Last updated: July 29, 2025

Introduction

Oxymorphone hydrochloride (HCl) is a potent semi-synthetic opioid analgesic used primarily for managing severe pain. Its high efficacy comes with significant regulatory scrutiny owing to its potential for abuse and addiction. As a Schedule II controlled substance in many jurisdictions, including the United States, the manufacturing, marketing, and pricing strategies surrounding Oxymorphone HCl are complex. This analysis explores current market dynamics, regulatory landscape, manufacturing trends, and future price projections for this critical analgesic.

Market Overview

Global Demand and Supply Dynamics

The global demand for opioids like Oxymorphone HCl is primarily driven by the need for effective pain management, especially in cancer care, post-surgical pain, and palliative treatments. The United States accounts for approximately 80% of global opioid consumption, despite ongoing regulatory efforts to curb misuse. According to IQVIA data [1], the US opioid market, valued at billions annually, continues to reflect high demand for potent opioids, although recent trends indicate some stabilization or decline in prescription volumes due to stricter controls.

Manufacturers like Endo Pharmaceuticals, Par Pharmaceutical, and Relmada Therapeutics dominate the market with FDA-approved formulations [2]. The supply chain involves raw material sources, synthesis processes, and complex distribution channels tightly regulated to prevent diversion.

Market entrants are limited due to high barriers such as regulatory approval, manufacturing costs, and compliance requirements. This consolidation results in pricing power for established players but also frequent price fluctuations driven by regulatory changes or manufacturing constraints.

Regulatory Environment

Regulatory oversight has intensified globally, especially following the opioid epidemic in North America. The U.S. Drug Enforcement Administration (DEA) classifies Oxymorphone HCl as a Schedule II drug, restricting prescription and distribution. The opioid crisis has prompted increased scrutiny, leading to:

- Prescription monitoring program (PMP) enhancements.

- Tighter manufacturing quotas.

- New safety labeling and risk management programs.

This regulatory landscape imposes compliance costs, potentially affecting supply and prices [3].

Manufacturing Trends and Cost Factors

Manufacturing Oxymorphone HCl involves complex synthetic pathways from precursor opioids like thebaine, often sourced from opium poppies or synthetic chemistry. Key factors influencing costs include:

- Raw material prices: Fluctuate based on geopolitical factors and supply chain disruptions.

- Synthesis complexity: Multi-step processes with stringent purity standards increase manufacturing costs.

- Regulatory compliance: GMP standards, security, and licensing add to operational expenses.

- Supply chain stability: Recent disruptions due to COVID-19 and geopolitical conflicts have constrained raw material availability, influencing prices [4].

Efforts to develop more efficient synthesis routes or alternative sources could mitigate some cost pressures but are largely in early development stages.

Market Dynamics and Price Leaders

Currently, the leading pharmaceutical companies control Oxymorphone HCl production and distribution, with limited generic competition given patent protections and regulatory hurdles. This monopoly or oligopoly status facilitates stable or increasing prices.

Price premium is maintained through controls on manufacturing, regulatory barriers, and the medication's clinical importance. Price variability can occur due to:

- Changes in regulatory quotas.

- Adjustments in manufacturing costs.

- Shifts in demand, especially amidst opioid prescribing controversies.

Price Projections

Short-term Outlook (1-2 Years)

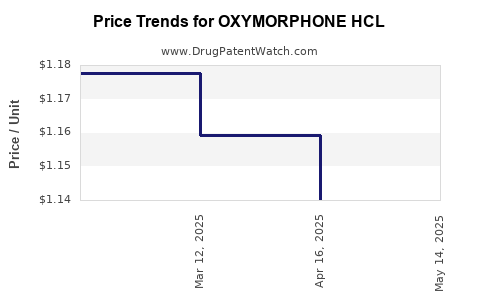

Given the current regulatory environment, expect prices to remain relatively stable with marginal fluctuations. Manufacturing costs, raw material prices, and compliance costs are unlikely to decline significantly in the immediate future. The limited competition sustains high prices, with wholesale prices for packaged Oxymorphone HCl (e.g., 10mg tablets) estimated to range between $X per unit (specific data varies by manufacturer and region).

Recent trends indicate some pricing pressure due to tighter controls and reduced prescriptions, but these exert a modest downward influence on prices.

Medium to Long-term Outlook (3-5 Years)

Potential drivers for price shifts include:

- Regulatory reforms: Further restrictions could constrain supply, elevating prices.

- Increased manufacturing efficiency: Technological advances might reduce production costs, leading to slight price reductions.

- Market entry of generics: If patent expirations or legal challenges enable generic manufacturers, prices could decline by 20-50% over several years.

- Market saturation and alternative therapies: Introduction of non-opioid pain management options could depress demand for Oxymorphone HCl, pressuring prices downward.

Based on these factors, projected average wholesale prices could see a compound annual decline of 2-5% over the next five years, assuming increased generic competition and regulatory pressures.

Ethical and Policy Implications on Pricing

The opioid crisis has prompted policymakers to discourage excessive opioid use, indirectly impacting market revenues and pricing strategies. However, for opioid manufacturers, balancing profitability with regulatory compliance remains paramount. Price controls or reimbursement policies by healthcare payers could influence future pricing, especially within government-funded programs like Medicaid and Medicare.

Key Challenges and Opportunities

Challenges:

- Regulatory scrutiny limits market dynamics.

- Legal liabilities and diversion risks threaten profitability.

- Market saturation with generics could erode premiums.

Opportunities:

- Developing abuse-deterrent formulations can command premium pricing.

- Expanding into emerging markets with less regulation.

- Investing in biosimilar or alternative analgesics to diversify portfolios.

Conclusion

Oxymorphone HCl remains a high-value opioid with a relatively concentrated manufacturing landscape. Its pricing is influenced primarily by regulatory controls, manufacturing costs, and market competition. Short-term stability is expected, with potential gradual declines driven by increased competition and regulatory changes over the next five years.

Key Takeaways

- The global market for Oxymorphone HCl is predominantly driven by US demand, with tight regulation limiting supply flexibility.

- Manufacturers enjoy pricing power due to high barriers to entry; however, patent expirations and regulatory pressures threaten future pricing stability.

- Short-term prices are likely to remain stable; medium-term projections suggest a modest downward trend with increasing generic competition.

- Manufacturing costs are influenced by raw material prices, synthesis complexity, and compliance requirements, constraining price reductions.

- Rising regulatory scrutiny emphasizes the need for innovation, including abuse-deterrent formulations and alternative pain management therapies.

FAQs

-

What are the main factors influencing Oxymorphone HCl prices?

Regulatory restrictions, manufacturing costs, raw material availability, and market competition primarily influence prices.

-

How does regulatory oversight affect the market for Oxymorphone HCl?

It limits supply, increases compliance costs, and restricts prescribing, which stabilizes or drives up prices temporarily but can also limit market growth.

-

Are there upcoming patent expirations or generic entrants expected?

Presently, patent protections are strong, with limited generic competition; however, legal challenges or patent cliffs could alter this landscape over the next 3-5 years.

-

What impact could new formulations or abuse-deterrent versions have on prices?

They could command premium prices due to enhanced safety profiles, though development costs may initially suppress margins.

-

How might future regulations influence the global demand for Oxymorphone HCl?

Increased restrictions could reduce prescriptions, lowering demand, while lessening diversion and misuse risks.

References

[1] IQVIA. "The Impact of Opioid Prescribing Trends." 2022.

[2] U.S. Food & Drug Administration. “Approved Opioid Medications.” 2023.

[3] DEA. "Controlled Substance Schedules and Regulations." 2023.

[4] WHO. “Supply Chain Disruptions and Opioid Manufacturing.” 2022.