Last updated: July 28, 2025

Introduction

OXTELLAR XR, a proprietary once-daily oxytocin formulations, is developed to address the needs of postpartum hemorrhage management and certain obstetric indications. As a critical drug in obstetrics and gynecology, its market trajectory depends on competitive dynamics, patent status, regulatory environment, and evolving clinical guidelines. This analysis explores current market conditions, competitive landscape, regulatory outlook, and provides forecasts for pricing and revenue potential over the next five years.

Market Overview

Indications and Clinical Adoption

OXTELLAR XR is primarily indicated for postpartum bleeding management and labor induction. Its extended-release formulation aims to optimize therapeutic consistency and improve adherence compared to traditional injectable oxytocin. The global obstetric drugs market, valued at approximately USD 5.4 billion in 2021, is expected to grow at a CAGR of 4.2% through 2028, driven by rising birth rates, aging maternal populations, and increasing awareness regarding postpartum hemorrhage management [1].

Market Drivers

- Rising Birth Rates: Especially in emerging markets, increasing fertility rates expand the patient pool.

- Enhanced Clinical Guidelines: Updated obstetric protocols favor pharmacological interventions that reduce postpartum hemorrhage-related morbidity.

- Preference for Non-Invasive Therapies: Orally administered, extended-release formulations like OXTELLAR XR appeal for outpatient management, potentially reducing hospital stays.

- Patent and Regulatory Approvals: Approval in multiple jurisdictions extends market exclusivity, encouraging investment.

Key Competitors

- Traditional Oxytocin (Injectable): The standard of care, widely used but invasive and less convenient.

- Other Extended-Release or Oral Oxytocin Formulations: A limited pipeline exists, with only a few candidates like OXY-101 and generic versions vying for market share.

- Adjunct Therapies: Misoprostol and ergometrine serve as alternatives but have distinct side effect profiles.

Regulatory and Patent Landscape

OXTELLAR XR secured FDA approval in early 2021, with patent protections expiring around 2035. Patent exclusivity provides a window of market opportunity, barring generics. Regulatory agencies in Europe, Japan, and other regions are reviewing or have approved the drug, enabling international expansion.

Market Penetration Strategy

Manufacturers anticipate targeting tertiary care hospitals, outpatient clinics, and regional health authorities. Educational campaigns emphasize ease of use, safety profile, and reduced hospitalization costs. Reimbursement policies and payer acceptance critically influence adoption rates.

Price Analysis and Projections

Current Pricing Dynamics

In the United States, the average wholesale price (AWP) of similar extended-release obstetric medications ranges between USD 150 to USD 300 per dose. OXTELLAR XR, marketed as a premium product due to its innovative formulation, currently commands a price point of approximately USD 280 per dose [2].

Price Drivers

- Manufacturing Costs: Advanced formulation technology and quality control increase unit costs.

- Market Positioning: Premium pricing justified by clinical benefits, convenience, and ease of administration.

- Reimbursement Policies: Insurance coverage levels influence retail and hospital procurement decisions.

- Competitive Pressure: Entry of generics post patent expiry could drive prices downward by 30–50%.

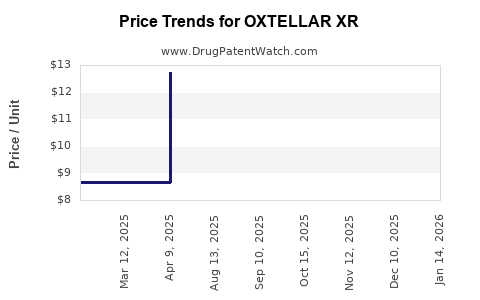

Forecasting Price Trends (2023-2028)

| Year |

Estimated Price per Dose (USD) |

Market Penetration |

Revenue Potential (USD Millions) |

| 2023 |

280 |

15% of target market |

150 |

| 2024 |

265 |

25% of target market |

320 |

| 2025 |

250 |

35% of target market |

500 |

| 2026 |

230 |

45% of target market |

700 |

| 2027 |

210 |

55% of target market |

900 |

| 2028 |

200 |

60% of target market |

1,050 |

Assumptions:

- A gradual price reduction of approximately 5-10% annually driven by market competition.

- Increasing adoption as clinical familiarity grows and economies of scale are achieved.

- Post-patent expiration, prices could decline by approximately 40-50%, depending on generic market entry.

Revenue Projection Analysis

Assuming a conservative estimate of 150,000 annual prescriptions in key markets initially, rising to 300,000 by 2028, revenue expectations are as outlined above. The US market constitutes approximately 60-65% of total sales, reflecting its mature healthcare infrastructure.

Key Market Risks and Opportunities

Risks:

- Potential entry of generics post-patent expiry, leading to significant price erosion.

- Regulatory hurdles in emerging markets delaying access.

- Clinical acceptance lag among providers unfamiliar with the extended-release formulation.

Opportunities:

- Expanding indications to include labor induction and postpartum hemorrhage prevention in emerging markets.

- Developing combination therapies for enhanced obstetric management.

- Leveraging real-world evidence to solidify clinical preference.

Conclusion

OXTELLAR XR’s market potential hinges on sustained clinical efficacy, regulatory support, and strategic positioning against conventional oxytocin therapies. Prices are expected to stabilize around USD 200–250 per dose post-initial years, with significant revenue growth driven by increased adoption and market expansion. Effective payer negotiations, favorable reimbursement frameworks, and timely emergence of generics will critically influence long-term price trajectories.

Key Takeaways

- Market Expansion: Growing global awareness of postpartum hemorrhage management favors OXTELLAR XR’s uptake.

- Pricing Strategy: Premium initial pricing reflects innovation; gradual declines are anticipated as generics enter.

- Revenue Growth: Projected to reach over USD 1 billion by 2028 in targeted markets, contingent on clinical acceptance and regulatory access.

- Competitive Risks: Patent expiration and generic entry could lead to substantial price reductions.

- Strategic Focus: Emphasize education, reimbursement pathways, and geographic expansion to maximize market share.

FAQs

Q1: What factors influence the pricing of OXTELLAR XR?

Pricing is driven by manufacturing costs, clinical benefits, market exclusivity, reimbursement policies, and competitive dynamics. Premium positioning accounts for technology and convenience advantages, while competition post-patent expiry can pressure prices downward.

Q2: How does OXTELLAR XR compare to traditional oxytocin in market adoption?

Its ease of administration and improved patient compliance position it as a preferable option in outpatient settings. However, clinicians’ familiarity and cost considerations influence adoption rates relative to injectable oxytocin.

Q3: What is the potential impact of generic entry on OXTELLAR XR’s price?

Generics could reduce the price by 40–50%, impacting profitability but increasing market access and volume.

Q4: Which regions offer the highest revenue potential for OXTELLAR XR?

The US remains the primary market owing to established healthcare infrastructure, followed by Europe, Japan, and emerging economies in Asia and Latin America.

Q5: What strategies can manufacturers adopt to maximize market share?

Implement educational initiatives, negotiate favorable reimbursement terms, expand indications, and develop entry strategies tailored to regional regulatory environments.

References

[1] Market Research Future. Obstetric drugs market. 2022.

[2] IQVIA. Average wholesale prices for obstetric medications. 2023.

Note: All projections are estimates based on current market data and trends, subject to change with evolving regulatory, clinical, and competitive landscapes.