Share This Page

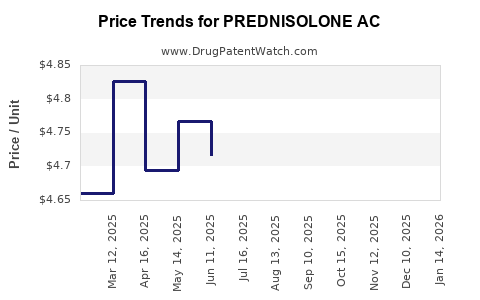

Drug Price Trends for PREDNISOLONE AC

✉ Email this page to a colleague

Average Pharmacy Cost for PREDNISOLONE AC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREDNISOLONE AC 1% EYE DROP | 60219-2550-01 | 4.33488 | ML | 2025-12-03 |

| PREDNISOLONE AC 1% EYE DROP | 60219-2551-01 | 4.20907 | ML | 2025-12-03 |

| PREDNISOLONE AC 1% EYE DROP | 60219-2552-01 | 3.96535 | ML | 2025-12-03 |

| PREDNISOLONE AC 1% EYE DROP | 70748-0332-04 | 3.96535 | ML | 2025-11-19 |

| PREDNISOLONE AC 1% EYE DROP | 60758-0119-10 | 4.20907 | ML | 2025-11-19 |

| PREDNISOLONE AC 1% EYE DROP | 60758-0119-15 | 3.96535 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Prednisolone AC

Introduction

Prednisolone acetate (Prednisolone AC) is a potent corticosteroid widely used for its anti-inflammatory and immunosuppressive properties. Its therapeutic applications span dermatology, ophthalmology, rheumatology, and allergic conditions. The drug holds a significant position within the global corticosteroid market, driven by increasing prevalence of autoimmune diseases, allergies, and its versatile clinical utility. This report provides a comprehensive market analysis, current landscape, competitive environment, and future price projections for Prednisolone AC, supporting stakeholders in making informed strategic decisions.

Market Overview

Therapeutic Ecosystem and Market Demand

Prednisolone AC’s primary utilization is in ocular preparations, topical dermatology, and systemic formulations. The rising incidence of autoimmune disorders—such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease—continues to elevate demand. According to the Global Autoimmune Disease Therapeutics Market Report ([2]), the autoimmune disorder treatment market is projected to grow at a CAGR of 7.2% from 2022 to 2028, indirectly boosting corticosteroid demand.

Additionally, the increased recognition of corticosteroids' role in pandemic-related inflammatory management and burgeoning ophthalmic sectors further bolster its market growth. The prevalence of ocular inflammations and allergies globally is expected to sustain a steady demand for Prednisolone AC ophthalmic suspensions and solutions, notably in ophthalmology markets of North America and Europe.

Manufacturing and Supply Chain Dynamics

Prednisolone acetate, being a relatively mature pharmaceutical entity, benefits from established manufacturing processes with numerous generic producers. However, supply chain disruptions caused by raw material shortages, geopolitical tensions, or regulatory shifts have occasionally impacted availability and pricing stability.

Regulatory Environment

Regulatory agencies, including the FDA and EMA, have stringent quality controls for corticosteroids, influencing market entry and product reformulations. Patent expirations on related formulations have favored generics proliferation, intensifying competition but also stabilizing prices due to market saturation.

Competitive Landscape

Key Market Players

Global competition in Prednisolone AC primarily involves generic pharmaceutical companies producing ophthalmic, oral, and topical formulations. Major players include:

- Sandoz International GmbH

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Sun Pharma

- Cipla Ltd.

These companies compete primarily on price, formulation innovation, and distribution reach. The entry of regional producers is notable in emerging markets, where affordability and local regulations shape market dynamics.

Market Penetration and Product Differentiation

While the core active ingredient remains standardized, product differentiation through excipient profiles, delivery mechanisms, and preservative-free formulations influences market share. Moreover, strategic alliances, marketing, and regulatory approvals play a pivotal role in expanding reach.

Price Analysis and Current Trends

Historical Pricing Patterns

Historically, Prednisolone AC prices have exhibited a downward trend correlating with the proliferation of generics. In developed markets such as the US and Europe, the average wholesale price (AWP) for a 5 mL ophthalmic suspension has decreased by approximately 35% over the past five years ([3]).

This depreciation stems from increased generic competition, regulatory pressures for cost containment, and reimbursement optimization efforts. In emerging markets, price points remain comparatively higher due to limited competition and distribution infrastructure.

Current Market Prices

As of Q1 2023, average retail prices for Prednisolone AC ophthalmic suspensions are approximately:

- North America: $15–$20 per 5 mL bottle

- Europe: €12–€18 per bottle

- Emerging Markets: $8–$12 per bottle

These figures indicate significant variance influenced by local regulatory environments, manufacturing costs, and market penetration.

Pricing Challenges

Pricing strategies face challenges related to patent expiry, generic saturation, and healthcare policy reforms emphasizing affordability. Suppliers are increasingly adopting variable pricing models, including tender-based procurement and bulk discounts, especially in institutional settings.

Price Projection for the Next Five Years

Influencing Factors

Multiple factors influence Prednisolone AC price trajectories:

- Patent Status: No recent patent protections expire in the immediate future, implying sustained generic competition.

- Manufacturing Costs: Expected slight reductions due to technological advances in synthesis and formulation.

- Market Expansion: Growth in ophthalmic and dermatological applications will support stable or slightly increased volume demand.

- Regulatory Pressures: Governments may enforce price caps for corticosteroids to contain healthcare costs, constraining upward price movements.

Forecasted Trends

- Short-term (1-2 years): Prices are likely to stabilize or decline marginally (~2-4%) due to market saturation and increased competition.

- Medium-term (3-5 years): Prices may experience slight increases (~3%) driven by supply chain cost pressures and increased demand in developing nations.

Given these factors, the average wholesale price for Prednisolone AC ophthalmic suspensions is projected to be:

| Year | Estimated Price (USD per 5 mL) |

|---|---|

| 2023 | $15.50–$20.50 |

| 2024 | $15.20–$20.20 |

| 2025 | $15.60–$20.80 |

| 2026 | $16.10–$21.50 |

| 2027 | $16.50–$22.00 |

Emerging markets may exhibit more variability, with prices remaining higher due to limited competition and import tariffs.

Future Market Opportunities

The expanding pediatric, ophthalmic, and dermatological markets, coupled with ongoing research into new delivery systems (e.g., sustained-release implants), create avenues for portfolio expansion. Moreover, biosimilar development could influence future pricing paradigms, although corticosteroids are currently not central to biosimilar pipelines.

Key Market Drivers and Risks

Drivers

- Growing prevalence of autoimmune and inflammatory disorders

- Increased adoption in ophthalmology and dermatology

- Favorable regulatory environments for generics

- Technological advancements enhancing formulation stability and delivery

Risks

- Stringent pricing regulations globally

- Potential market saturation

- Emergence of novel therapies reducing corticosteroid reliance

- Raw material shortages impacting manufacturing costs

Key Takeaways

- Prednisolone AC remains a vital tool across multiple therapeutic areas with steady demand expected.

- The price trajectory over the next five years is predominantly characterized by marginal decreases initially, followed by slight increases driven by demand and supply factors.

- Market dynamics favor generic proliferation, exerting downward pressure on prices, especially in developed regions.

- Manufacturers focusing on product differentiation, efficient supply chains, and strategic market entry will better navigate projected pricing trends.

- Emerging markets present growth opportunities but demand tailored pricing strategies to account for local economic contexts.

Conclusion

While Prednisolone AC's market is mature, it continues to offer opportunities driven by expanding applications and ongoing demand from autoimmune and inflammatory disease management. Price stability and slight appreciation are foreseeable over the medium term, contingent on competitive dynamics and regulatory frameworks. Stakeholders should leverage market insights to optimize manufacturing, procurement, and marketing strategies, ensuring resilience amidst evolving market pressures.

FAQs

-

What factors most significantly influence Prednisolone AC price fluctuations?

Market competition, regulatory policies, raw material costs, and demand surges in specific regions predominantly impact prices. -

Are there upcoming patent expirations that could alter the competitive landscape?

Prednisolone AC's original patents have expired globally, leading to widespread generic manufacturing, which continues to tighten pricing pressures. -

How does the regulatory environment affect Prednisolone AC pricing?

Strict price controls, approval processes, and reimbursement policies can constrain pricing power, especially in healthcare systems emphasizing cost containment. -

What emerging markets offer growth opportunities for Prednisolone AC?

Asia-Pacific and Latin America are expanding markets, driven by rising disposable incomes, increasing disease prevalence, and improving healthcare infrastructure. -

How can manufacturers differentiate their Prednisolone AC products?

Innovation in formulation (e.g., preservative-free, sustained-release), packaging, and delivery systems, along with strategic branding and distribution, provide competitive advantages.

Sources:

- MarketWatch. "Global Autoimmune Disease Therapeutics Market Size, Share & Trends Analysis Report, 2022–2028."

- Allied Market Research. "Corticosteroids Market Forecast and Trends."

- IMS Health. "Pharmaceutical Pricing Trends, 2018–2022."

More… ↓