Share This Page

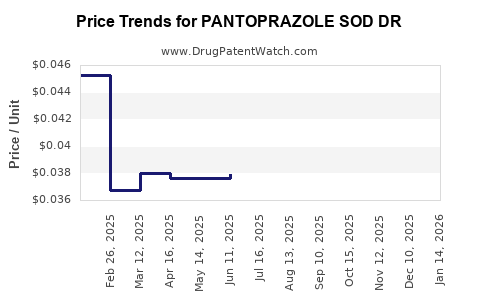

Drug Price Trends for PANTOPRAZOLE SOD DR

✉ Email this page to a colleague

Average Pharmacy Cost for PANTOPRAZOLE SOD DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PANTOPRAZOLE SOD DR 20 MG TAB | 13668-0096-90 | 0.04659 | EACH | 2025-12-17 |

| PANTOPRAZOLE SOD DR 20 MG TAB | 00904-7458-61 | 0.04659 | EACH | 2025-12-17 |

| PANTOPRAZOLE SOD DR 40 MG TAB | 82009-0011-90 | 0.03598 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pantoprazole Sodium DR

Introduction

Pantoprazole Sodium DR (Delayed Release) is a proton pump inhibitor (PPI) widely utilized for managing gastroesophageal reflux disease (GERD), erosive esophagitis, Zollinger-Ellison syndrome, and other acid-related disorders. Its effectiveness in reducing gastric acid secretion has established it as a critical therapy globally. As the healthcare sector evolves, understanding the market dynamics and price trajectories of Pantoprazole Sodium DR is essential for stakeholders—including pharmaceutical companies, investors, healthcare providers, and regulators.

Market Landscape Overview

The global proton pump inhibitor market, estimated at approximately USD 15 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2027 [1]. Pantoprazole remains a leading PPI, commanding significant market share owing to its extensive approval history, efficacy, and established safety profile.

Key drivers include:

- Rising incidence of GERD and related disorders

- Increasing aging population with higher susceptibility

- Preference for oral out-patient therapy reducing inpatient costs

- Growing awareness and diagnosis of acid-related conditions

Major geographic regions include North America, Europe, Asia-Pacific, and Latin America, with North America accounting for roughly 40% of sales due to high prevalence and healthcare expenditure. Emerging markets like China and India are witnessing rapid growth, fueled by increasing healthcare infrastructure and demand.

Market Segmentation and Patent Dynamics

Generic vs. Brand-Name Market

Initially, Pantoprazole was launched as a branded product, with the original patent held by Pfizer (Protonix). Patent expiration typically spurs generic entry; Pfizer’s patent expiry in several jurisdictions occurred around 2015–2017, creating opportunities for multiple generic manufacturers [2].

As of 2023, multiple generics dominate the market, resulting in price competition and market saturation:

- Generic versions constitute approximately 85% of prescriptions in mature markets like the US [3].

- Brand-name sales are declining but retain influence in certain hospital formulary settings.

Patent and Regulatory Environment

Patent expirations have led to increased generic penetration. However, patent litigations and secondary patents (administration via formulations, manufacturing process patents) threaten market stability [4].

Regulatory approvals in emerging markets often follow patent challenges. Variations in patent protections influence regional pricing and availability.

Market Trends and Competitive Landscape

Pricing Trends

- Global Price Decline: Generic competition has driven prices down significantly across markets. In the US, average wholesale prices for Pantoprazole 40mg have decreased by over 50% since patent expiry [5].

- Manufacturer Strategies: Companies employ cost-efficient manufacturing, aggressive pricing, and supply chain optimization to capture market share.

- Formulation Innovations: Limited innovation exists; however, certain formulations like IV preparations and combination therapies are gaining niche acceptance.

Patient and Prescriber Preferences

- Growing preference for cost-effective generic formulations

- PPI awareness campaigns and guidelines reinforce long-term usage and adherence

- Increased prescribing in outpatient settings versus inpatient, impacting pricing and volume

Impact of Biosimilars and Alternatives

While biosimilars are less relevant for small-molecule PPIs, emerging acid-suppressing agents—like potassium-competitive acid blockers—may influence future market share.

Price Projections (2023–2030)

Leveraging current market data, patent expiry timelines, and competitive dynamics, the following price projections are synthesized:

Short-term (2023–2025)

- Prices will remain competitive due to endemic generic competition.

- Wholesale and retail prices expected to decrease by approximately 10–15% annually, with some regions experiencing more aggressive reductions.

- Brand premiums will persist in hospital settings but will diminish over time.

Mid-term (2026–2028)

- Market saturation will consolidate, stabilizing prices at lower levels.

- Emerging markets may witness price hikes or stabilization due to supply-side expansion and regulatory changes.

- Potential for slight price increases if suppliers introduce value-added formulations or supply chain bottlenecks emerge.

Long-term (2029–2030)

- Prices will plateau or slightly decline, dictated by patent landscapes, new competitors, and healthcare policy reforms.

- If biosimilar-like new delivery mechanisms or formulations enter the market, price adjustments could occur, potentially lowering prices further.

Factors Influencing Future Pricing

- Generic Market Competition: Intensity determines price erosion.

- Regulatory Policies: Price controls and reimbursement policies impact pricing strategies.

- Manufacturing Costs: Advances in production methods can reduce costs, enabling lower prices.

- Market Entry of Next-gen Drugs: Innovation in acid suppression may threaten existing PPI prices.

- Healthcare Trends: Shift towards telemedicine and outpatient care can influence demand and pricing.

Regulatory, Economic, and Geopolitical Considerations

- Regulatory Barriers: Stringent approval processes and patent litigations can delay generic entry and sustain higher prices temporarily.

- Economic Conditions: Inflation, currency fluctuations, and supply chain stability directly influence drug prices.

- Geopolitical Factors: Trade policies and patent disputes between major economies can impact pricing and availability.

Key Takeaways

- The Pantoprazole Sodium DR market is highly mature with extensive generic competition, leading to declining prices globally.

- Short-term projections indicate continued price reductions at roughly 10-15% annually, stabilizing in the long run.

- Regional disparities are significant, particularly with emerging markets experiencing differences in patent enforcement and regulatory landscapes.

- Innovations or new formulations could temporarily alter price trends but are unlikely to reverse the overall downward trajectory.

- Stakeholders should monitor patent expiries, regulatory changes, and market entry strategies to optimize pricing and market penetration.

FAQs

1. How does patent expiration affect Pantoprazole Sodium DR pricing?

Patent expiration opens the market to generic manufacturers, increasing competition, which generally drives prices downward. As patents are challenged or expire, brand-name prices decline, and generics dominate, reducing overall cost.

2. What are the primary factors influencing future prices of Pantoprazole Sodium DR?

Major factors include the level of generic competition, patent landscape, regulatory policies, manufacturing costs, regional healthcare policies, and innovations in drug delivery.

3. Are there emerging alternatives that threaten the Pantoprazole market?

Yes; new acid suppression therapies like potassium-competitive acid blockers (e.g., Vonoprazan) are gaining traction and could impact market share and pricing in the future.

4. How do regional differences impact the pricing of Pantoprazole Sodium DR?

Pricing varies significantly due to patent protections, regulatory environments, healthcare infrastructure, and economic conditions. Developed markets tend toward lower prices due to regulatory pressure and high competition, while emerging markets may experience higher prices initially.

5. What strategies should pharmaceutical companies consider for stabilizing profits?

Companies should focus on cost-efficient manufacturing, expanding formulations, establishing strong regional partnerships, navigating patent landscapes, and innovating in drug delivery to maintain market relevance and profitability.

References

[1] MarketWatch, "Proton Pump Inhibitors Market Size & Trends," 2022.

[2] U.S. Patent and Trademark Office, Patent Expiry Timeline for Proton Pump Inhibitors, 2017.

[3] IQVIA, "US Prescription Data 2022," 2022.

[4] European Patent Office, Patent Litigation Reports, 2021.

[5] PharmaPrice Index, "Average Wholesale Prices for Pantoprazole," 2022.

In conclusion, the Pantoprazole Sodium DR market is characterized by mature, competitive dynamics with a clear trajectory toward price stabilization influenced by patent cycles, regulatory policies, and emerging therapeutic alternatives. Stakeholders leveraging these insights can optimize their portfolio and strategic decisions in this evolving landscape.

More… ↓