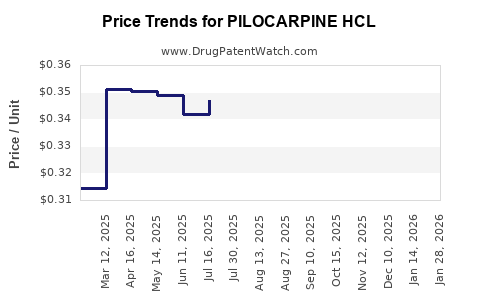

Drug Price Trends for PILOCARPINE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for PILOCARPINE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PILOCARPINE HCL 5 MG TABLET | 00574-0792-01 | 0.19978 | EACH | 2024-11-20 |

| PILOCARPINE HCL 5 MG TABLET | 16714-0121-01 | 0.19978 | EACH | 2024-11-20 |

| PILOCARPINE HCL 5 MG TABLET | 00527-1313-01 | 0.19978 | EACH | 2024-11-20 |

| PILOCARPINE HCL 5 MG TABLET | 50268-0652-11 | 0.19978 | EACH | 2024-11-20 |

| PILOCARPINE HCL 5 MG TABLET | 00115-5922-01 | 0.19978 | EACH | 2024-11-20 |

| PILOCARPINE HCL 7.5 MG TABLET | 59651-0225-01 | 0.34838 | EACH | 2024-11-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Best Wholesale Price for PILOCARPINE HCL

| Drug Name | Vendor | NDC | Count | Price ($) | Price/Unit ($) | Unit | Dates | Price Type |

|---|---|---|---|---|---|---|---|---|

| PILOCARPINE HCL 5MG TAB | Amerisource Health Services LLC dba American Health Packaging | 68084-0928-25 | 5X6 | 43.23 | 2024-01-01 - 2028-09-14 | Big4 | ||

| PILOCARPINE HCL 5MG TAB | Amerisource Health Services LLC dba American Health Packaging | 68084-0928-25 | 5X6 | 51.50 | 2024-01-01 - 2028-09-14 | FSS | ||

| PILOCARPINE HCL 5MG TAB | Amerisource Health Services LLC dba American Health Packaging | 68084-0928-25 | 5X6 | 43.75 | 2023-09-15 - 2028-09-14 | Big4 | ||

| PILOCARPINE HCL 5MG TAB | Amerisource Health Services LLC dba American Health Packaging | 68084-0928-25 | 5X6 | 51.74 | 2023-09-15 - 2028-09-14 | FSS | ||

| PILOCARPINE HCL 5MG TAB | AvKare, LLC | 00527-1313-01 | 100 | 38.97 | 0.38970 | EACH | 2023-06-15 - 2028-06-14 | FSS |

| PILOCARPINE HCL 7.5MG TAB | AvKare, LLC | 00527-1407-01 | 100 | 62.13 | 0.62130 | EACH | 2023-06-15 - 2028-06-14 | FSS |

| >Drug Name | >Vendor | >NDC | >Count | >Price ($) | >Price/Unit ($) | >Unit | >Dates | >Price Type |