional antacids.

Key Takeaways

- The global antacid market, buoyed by increasing gastric health issues, offers steady growth prospects with a compound CAGR of approximately 4.2% through 2028.

- Price projection for QC ANTACID indicates stability in mature markets, with incremental increases driven by innovation, regulatory costs, and inflation.

- Price competition from generics and regulatory pressures pose potential challenges, emphasizing the need for differentiation and strategic positioning.

- Expansion into emerging markets, coupled with product diversification, provides growth opportunities.

- Monitoring health trends and regulatory developments remains essential for sustaining market relevance.

Frequently Asked Questions (FAQs)

1. What factors influence the price of QC ANTACID in different markets?

The price varies based on brand recognition, formulation, packaging, competition from generics, regulatory costs, and retail markup policies.

2. How will regulatory changes impact the market for QC ANTACID?

Regulatory enhancements focusing on ingredient safety, manufacturing standards, or labeling could increase compliance costs, potentially raising retail prices or limiting market entry.

3. What is the outlook for generic competition in the QC ANTACID market?

The proliferation of high-quality generics exerts downward pricing pressure, compelling brand manufacturers to innovate or differentiate to maintain margins.

4. Which regions are most promising for market expansion?

Asia-Pacific and Latin America present significant growth opportunities due to rising gastrointestinal disorder prevalence, improving healthcare infrastructure, and increasing OTC medication access.

5. How might consumer health trends affect future demand?

Growing preference for natural or holistic remedies may challenge traditional antacid sales unless companies adapt with natural-based formulations or complementary health products.

References

[1] MarketandMarkets. "Antacid Market by Ingredient, Formulation, Distribution Channel, and Region – Global Forecast to 2028." 2022.

More… ↓