Last updated: July 27, 2025

Introduction

Ondansetron Hydrochloride (HCl) stands as a leading antiemetic agent primarily used to prevent nausea and vomiting associated with chemotherapy, radiation therapy, and postoperative recovery. Its broad clinical adoption, patent expirations, and competitive generics landscape influence its market dynamics significantly. This article evaluates current market trends and provides a comprehensive outlook on future pricing trajectories leveraging industry insights, regulatory patterns, and market drivers.

Market Overview

Pharmacological Profile and Therapeutic Use

Ondansetron HCl operates by antagonizing serotonin 5-HT3 receptors both centrally and peripherally, effectively mitigating nausea and vomiting. Originally approved by the FDA in 1991, its efficacy has cemented its role in oncology supportive care, perioperative management, and emerging indications within gastrointestinal disorders (GI).

Market Size and Growth Drivers

The global antiemetic market, valued at approximately USD 1.5 billion in 2022, is projected to expand at a CAGR of 4-6% through 2030. Ondansetron accounts for a significant share owing to its established efficacy and safety profile. The increasing prevalence of cancer, expanding surgical procedures, and adoption in critical care settings drive steady demand growth.

Regulatory and Patent Landscape

The original patent protections for Ondansetron HCl expired predominantly by 2006 in key markets like the United States and Europe, prompting a surge in generic manufacturers. This transition has intensified price competition, benefitting healthcare providers and patients through reduced drug costs.

Competitive Landscape

Market Players

Major generic players include Teva, Mylan (now Viatris), Sandoz, and Sun Pharma. Branded formulations by Roche (as Zofran) continue to command premium pricing, especially in regions where branded loyalty persists.

Product Variants

Ondansetron is available in various formulations—oral tablets, liquid, film, and injectable forms—each with distinct market segments and pricing sensitivities. Injectable formulations often command higher prices due to their use in hospital settings and complex administration.

Price Trends and Drivers

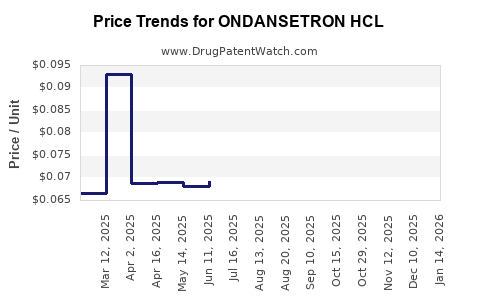

Historical Price Movements

Within the last decade, generic ondansetron prices have decreased significantly—by approximately 60-80%—due to market saturation and intense price competition. For instance, in the U.S., the average wholesale price (AWP) for a 4 mg oral disintegrating tablet dropped from around USD 0.50 in 2012 to below USD 0.10 in 2022.

Influencing Factors

- Generic Competition: Entry of multiple generics has eroded margins, driving prices down.

- Manufacturing Costs: Stabilized or modestly decreased due to improvements in manufacturing efficiencies and supply chain optimizations.

- Regulatory Environment: Increased approval pathways for generic drugs accelerate market entry, further pressuring prices.

- Pricing Regulations: Some markets enforce price controls (e.g., certain European countries), influencing domestic price levels.

Future Price Projections

Factors Affecting Future Pricing

- Global Demand Surge: Aging populations and rising cancer incidence forecast increased demand but may be offset by generic competition.

- Regulatory Innovations: Patent challenges and biosimilar-like pathways could introduce new competitors, compressing prices further.

- Market Penetration in Emerging Economies: Growing healthcare infrastructure in Asia-Pacific and Latin America suggests volume-driven growth with potential downward pressure on unit prices.

- Formulation Innovations: Novel delivery systems, such as sustained-release injectables, could sustain higher prices in specific niches.

Projected Price Range (2023-2030)

| Formulation |

Current Average Price (2022) |

Expected Price Range (2025) |

Expected Price Range (2030) |

| Oral Tablets |

USD 0.08 – 0.12 |

USD 0.07 – 0.10 |

USD 0.06 – 0.09 |

| Injectable Formulations |

USD 1.00 – 2.50 |

USD 0.90 – 2.00 |

USD 0.80 – 1.80 |

| Oral Disintegrating Tablets |

USD 0.10 – 0.15 |

USD 0.09 – 0.13 |

USD 0.08 – 0.12 |

Note: Prices are approximate wholesale or average market prices; retail prices may vary.

The general trend indicates stabilization of prices with potential marginal decreases, primarily driven by ongoing generic competition. Injectable formulations may sustain slight premium levels due to hospital procurement protocols and formulations with improved pharmacokinetics.

Market Opportunities and Challenges

Opportunities

- Emerging Markets Expansion: Growing healthcare infrastructure enhances access, creating volume-driven growth.

- New Indications: Off-label uses and expanded therapeutic scope may increase demand.

- Formulation Differentiation: Novel delivery systems could command higher prices.

Challenges

- Price Erosion: Continued generic proliferation limits achievable margins.

- Regulatory Barriers: Stringent approval pathways in some jurisdictions potentially delay new competitors.

- Market Saturation: Mature markets face limited growth, requiring strategic focus on emerging regions.

Regulatory and Policy Impact

Regulatory authorities in various regions are increasingly scrutinizing drug prices and promoting biosimilar and generic competition to ensure affordability. Policies favoring price transparency and comparator-based pricing further exert downward pressure on current and future prices.

Key Market Dynamics Summary

- The market is highly commoditized with intense price competition.

- Price declines have plateaued, indicating a stabilization trend.

- Emerging markets hold significant growth potential, albeit with continued price competition.

- Innovation in formulations may temporarily sustain higher price points in niche markets.

Key Takeaways

- Price Decline Continuity: Expect ongoing but slowed price reductions for ondansetron HCl, particularly in oral formulations.

- Market Saturation: The mature state in primary markets limits substantial price increases.

- Emerging Markets Expansion: Greater access and demand in developing economies create volume opportunities, potentially offsetting unit price declines.

- Formulation Diversification: Injectable and specialized formulations may retain higher price points due to clinical utility.

- Regulatory Environment: Vigilance is necessary regarding policies targeting drug pricing and patent challenges, which influence market entry and pricing strategies.

Conclusion

Ondansetron HCl's market presents a mature, competitive landscape dominated by generics, with prices trending downward due to persistent competition and regulatory pressures. Future pricing strategies should focus on regional expansion, formulation innovations, and navigating regulatory environments. While pricing stability is expected in the near term, opportunities exist for targeted premium offerings via specialized formulations and emerging market penetration.

FAQs

-

What factors primarily influence ondansetron HCl's market prices?

Competition among generic manufacturers, manufacturing costs, regulatory policies, and regional price regulation primarily drive pricing dynamics.

-

Is there potential for price increases in ondansetron HCl?

Price increases are unlikely in mature markets due to intense competition; however, niche formulations and emerging markets may support higher margins.

-

How does patent expiration impact ondansetron's price?

Patent expirations in the mid-2000s led to proliferation of generics, significantly reducing prices globally.

-

Are there recent innovations that could affect future prices?

Yes, advancements in formulations, such as sustained-release injectables or novel delivery systems, could sustain higher prices temporarily.

-

What regional factors affect ondansetron price projections?

Regulatory policies, market maturity, competitive landscape, and healthcare infrastructure influence regional pricing and growth prospects.

Sources:

[1] Global Industry Analysts, "Antiemetics Market Report," 2022.

[2] Statista, "Global Anti-Emetic Market Size and Forecast," 2022.

[3] FDA, "Ondansetron (Zofran) Product Label," 2023.

[4] IMS Health, "Generic Drug Pricing Trends," 2022.

[5] European Medicines Agency, "Medicines Regulations Overview," 2023.