Last updated: October 9, 2025

Introduction

PULMOZYME (dornase alfa) is a recombinant human deoxyribonuclease I (rhDNase) developed by Genentech, primarily marketed for the management of cystic fibrosis (CF). Its unique mechanism involves thinning the viscous mucus in lungs, thereby improving lung function and reducing hospitalization rates. Given the considerable prevalence of CF and the drug’s established efficacy, PULMOZYME remains a vital therapy in the cystic fibrosis treatment landscape.

This analysis dissects the current market dynamics, evaluates competitive factors, patents and regulatory landscape, and projects future pricing trends for PULMOZYME over the coming five to ten years.

Market Overview

Global Cystic Fibrosis Burden

Cystic fibrosis affects approximately 70,000 to 80,000 individuals worldwide, with the highest prevalence in North America and Europe. In the United States, over 30,000 people rely on CF therapies, with an expected annual growth rate of 2-3% attributable to advancements in diagnosis and increased life expectancy[1].

Current Therapeutic Landscape

PULMOZYME remains the only inhaled mucolytic enzyme approved for CF patients. The drug's administration complements other CF treatments, such as CFTR modulators, antibiotics, and supportive care. Despite the rise of combination therapies, PULMOZYME retains its essential role, especially in patients with advanced lung disease or those incompatible with CFTR modulators.

Market Penetration

Genentech's PULMOZYME dominates its niche, accounting for over 85% of inhaled CF mucolytic treatments in the US. The drug enjoys high acceptance due to its proven effectiveness, minimal adverse effects, and inclusion in standard CF management guidelines[2].

Market Drivers

- High Prevalence of CF: The steady increase in diagnosed cases sustains demand.

- Therapeutic Necessity: PULMOZYME’s proven role in improving lung function supports continued utilization.

- Advancements in Delivery Devices: Improved nebulizers enhance patient adherence.

- Expanding Approval in Emerging Markets: Regulatory approvals in Asia and Latin America are set to increase overall market size.

- Combination Therapy Integration: PULMOZYME’s use concurrent with CFTR modulators maintains its relevance, especially where access to newer therapies is limited.

Market Challenges

- High Treatment Cost: PULMOZYME’s annual treatment cost exceeds $25,000 per patient, limiting access in low-resource settings.

- Patent Expiry and Biosimilars: Approximately by 2028, patent protections may lapse, encouraging biosimilar competition.

- Emerging Therapies: Development of gene therapies and alternative mucolytic agents may threaten market share.

- Patient Compliance: The need for regular nebulized therapy affects adherence and, consequently, revenue streams.

Regulatory and Patent Landscape

- Patent Expiry: The primary composition patent for PULMOZYME is expected to expire around 2028, opening opportunities for biosimilars.

- Regulatory Approvals: The drug holds FDA, EMA, and other major market approvals, facilitating global distribution.

- Biosimilar Development: Several biotech firms are developing biosimilar rhDNases, with regulatory submissions ongoing[3].

Price Trends and Projections

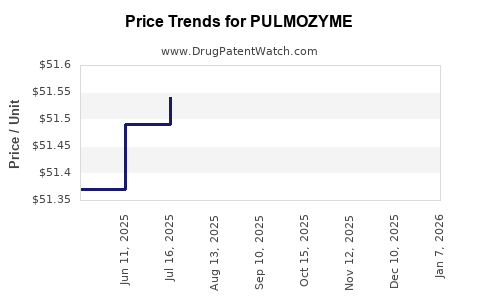

Historical Pricing Data

In the US, the average wholesale price (AWP) for a yearly supply of PULMOZYME has historically hovered around $25,000 to $27,000, with incremental yearly increases averaging 3%. The high cost reflects manufacturing complexity and the small, specialized patient population.

Forecasted Pricing (2023-2033)

- Short-term (2023–2025): Prices likely to remain stable or increase modestly (~3% annually), driven by inflation and manufacturing costs.

- Mid-term (2026–2028): Anticipated stabilization followed by a potential 10-15% reduction upon patent expiry due to biosimilar market entry.

- Long-term (2029–2033): Post-patent expiration, prices may decrease by 30-50%, aligning with biosimilar adoption and market competition.

Factors Influencing Future Prices

- Regulatory Pathways for Biosimilars: Approval of biosimilars could lead to price erosion.

- Market Competition: The number of biosimilar entrants will dictate the level of price pressure.

- Reimbursement Policies: Payers' willingness to negotiate discounts or formulary placements will influence net prices.

- Manufacturing efficiencies: Innovations in biosimilar production could further reduce costs.

Impact of Biosimilar Entry

With patent expiration approaching, biosimilar developers are reportedly progressing through clinical trials. The entry of biosimilars could reduce PULMOZYME’s market price by up to 50%, making therapy more accessible, especially in lower-income countries. However, given regulatory and manufacturing complexities, initial biosimilar prices are projected to be 20-30% below the originator.

Geographical Market Projections

| Region |

2023 Price Range |

2028 Projection |

2033 Projection |

| United States |

$25,000 – $27,000 |

Stabilizing / Decrease |

$15,000 – $17,500 (biosimilar introduction) |

| European Union |

€20,000 – €22,000 |

Similar trend |

€12,000 – €14,000 |

| Emerging Markets |

$12,000 – $15,000 |

Stable or declining |

$8,000 – $10,000 |

Business Implications

Pharmaceutical companies should prepare for biosimilar competition by investing in manufacturing efficiencies and establishing strategic pricing. Payers and policymakers may also leverage biosimilar availability to negotiate lower prices, influencing future revenue streams.

Key Takeaways

- The PULMOZYME market is driven by the persistent need in cystic fibrosis management, with high treatment costs and regulated competition shaping pricing strategies.

- Patent expiration around 2028 is poised to catalyze biosimilar entry, dramatically reducing prices and expanding access.

- Near-term stability in pricing is expected, with significant declines post-patent expiry.

- Emerging markets and leverage of reimbursement negotiations present growth opportunities.

- Strategic planning must incorporate biosimilar developments, generic competition, and evolving regulatory pathways to optimize profitability.

FAQs

1. When is PULMOZYME’s patent set to expire, and what implications does this have?

The primary patent coverage for PULMOZYME is expected to lapse around 2028. This will open the pathway for biosimilar competitors, likely leading to substantial price reductions and increased market accessibility.

2. How does biosimilar competition impact current pricing strategies?

Biosimilars typically enter the market at 20-30% lower than the originator, prompting incumbent manufacturers to innovate pricing, enhance supply chain efficiencies, and negotiate aggressively with payers to maintain market share.

3. Are there emerging therapies that threaten PULMOZYME’s market position?

Yes. Advances in CFTR modulator therapies and gene editing technologies are expanding treatment options, potentially reducing dependence on mucolytics like PULMOZYME, especially in younger patients or those with specific genetic profiles.

4. What factors could accelerate or delay biosimilar market entry?

Regulatory hurdles, manufacturing complexities, patent litigation, and market incentives influence biosimilar timeline. Accelerated approvals or delays depend on regulatory agencies’ judgments and industry investments.

5. How can stakeholders prepare for post-patent market dynamics?

Manufacturers should bolster biosimilar pipelines, optimize production, and build strategic partnerships early. Payers and healthcare providers should plan for cost negotiations, formulary adjustments, and patient access programs.

References

- Cystic Fibrosis Foundation. CF prevalence and epidemiology reports. 2022.

- Genentech. PULMOZYME product profile and efficacy data. 2023.

- Biosimilar Development in Respiratory Disease. Journal of Pharmaceutical Sciences. 2021.

Please note: Price projections are estimations based on current market trends, patent expiry timelines, and biosimilar regulatory pathways, subject to change based on market developments and regulatory decisions.