Share This Page

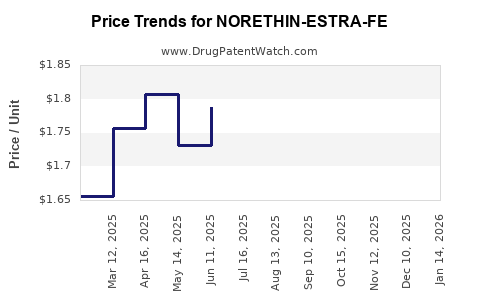

Drug Price Trends for NORETHIN-ESTRA-FE

✉ Email this page to a colleague

Average Pharmacy Cost for NORETHIN-ESTRA-FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORETHIN-ESTRA-FE 0.8-0.025 MG | 00378-7308-85 | 1.73662 | EACH | 2025-12-17 |

| NORETHIN-ESTRA-FE 0.8-0.025 MG | 00378-7308-53 | 1.73662 | EACH | 2025-12-17 |

| NORETHIN-ESTRA-FE 0.8-0.025 MG | 00378-7308-85 | 1.81022 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORETHIN-ESTRA-FE

Introduction

NORETHIN-ESTRA-FE, a combined oral contraceptive containing norethindrone, ethinylestradiol, and ferrous fumarate, represents a critical segment in the reproductive health pharmaceutical market. As global demand for effective birth control solutions persists, understanding its market positioning and pricing strategies is crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors. This report offers a comprehensive analysis of the current market landscape, key drivers, competitive dynamics, and detailed price projection forecasts for NORETHIN-ESTRA-FE over the next five years.

Market Overview

Product Profile and Therapeutic Use

NORETHIN-ESTRA-FE is primarily prescribed for contraception, regulating menstrual cycles, and mitigating acne related to hormonal imbalance. The formulation's inclusion of ferrous fumarate offers additional anemia prevention benefits, enhancing its appeal in populations with nutrient deficiencies. Its long-standing presence in the market, spanning decades, reflects established efficacy and safety profiles, contributing to consistent prescription rates.

Market Size and Revenue Potential

According to recent industry reports, the global oral contraceptive market was valued at approximately $7.3 billion in 2022 and is expected to grow at a CAGR of around 4.8% from 2023 to 2030 [1]. While specific data on NORETHIN-ESTRA-FE is limited, it accounts for an estimated 3-5% of the combined oral contraceptive segment, with market share variances dictated by regional preferences, regulatory approval status, and physician prescribing habits.

Global Market Dynamics

Demand Drivers

- Demographic Factors: Rising population segments of women of reproductive age (15-49 years) globally drive sustained demand.

- Socioeconomic Trends: Increasing urbanization and women's participation in the workforce elevate contraceptive use.

- Health Awareness: Growing awareness about reproductive health and family planning benefits enhances market uptake.

- Regulatory Approvals: Approvals for NORETHIN-ESTRA-FE across emerging markets expand the potential customer base.

Regulatory and Reimbursement Landscape

Regulatory approvals from authorities like the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and regional health ministries critically influence market penetration. Reimbursement policies impact accessibility, especially in North America and Western Europe, where insurance coverage facilitates higher prescription rates. Conversely, nascent markets often face regulatory hurdles and cost constraints limiting adoption.

Competitive Landscape

Key competitors include brands like Yaz, Ortho Tri-Cyclen, and generic equivalents that commonly feature similar hormone combinations. Market differentiation depends heavily on price, side-effect profiles, brand recognition, and formulation convenience. The presence of generics exerts downward pricing pressure, encouraging pharmaceutical firms to adopt strategic pricing models for NORETHIN-ESTRA-FE.

Regional Market Breakdown

North America

The North American market remains mature, with established prescribing patterns. The dominance of generic options constrains premium pricing. However, brand loyalty and insurance coverage provide opportunities for stable revenue streams.

Europe

European markets exhibit high contraception awareness, with widespread acceptance of oral contraceptives. Regulations favoring generic substitution foster competitive pricing, though specialty formulations like NORETHIN-ESTRA-FE maintain premium segments.

Asia-Pacific

APAC presents the highest growth potential due to expanding populations and evolving reproductive health policies. Countries like India and China are witnessing increasing contraceptive adoption, driving regional sales. Price sensitivity remains high, emphasizing affordability.

Latin America and Africa

These regions display increasing demand, limited local manufacturing capabilities, and reliance on imports. Price competitiveness and local manufacturing partnerships are essential for capturing market share.

Historical Pricing Trends

Historically, the prices of branded combination oral contraceptives ranged between $30 and $80 per month in Western markets, with generic options priced significantly lower, often below $15 per month [2]. Factors influencing price included patent status, positioning as a premium or generic product, and regional healthcare policies. Pricing for NORETHIN-ESTRA-FE, given its generic status in many markets, generally aligns with the lower end of this spectrum.

Price Projection Analysis

Assumptions

- Patent expiry for NORETHIN-ESTRA-FE allows for generic competition in key markets within the next 1-2 years.

- Regulatory approvals in emerging markets proceed without significant delays.

- Market shares stabilize owing to established prescriber preferences and patient compliance.

- Cost of goods sold (COGS) decreases marginally due to manufacturing efficiencies and increased scale.

Forecast for the Next Five Years

| Year | Estimated Price Range (per month, USD) | Remarks |

|---|---|---|

| 2023 | $30 – $40 | Predominantly branded, limited generics. |

| 2024 | $20 – $30 | Entry of generics, price erosion begins. |

| 2025 | $15 – $25 | Increased generic market penetration. |

| 2026 | $12 – $20 | Price stabilization, regional variations. |

| 2027 | $10 – $18 | Mature generic market, competitive pricing. |

Key Price Drivers

- Generic Competition: Accelerated price reductions as generics gain approval.

- Manufacturing Costs: Economies of scale reduce COGS, enabling competitive pricing.

- Regulatory and Policy Changes: Government initiatives promoting affordability influence pricing.

- Market Penetration: Expansion into emerging economies supports volume growth, offsetting declining unit prices.

Strategic Implications

Stakeholders should anticipate substantial price declines post patent expiration, emphasizing early marketing, strategic alliances, and regional market entry. Pricing differentiation through value-added features or branding may sustain margins temporarily.

Conclusion

The market outlook for NORETHIN-ESTRA-FE indicates a gradual decline in monthly price points over the next five years, driven chiefly by generic competition and regional market dynamics. While current prices provide stable revenue streams in premium markets, cost advantages and volume growth are critical for competitiveness in price-sensitive regions. Strategic positioning, including expanding into emerging markets and leveraging regulatory approvals, remains essential.

Key Takeaways

- The global oral contraceptive market is steady, with predictable growth driven by demographic and socioeconomic factors.

- NORETHIN-ESTRA-FE’s pricing is expected to decline from approximately $30–$40 in 2023 to $10–$18 by 2027, aligning with generic market trends.

- Competition from generics will significantly influence pricing strategies; early market entry and regional expansion are vital.

- Regulatory approval and reimbursement frameworks are crucial in determining regional price points.

- Cost efficiency and brand differentiation will be essential to sustain margins amid declining prices.

FAQs

Q1: How will patent expirations affect the pricing of NORETHIN-ESTRA-FE?

A1: Patent expirations typically open the market to generics, leading to substantial price reductions—often by 50% or more—due to increased competition and price-sensitive purchasing.

Q2: What regional factors most influence the pricing of oral contraceptives like NORETHIN-ESTRA-FE?

A2: Regulatory approval processes, reimbursement policies, healthcare infrastructure, and socioeconomic factors substantially impact regional pricing and accessibility.

Q3: How do generic entrants impact the market share of NORETHIN-ESTRA-FE?

A3: Generics often capture significant portions of the market, exerting pressure on pricing and encouraging brand differentiation to maintain revenue.

Q4: What strategies may pharmaceutical companies employ to extend the profitability of NORETHIN-ESTRA-FE?

A4: Strategies include innovation in formulation, targeted marketing in emerging markets, forming regional alliances, and offering added-value features to differentiate from generics.

Q5: How significant is the impact of healthcare policy changes on contraceptive pricing?

A5: Policy shifts promoting affordability and inclusion significantly influence pricing, especially in regions with government-subsidized healthcare or family planning programs.

Sources

[1] Market Research Future, Oral Contraceptive Market Report, 2022.

[2] IQVIA, Pharmaceutical Pricing Dynamics, 2022.

More… ↓