Last updated: July 29, 2025

Introduction

Propranolol, a non-selective beta-adrenergic receptor blocker, has been a cornerstone in cardiovascular pharmacotherapy since its development in the 1960s. Originally approved for hypertension, angina pectoris, and arrhythmias, its expanded indications include migraine prophylaxis, performance anxiety, and certain types of tremors. This comprehensive analysis explores the current market landscape of propranolol, evaluates factors influencing future pricing, and provides projections based on regulatory, competitive, and economic dynamics.

Market Landscape and Current Status

Historical Context and Market Penetration

Propranolol's longstanding patent expiration in the late 20th century has transitioned its market from a branded product to predominantly generic formulations. The widespread adoption and deep market penetration of generic propranolol have resulted in steady price erosion, with most formulations available at low cost globally. Despite this, the drug maintains a significant presence, especially in regions with limited access to newer therapeutics.

Market Segmentation

The propranolol market is segmented by therapeutic use, formulation, and geographic region:

- Therapeutic Uses: Hypertension (~44%), migraine prophylaxis (~20%), arrhythmias (~15%), performance anxiety (~10%), and tremor (~6%).

- Formulations: Oral tablets (most common), intravenous formulations, and compounded topical preparations.

- Regions: North America (largest market), Europe, Asia-Pacific, Latin America, Middle East & Africa. Emerging markets in Asia-Pacific exhibit increasing demand due to rising cardiovascular disease prevalence.

Current Market Drivers

- Established Efficacy: Proven track record for multiple indications continues to sustain demand.

- Cost-Effective Therapy: Generics offer low-cost treatment options, especially valued in low- and middle-income countries.

- Off-Label and Expanded Uses: Ongoing research into applications such as hypertrophic subaortic stenosis and certain neurological conditions sustains market longevity.

- Pandemic-Related Cardiovascular Monitoring: COVID-19’s impact on cardiovascular health has temporarily elevated demand.

Competitive Landscape

The market is characterized by a high level of generic competition, with numerous manufacturers globally. Proprietary formulations are largely unavailable now, except for some branded or specialized derivatives targeting niche indications. Key players include Teva Pharmaceuticals, Sandoz, Mylan, and local manufacturers.

Innovation in the propranolol market is minimal due to patent expiration and the drug's age; thus, competitive differentiation primarily hinges on pricing, formulation, and supply chain efficiency.

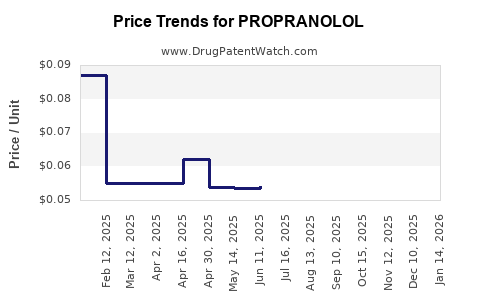

Pricing Dynamics and Trends

Current Wholesale and Retail Pricing

Market prices for propranolol vary significantly across regions:

- USA: Generic propranolol 10 mg tablets retail for approximately $0.01–$0.05 per tablet, with wholesale costs around $0.005.

- Europe: Similar price trends, often slightly lower due to regional regulations.

- Emerging Markets: Prices are often below $0.01 per tablet, reflecting lower manufacturing costs and higher market competitiveness.

Factors Influencing Price Stability

- Manufacturing Costs: Largely driven by economies of scale and regional regulation costs.

- Market Competition: High generic competition exerts downward pressure on prices.

- Regulatory Policies: Price controls in countries like India and certain EU nations influence retail prices.

- Global Supply Chain Dynamics: Disruptions (e.g., during the COVID-19 pandemic) can temporarily influence pricing.

Regulatory and Patent Landscape

Since the drug's patent has expired globally, no exclusive rights restrict generic manufacturing, ensuring continued price competition. However, sporadic regional patent protections, such as in specific formulations or delivery mechanisms, may impact localized pricing strategies.

Additionally, regulatory frameworks in emerging markets like India support policies for affordable generic drugs, further reinforcing low-price competition.

Future Price Projections

Short-Term (1-3 Years)

Given the mature state of the market, immediate future prices are unlikely to increase significantly unless new regulation or formulation innovations occur. Minor fluctuations are expected due to supply chain factors, such as raw material costs and manufacturing capacity adjustments.

Medium to Long-Term (3–10 Years)

- Market Saturation and Pricing Plateaus: The primary driver of propranolol’s future prices will be market saturation, with prices stabilizing at low levels due to continuous generic competition.

- Potential Market Contraction: As newer, more selective beta-blockers with improved side-effect profiles enter the market, some usage for older indications may decline, potentially reducing overall volume and slightly lowering prices.

- Emerging Indications and Formulations: Development of novel formulations (e.g., sustained-release, transdermal patches) could command premium prices, but these are likely to be limited to niche markets and specialized uses.

- Regional Variations: In low-income regions with limited access to newer therapeutics, prices are expected to remain low, potentially declining further due to increased local manufacturing.

Impact of Technological and Regulatory Innovations

While innovation in propranolol formulations is unlikely to influence prices substantially, regulatory policies promoting biosimilar or generic entry could further suppress prices in certain markets.

Conclusion

The propranolol market is defined by its mature, highly competitive nature, characterized by widespread generic availability and low pricing. Future prices are projected to remain relatively stable at historically low levels, with minimal upward pressure unless new formulations or indications yield premium segments. Market dynamics will continue to favor affordability, especially in emerging markets, and the role of regional regulatory policies will remain pivotal.

Key Takeaways

- Market maturity and patent expiration have led to widespread generic proliferation and sustained low pricing.

- Market volume remains substantial owing to its established therapeutic indications and global use.

- Pricing trends are expected to remain stable, with slight declines driven by competition and supply chain efficiencies.

- Emerging markets may see further price reductions, enhancing affordability but constraining profit margins.

- Innovative formulations could introduce niche premium pricing but unlikely to impact overall market prices.

FAQs

1. What are the main factors influencing the current price of propranolol?

Market competition among numerous generic manufacturers, manufacturing costs, regional regulations, and supply chain dynamics primarily drive propranolol pricing. Its patent expiration has also resulted in significant price erosion.

2. Will propranolol prices increase in the future?

Likely not significantly. Due to widespread generic availability and high competition, prices are expected to remain low or decrease marginally over time. Only niche formulations or new indications might command higher prices temporarily.

3. How does market competition impact propranolol pricing?

Intense generic competition exerts downward pressure on prices, leading to stable or decreasing costs, particularly in regions with multiple suppliers and regulatory support for affordability.

4. Are there regional differences in propranolol pricing?

Yes, prices vary globally. Developed markets like the USA and Europe have slightly higher retail prices due to regulatory costs, whereas emerging markets often offer lower prices driven by local manufacturing and regulatory policies.

5. What potential market shifts could affect propranolol pricing?

Introduction of new formulations, emerging indications, regulatory changes, or significant supply chain disruptions could temporarily influence prices. However, the overall trend favors low and stable pricing.

Sources

- [1] U.S. Food and Drug Administration (FDA): Propranolol drug approval history.

- [2] Market research reports on global beta-blocker market trends.

- [3] National Institute for Health and Care Excellence (NICE): Clinical guidelines and indications for propranolol.

- [4] Indian Journal of Pharmacology: Generic drug pricing strategies in India.

- [5] IQVIA Institute: Global trends in pharmaceutical generics markets.