Last updated: July 27, 2025

Introduction

Pyridostigmine bromide (PYRIDOSTIGMINE BR) is a cholinesterase inhibitor primarily employed in the treatment of myasthenia gravis (MG), a neuromuscular disorder characterized by weakness in skeletal muscles. Its utility extends into military and chemical defense domains as a prophylactic agent against nerve agent poisoning. Given its critical therapeutic role and niche applications, understanding the current market landscape, competitive positioning, and future price trends is essential for stakeholders including pharmaceutical manufacturers, suppliers, healthcare providers, and strategic investors.

Market Overview

Therapeutic Market for Pyridostigmine Bromide

The global myasthenia gravis market was valued at approximately USD 236 million in 2022, with projections reaching USD 340 million by 2030, reflecting a CAGR of around 4.7% (2023-2030) [1]. Pyridostigmine bromide constitutes the cornerstone of symptomatic management owing to its favorable efficacy and safety profile. Its niche application in military preparedness for nerve agent casualties adds a secondary demand source, notably influencing procurement patterns, especially by defense agencies.

Regional Market Dynamics

-

North America: Dominates due to advanced healthcare infrastructure, high disease awareness, and robust pharmaceutical distribution networks. The United States, in particular, accounts for over 50% of the global pyridostigmine bromide market, driven by both therapeutic and defense-related demand.

-

Europe: Exhibits steady growth, supported by comprehensive healthcare coverage and strong pharmaceutical manufacturing capabilities.

-

Asia-Pacific: Expected to demonstrate the highest CAGR (~6%) owing to increasing healthcare investments, rising prevalence of neuromuscular disorders, and expanding military budgets.

-

Other Regions: Latin America and the Middle East show moderate growth, primarily centered on military procurement and regional healthcare enhancements.

Key Market Drivers

- Rising prevalence and improved diagnostics of myasthenia gravis.

- Aging population contributing to increased neuromuscular disorder cases.

- Government and military procurement for nerve agent protection.

- Ongoing research into new formulations and delivery mechanisms.

Competitive Landscape

Major pharmaceutical companies such as Novartis, Boehringer Ingelheim, and Teva Pharmaceuticals dominate the prescription drug segment, with several generic manufacturers increasing market share through cost-effective alternatives. Additionally, government contracts for military neuro-protective agents influence supply dynamics.

Pricing Dynamics of Pyridostigmine Bromide

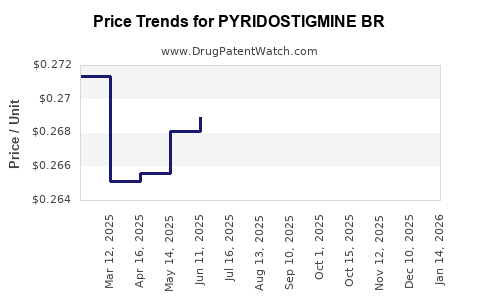

Historical Price Trends

Historically, pyridostigmine bromide prices have remained relatively stable within the prescription segment, with minor fluctuations driven by manufacturing costs, patent statuses, and market competition. In regions with high generic penetration, unit prices tend to decline, enhancing affordability but impacting margins for brand-name suppliers.

Market Segmentation and Price Differentiation

- Brand-name drugs: Typically priced 20-30% higher due to brand recognition and patent protections.

- Generics: Offer significant price reductions; prices can be up to 50% lower than branded counterparts.

- Military and government procurement: Prices are often negotiated under bulk contracts, generally resulting in reduced unit prices compared to retail pharmacy sales.

Supply Factors Impacting Pricing

- Raw Material Availability: Changes in starting material costs influence manufacturing expenses.

- Manufacturing Capacity: Limited due to complex synthesis pathways can constrain supply, thus affecting price.

- Regulatory Environment: Stringent approvals and quality standards can elevate costs but are essential for market access.

Price Projections (2023-2030)

Considering current market conditions, the following projections are anticipated:

- Prescription drug prices: Will likely experience modest annual increases (~2-3%) attributed to inflation, raw material costs, and regulatory compliance.

- Generic competition: Will exert downward pressure, potentially reducing average unit prices by 10-15% over the next five years.

- Military procurement prices: Expected to remain stable, with minor fluctuations based on geopolitical factors and defense budgets.

- Impact of biosimilars/substitutes: Limited here, but any development of alternative neuroprotective agents could influence overall pricing strategies.

The interplay of these factors suggests a relatively stable pricing environment with slight downward trends in the commercial sector, counterbalanced by stable military procurement costs.

Market and Price Projection Outlook

Short-term (2023-2025)

- Slight price stabilization in prescription markets.

- Continued growth in demand due to increasing neuromuscular disorder prevalence.

- Competitive generic entry driving prices downward.

Mid to Long-term (2026-2030)

- Potential for incremental price reductions due to proliferation of generics.

- Possible introduction of improved formulations or delivery mechanisms (e.g., sustained-release tablets) potentially commanding higher prices.

- Military and government procurement prices to remain relatively unchanged unless geopolitical tensions escalate nerve agent threats.

Factors Influencing Future Market and Prices

- Regulatory developments: Approvals of new formulations or alternative agents.

- Research advancements: Innovative delivery systems could alter manufacturing costs and pricing.

- Healthcare policy changes: Reimbursement policies and drug pricing legislation could impact profit margins and pricing strategies.

- Geopolitical events: Increased defense focus could sustain or elevate military procurement prices amid global tensions.

Key Takeaways

- The pyridostigmine bromide market is driven predominantly by medical applications for myasthenia gravis and military neuro-protection programs.

- Supply and demand equilibrium is stable but sensitive to geopolitical and regulatory changes.

- Price trends are expected to remain relatively stable in the near term, with modest declines driven by generic competition.

- Defense procurement prices will likely remain insulated from healthcare market fluctuations but are susceptible to geopolitical factors.

- Innovation in formulations and alternative therapies could influence future pricing and market dynamics.

FAQs

1. What are the primary therapeutic indications for pyridostigmine bromide?

Pyridostigmine bromide is mainly used to treat myasthenia gravis by improving neuromuscular transmission. Additionally, it serves as a prophylactic agent against nerve agents in military settings.

2. How does generic competition influence pyridostigmine bromide pricing?

The entry of generic manufacturers typically lowers prices by up to 50%, increasing affordability but reducing margins for branded formulations.

3. Are there upcoming innovations expected to impact the pyridostigmine bromide market?

Potential developments include sustained-release formulations and combination therapies, which could alter manufacturing costs and pricing structures, although such innovations are currently in early research stages.

4. How will geopolitical tensions affect military procurement prices?

Increased threats from nerve agents could lead to higher military demand and potentially better procurement terms, stabilizing or elevating prices in defense sectors.

5. What are the key challenges facing manufacturers of pyridostigmine bromide?

Challenges include raw material supply variability, regulatory compliance costs, competition from generics, and potential patent expirations that could erode market share.

Sources

[1] Allied Market Research. "Myasthenia Gravis Treatment Market Size, Share & Trends Analysis." 2023.